ARTICLE AD

The US Securities and Exchange Commission (SEC) has taken legal action against 17 individuals allegedly involved in a Crypto Ponzi scheme that defrauded more than 40,000 victims and amassed $300 million.

As per the SEC’s press release, Houston-based CryptoFX LLC operated the scheme, primarily targeting Latino investors in the United States and two other countries. This most recent complaint follows the SEC’s emergency action in September 2022, which shut down the CryptoFX scheme and charged its leaders, Mauricio Chavez and Giorgio Benvenuto.

Crypto Ponzi Scheme Targets Latino Community

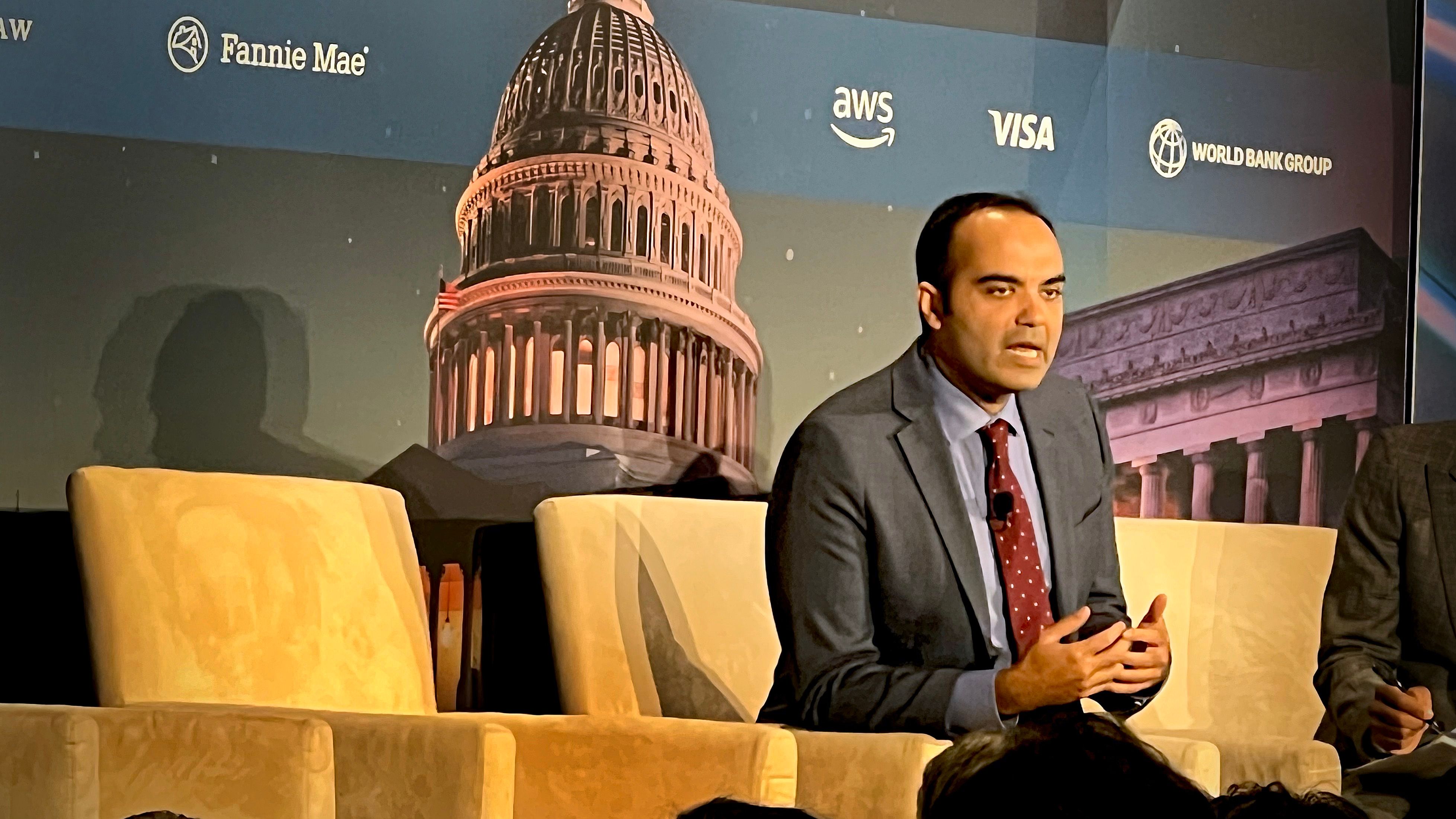

According to Gurbir Grewal, director of the SEC’s Division of Enforcement, CryptoFX operated as a massive Ponzi scheme, enticing Latino investors with promises of financial freedom and guaranteed returns through cryptocurrency and foreign exchange investments.

The SEC’s investigation revealed that the scheme relied primarily on funds from new investors to repay earlier investors, with only a fraction of the funds raised being used for actual trading activities. Grewal, director of the SEC’s Division of Enforcement, said:

In the end, the only thing that CryptoFX guaranteed was a trail of thousands upon thousands of victims stretching across ten states and two foreign countries. A scheme of that size requires lots of participants, and as today’s action demonstrates, we will pursue charges against not just the principal architects of these massive schemes, but all those who further their fraud by unlawfully soliciting victims.

The complaint alleges that the 17 individuals from Texas, California, Louisiana, Illinois, and Florida served as leaders within the CryptoFX network. They allegedly solicited investors by offering “unrealistic returns” ranging from 15 to 100 percent.

Instead of utilizing the funds as promised, the defendants allegedly used them to pay returns to previous investors, provide commissions and bonuses to themselves and others involved, and finance their lifestyles.

Defendants Accused Of Defying Court Orders

The SEC’s legal action also highlights the involvement of certain defendants in continuing to solicit investments even after court orders were issued to halt the CryptoFX scheme.

Gabriel and Dulce Ochoa, for instance, are accused of instructing investors to retract their complaints to the SEC to recover their investments. Moreover, Maria Saravia allegedly misinformed investors, claiming the SEC’s lawsuit was fake.

The SEC’s complaint, filed in the US District Court for the Southern District of Texas, charges various violations against the defendants, including antifraud, securities registration, broker-registration provisions, and whistleblower protection provisions. The SEC seeks permanent injunctions, disgorgement with prejudgment interest, and civil penalties for each defendant.

While two defendants, Luis Serrano and Julio Taffinder, have consented to the entry of final judgments without admitting or denying the allegations, the court’s approval is pending. Serrano and Taffinder have agreed to pay over $68,000 combined in civil penalties, disgorgement, and interest.

Featured image from Shutterstock, chart from TradingView.com

9 months ago

57

9 months ago

57