ARTICLE AD

Key Notes

Bitcoin's options data shows a bearish sentiment with a put-to-call ratio of 1.09, suggesting the possibility of a brief price correction.Analyst Ali Martinez forecasts a potential dip to $97,085, though a close above $100,470 could invalidate this bearish outlook.Ethereum options expiry is also imminent, with a bullish market sentiment indicated by a put-to-call ratio of 0.66.Just as the cryptocurrency market is heading for a weekly expiry, Bitcoin price BTC $98 482 24h volatility: 0.8% Market cap: $1.95 T Vol. 24h: $110.44 B has rallied to its new all-time high of $99,502 with its market cap at $1.95 trillion. A total of $2.86 billion in Bitcoin options will expire today hinting at crypto market volatility ahead.

The substantial expiration event could trigger short-term price volatility, especially as markets eagerly anticipate Bitcoin reaching the $100,000 milestone.

A Look into the Bitcoin Options Expiry Data

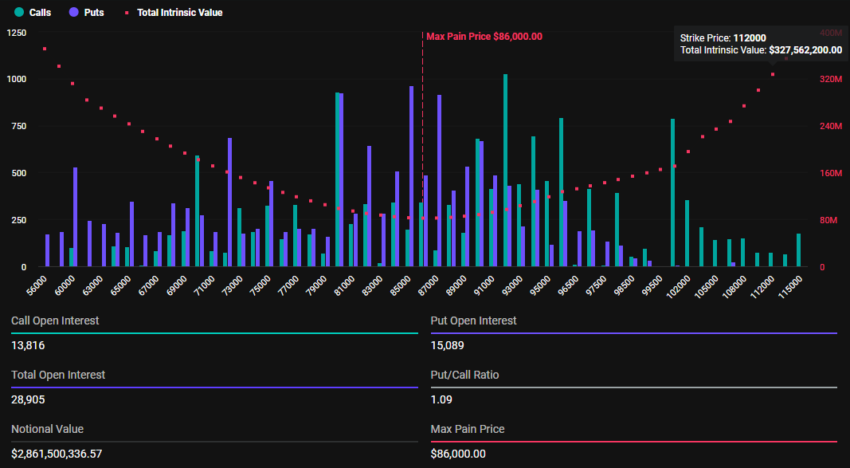

Data from Deribit shows that 28,905 Bitcoin options contracts are set to expire on Friday, featuring a put-to-call ratio of 1.09 and a maximum pain point of $86,000.

The put-to-call ratio, which measures market sentiment, currently stands above 1, signaling bearish sentiment despite recent growth fueled by Bitcoin whales and long-term holders.

Courtesy: Deribit

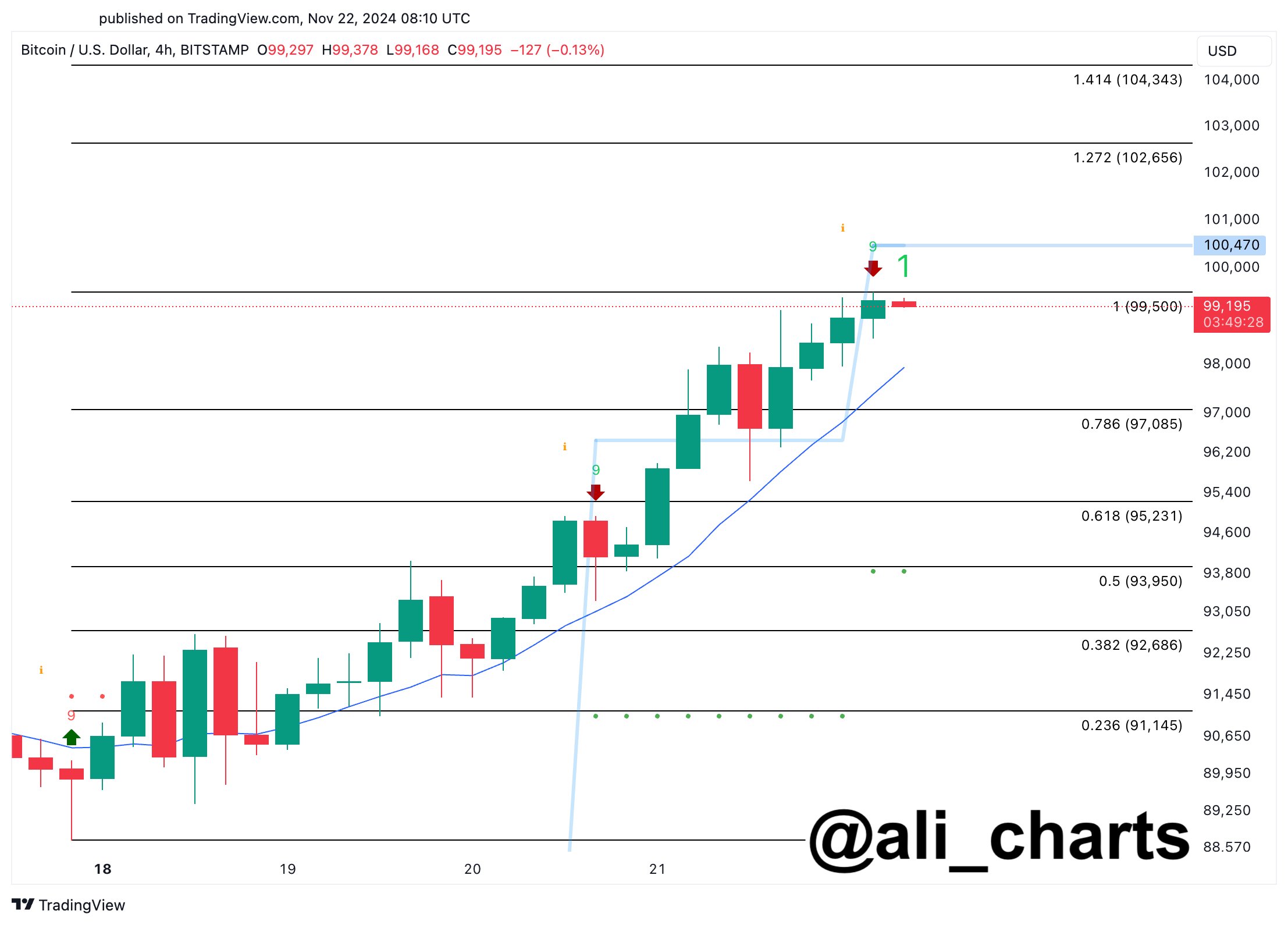

While everyone is expecting a Bitcoin price breakout above $100K, there could be a brief correction ahead before it finally happens. According to crypto analyst Ali Martinez, the TD Sequential indicator has flashed a sell signal on Bitcoin’s 4-hour chart, suggesting a potential correction toward $97,085.

Courtesy: Ali Charts

However, if Bitcoin manages a candlestick close above $100,470, it could invalidate the bearish pattern. In such a scenario, BTC may climb to targets of $102,656 or $104,343, noted Martinez.

Ethereum Options Expiry and Analyst Predictions

A total of 164,687 Ethereum options contracts are set to expire today, with a put-to-call ratio of 0.66 and a maximum pain point of $3,050. The lower put-to-call ratio reflects a generally bullish sentiment in the ETH market.

As of press time, Ethereum is trading at $3,389. Analysts at Greeks.live suggest Ethereum ETH $3 328 24h volatility: 6.1% Market cap: $401.22 B Vol. 24h: $57.29 B could see continued upward momentum in line with the bullish put-to-call ratio, while Bitcoin appears poised for a potential correction. They added:

“With about 8% of positions expiring this week, the big rally in Ethereum has led to a significant increase in ETH major term options IV [implied volatility], while BTC major term options IV has remained relatively stable. The market sentiment remains extremely optimistic at this point”.

Analysts highlight that despite Bitcoin’s risk of a correction, the broader market rally may prevent a significant pullback. This could be due to the substantial capital inflows into ETFs, particularly BlackRock’s newly launched IBIT options. Yesterday, BlackRock’s IBIT clocked $5 billion in trading volumes.

Also, the total inflows into spot Bitcoin ETFs yesterday crossed over $1 billion with IBIT alone contributing more than $600 million.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, Ethereum News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

5 hours ago

2

5 hours ago

2