ARTICLE AD

Bitcoin’s retrace below $63,000 has offered a clearer view of support and resistance levels to watch leading to next month’s halving.

Bitcoin (BTC) and cryptocurrency analyst Ali-Charts identified three critical prices that serve as support levels for the largest digital asset in the world. According to the on-chain observer citing Glassnode data, $61,100, $56,685, and $51,530 should cushion against further Bitcoin dips.

Conversely, $66,990 and $72,88 have emerged as the following resistance levels to break after BTC set a new all-time high on March 14, per CoinGecko. The crypto peaked at $73,737 following multiple weeks of massive inflows into U.S. spot Bitcoin ETF products.

BTC daily chart | Source: CoinGecko

BTC daily chart | Source: CoinGecko

Bitcoin down 6%, spot BTC ETFs log negative daily flows

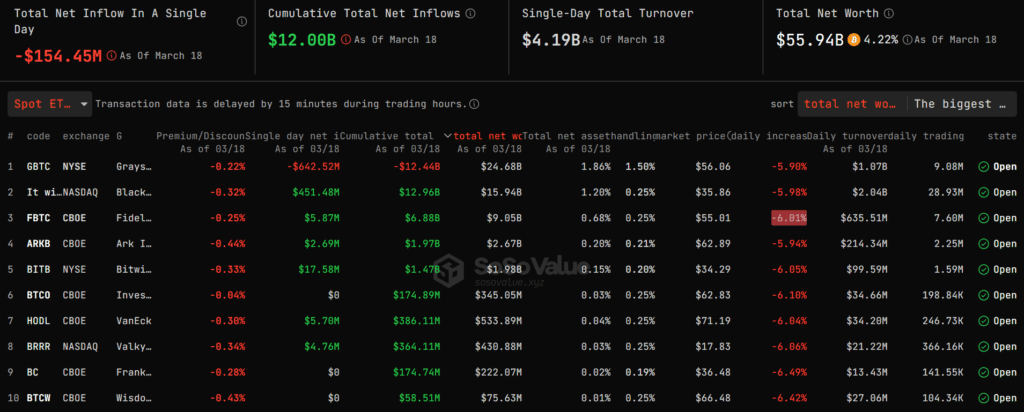

BTC’s 6% downturn on March 19 followed the first single-day net outflow since late last month. Although BlackRock’s BTC ETF drew in $451 million, investors ditched $642 million worth of Grayscale’s GBTC, per Soso Value. March 18 marked the largest GBTC departure so far, ETF expert Eric Balchunas confirmed.

Price movement resulted in net outflows of $154 million as eight other issuers attracted less than $20 million each on the day. Franklin Templeton, Invesco Galaxy, and WisdomTree funds saw $0 single-day net inflows.

Spot BTC ETF flows | Source: SoSo Value

Spot BTC ETF flows | Source: SoSo Value

While the numbers deviated from consecutive inflows previously recorded, spot BTC ETFs have still accumulated 4.2% of Bitcoin’s available supply in three months of trading. Nine funds boast over $20 billion in assets under management, led by BlackRock’s more than 203,000 BTC valued at nearly $16 billion.

Veterans like Balchunas also predict an expansion in spot BTC ETF demand as more institutional players allocate capital and support exposure to the asset class. Wall Street asset managers like Bank of America’s Merrill Lynch and Wells Fargo have added spot Bitcoin ETFs to offerings, backtracking an earlier decision to disallow such funds for clients.

This ties out w what issuers telling me re Advisors’ clients: so far it’s only ones into btc already, they are “handful” of early adopters inquiring, then making allocations. Advisors are not yet soliciting the rest of their clients. All these flows are from inbound traffic.

— Eric Balchunas (@EricBalchunas) March 18, 2024

8 months ago

43

8 months ago

43