ARTICLE AD

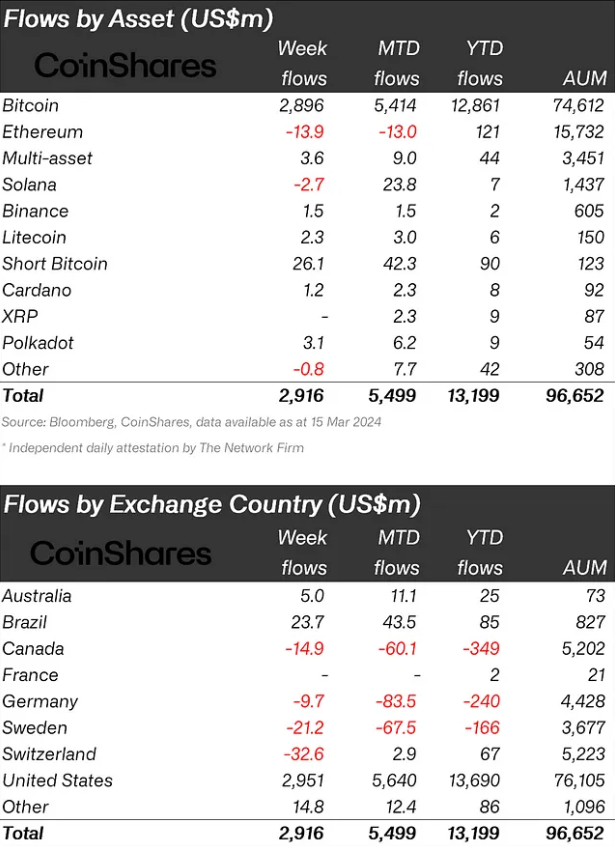

Crypto investment products have set a new record with weekly inflows reaching $2.9 billion, surpassing the previous week’s high of $2.7 billion, according to the latest weekly inflow report by asset management firm CoinShares. This surge has propelled the year-to-date inflows to $13.2 billion, eclipsing the total inflows of $10.6 billion for the entire year of 2021.

Despite the overall success, smart contracting platforms like Ethereum, Solana, and Polygon experienced outflows, with Ethereum seeing $14 million, Solana $2.7 million, and Polygon $6.8 million leaving their ecosystems through funds.

The trading volume for the week remained steady at $43 billion, maintaining the previous week’s levels and accounting for nearly half of the global bitcoin trading volume. Notably, global exchange-traded products (ETPs) reached a milestone, breaking the $100 billion mark for the first time, although a price correction later in the week caused the value to settle at $97 billion.

Image: CoinShares

Image: CoinSharesRegionally, the US led with inflows of $2.95 billion, complemented by smaller amounts entering markets in Australia, Brazil, and Hong Kong, which saw inflows of $5 million, $24 million, and $15 million, respectively. In contrast, Canada, Germany, Sweden, and Switzerland experienced combined outflows of $78 million. The year has started on a shaky note, with $685 million in outflows recorded so far.

Bitcoin continued to assert its dominance in the market, with inflows of $2.86 billion last week, now representing 97% of all inflows for the year. Meanwhile, short Bitcoin positions attracted their largest inflows in a year, totaling $26 million, marking the fifth consecutive week of inflows.

Blockchain equities also reversed a six-week trend of outflows by attracting $19 million in inflows, signaling renewed investor interest in the sector.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by HAL, our proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

38

9 months ago

38