ARTICLE AD

Key Notes

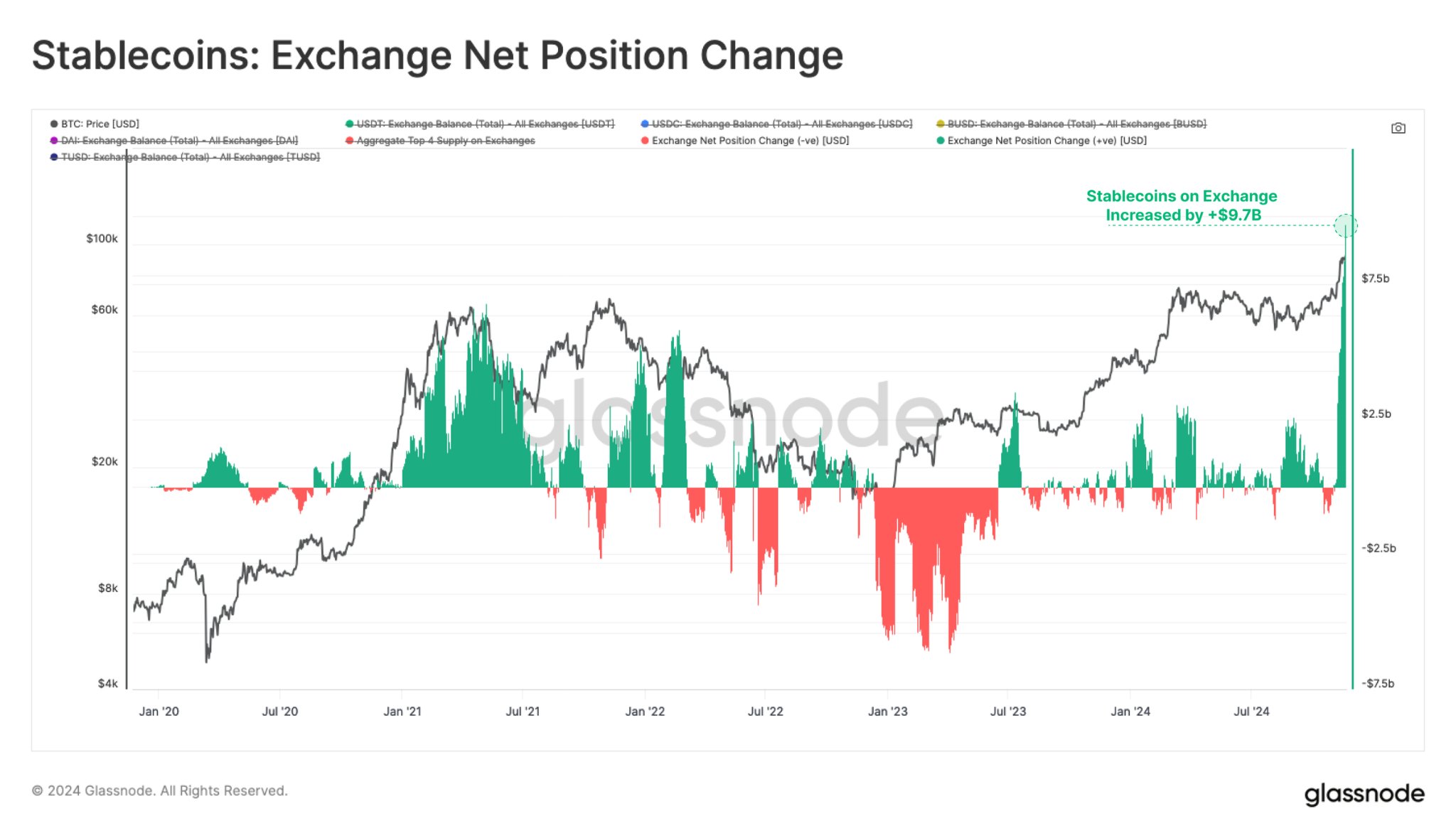

Stablecoin liquidity has seen a sharp rise pointing to heightened speculative demand, which could fuel BTC price beyond $100K.Crypto analysts are increasingly bullish on Bitcoin's price, drawing parallels to December 2020 market behavior.US Bitcoin ETFs continue to see strong inflows, further supporting the ongoing bullish momentum.In the last 24 hours, Bitcoin price BTC $98 019 24h volatility: 4.5% Market cap: $1.94 T Vol. 24h: $107.38 B rallied another 5% hitting a new all-time high above $97,500. But the record $9.7 billion stablecoin inflows into the market over the past month show that the investor interest in the market is increasing and the Bitcoin party could be pending yet.

Over the last month, the stablecoin inflows have reached nearly $10 billion. Leon Waidmann, head of research at The Onchain Foundation, said that this clearly signals an uptick in the investors’ demand. He said:

“Stablecoin inflows to exchanges hit $9.7B in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode!”

Courtesy: Leon Waidmann

Rising stablecoin inflows to crypto exchanges may indicate upcoming buying pressure and a growing investor appetite, as stablecoins serve as the primary gateway for converting fiat into crypto.

This massive stablecoin inflows suggest that Bitcoin price could end up smashing the $100,000 milestone very soon. Crypto market analyst Ali Martinez reported that Bitcoin price could this milestone today itself as it breaks out of the bull flag in the hourly time frame.

#Bitcoin $BTC could reach $100,000 today as it appears to be breaking out of a bull flag on the lower timeframes. pic.twitter.com/UKKcXilHO4

— Ali (@ali_charts) November 21, 2024

Bitcoin Price Going to $135,000 with Stablecoin Support?

Following today’s price action, crypto market analysts have turned bullish about BTC stating that the rally can continue further. Crypto analyst Ali Martinez has drawn parallels between Bitcoin’s current market behavior and its performance in December 2020, noting that the Relative Strength Index (RSI) is nearly identical to that period. If history repeats itself, Martinez predicts Bitcoin could reach $108,000, then drop to $99,000 before surging to $135,000.

Courtesy: Ali Charts

Other market analysts like Peter Brandt also pointed out the BTC price action after the US election results on November 5. In the last 15 days, BTC has seen a swift rally from $65,000 levels to where it is today. After the consolidation of around $90,000 for a while, BTC has once again given a strong break from the flag, which could lead to a rally to $125,000 and above.

Courtesy: Peter Brandt

On the other hand, Spot Bitcoin exchange-traded funds (ETFs) are continuing to fuel Bitcoin’s price rally. Yesterday, November 20, the US Bitcoin ETFs saw over $773 million in net positive inflows, led by BlackRock’s IBIT alone seeing $662 million in inflows. The launch of options for BlackRock’s IBIT a day before triggered huge trading volumes on the first day showing strong demand for the product.

The US Bitcoin ETFs experienced their sixth straight week of net inflows, accumulating more than $1.67 billion during the trading week of November 11–15.

CoinGlass data shows that bitcoin futures open interest (OI) on the Chicago Mercantile Exchange (CME) reached a record high of 218,000 BTC ($21.3 billion), marking an increase of over 30% compared to levels before the Nov. 5 election, showing huge bullish sentiment.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

3 hours ago

2

3 hours ago

2