ARTICLE AD

AVAX, the ninth-largest cryptocurrency by market capitalization, has defied recent selling pressure, experiencing a notable 13% surge in the last 24 hours. This rally propelled the Avalanche Network token to a 10-day high of $36, sparking optimism among investors for a more sustained upward trend.

Analysts attribute this positive momentum to two key factors: the increased activity on a decentralized social app called The Arena and the introduction of a groundbreaking scaling solution by Ava Labs.

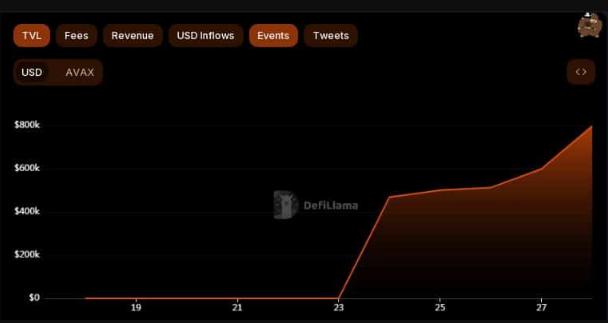

Solid Run: AVAX TVL Soars 27%

The Arena, a SocialFi platform built on the Avalanche blockchain, witnessed a remarkable 27% surge in its total value locked (TVL) within just 24 hours. As the fourth-largest SocialFi decentralized application (dApp) with over $798,000 in deposits.

Source: Defillama

Source: Defillama

The Arena aims to capitalize on the growing popularity of similar platforms like Friend.tech. Despite facing a temporary setback due to an exploit shortly after its launch, the recent rebound is viewed by proponents as a potential turning point. Given that AVAX is the utility token for The Arena, its success could directly contribute to the increased value of the crypto.

One of the catalysts behind Avalanche’s bullish momentum, however, stems from Ava Labs’ ambitious new project: Vryx. This innovative scaling solution aims to transform transaction processing on the Avalanche network, promising an impressive capacity of 100,000 transactions per second (TPS) without compromising security or decentralization.

1/ Introducing Vryx: Fortifying Decoupled State Machine Replication

(How the #Avalanche HyperSDK Will Reach HyperTPS)https://t.co/eY3uWcyTPr

— Patrick O’Grady 🔺 (@_patrickogrady) January 26, 2024

Addressing a significant challenge in blockchain technology—scalability—Vryx’s successful implementation has the potential to attract a wave of new users to the Avalanche ecosystem.

AVAX Surge: Excitement Amid Volatility

In a related development, the latest price surge of AVAX got the derivatives market excited as well. According to NewsBTC’s analysis of Coinglass’ data, the Open Interest (OI) in AVAX futures jumped by a whopping 20% to $239 million in the last 24 hours.

Despite the promising developments, caution prevails. The cryptocurrency market is notorious for its volatility, and the broader market sentiment plays a crucial role in AVAX’s performance. Ongoing market turmoil could temper AVAX’s momentum. Additionally, the success of both The Arena and Vryx remains uncertain, necessitating close monitoring of their development.

Avalanche’s recent surge is viewed positively, offering promising indicators for the future of AVAX. Increased adoption of The Arena and the successful deployment of Vryx could drive further demand for the token, potentially sustaining an upward trajectory. However, investors are reminded to conduct their own research and exercise prudence before engaging in any cryptocurrency investment, considering the inherent risks associated with the market.

Featured image from Shutterstock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 year ago

74

1 year ago

74