ARTICLE AD

In a chart analysis shared via X, the crypto analyst Dark Defender provided insight into the potential price movements of XRP ahead of this week’s Ripple-SEC case update. The analysis, conducted on a monthly time frame, reveals that XRP has been holding above a critical support trend marked in blue. With the crypto community’s eyes set on the new Ripple filings expected next week, there’s a mix of anticipation and caution.

XRP Price Enters Potentially Crucial Week

Dark Defender notes that although market news does not typically have a direct correlation with price movements, the “last puzzle piece” pertaining to the Ripple case may add a layer of enthusiasm to the market sentiment surrounding XRP. The question posed is: What could happen if XRP fails to maintain its position above the blue support line?

XRP price analysis | Source: X @DefendDark

XRP price analysis | Source: X @DefendDark

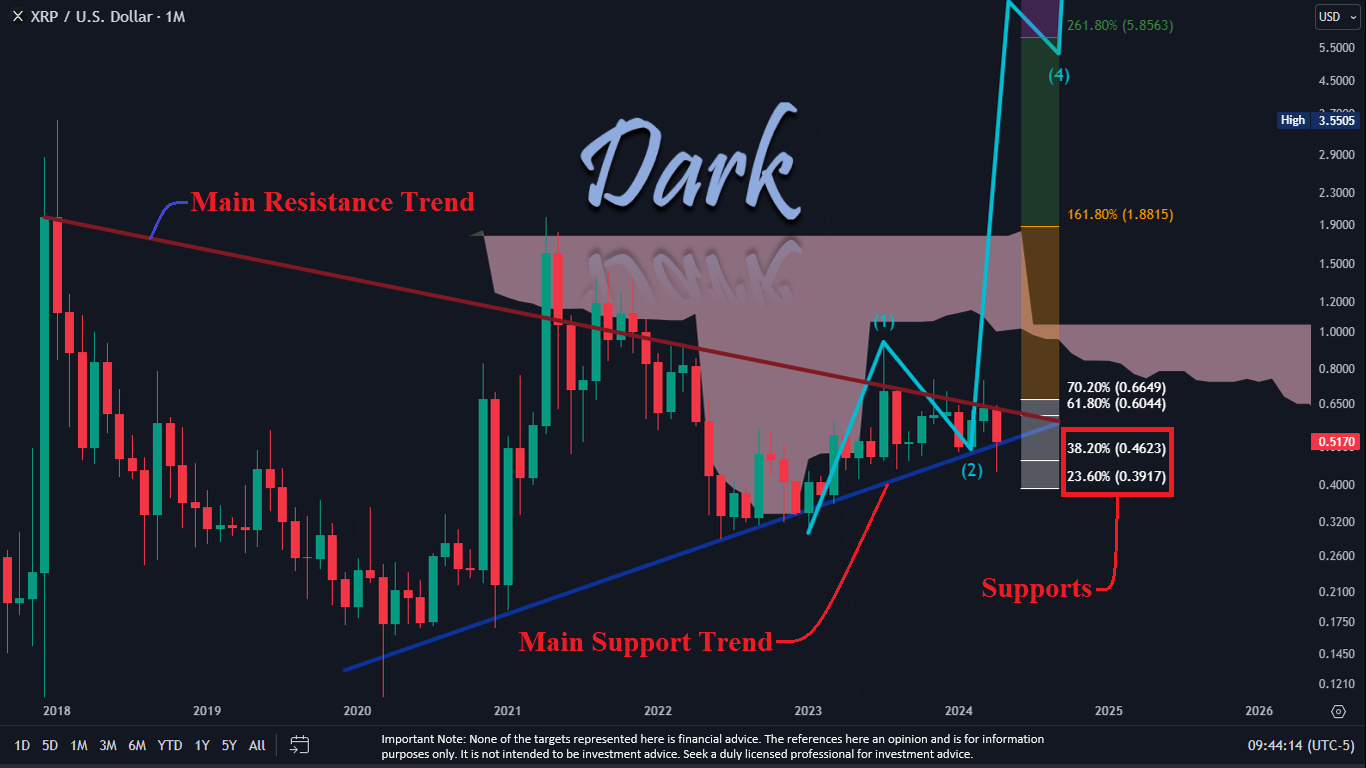

According to the analysis, if XRP breaks below this blue support line, it will likely approach the two critical Fibonacci retracement levels at $0.4623 (38.2% retracement level) and $0.3917 (23.6% retracement level). These figures are derived from the swing high and low points on the chart, traditionally considered potential support levels where the price could stabilize or bounce back.

In the context of the current chart, a drop below these levels, particularly if the price closes under $0.3917 for two to three days consecutively, would invalidate the bullish five-wave structure that Dark Defender suggests could propel XRP to a high of $5.85. On the flip side, should XRP reclaim the 61.8% Fibonacci level at $0.6044, it could signify a first step towards a strong upward move.

Between the price range of $0.6649 and $0.3917, any price movement is considered a sideways trend. A breakout above the 70.2% level at $0.6649 would likely confirm a bullish trend, with the analyst highlighting this as a significant threshold for a positive price trajectory. Above this level, XRP would then eye the next Fibonacci extension levels of $1.8815 (161.8% extension) and potentially $5.8563 (261.8% extension), which are ambitiously projected targets.

The chart also highlights a “Main Resistance Trend” line that has capped the price since the peak of early 2018, and the current price action is pinched between this descending resistance and the ascending support trend lines, forming a converging pattern that traders often interpret as a potential breakout signal.

A breakout could be the first bullish indication of a larger rally, with at least one monthly close above the line required. In the past, several attempts at a breakout have failed, and even one monthly close was followed by a fall back below the trendline the following month.

Ripple Vs. SEC: What To Expect This Week

Ripple Labs is gearing up to file its response to the US Securities and Exchange Commission’s (SEC) remedies briefing on April 22, a pivotal moment in their protracted legal battle. This response from Ripple is in reaction to the SEC’s briefing that put forth potential remedies including disgorgement of profits derived from XRP sales and civil penalties. The financial stakes are high, with the SEC calculating fines that could reach around $2 billion, claiming that Ripple engaged in an unregistered securities offering with its XRP sales.

The legal and financial communities expect Ripple to mount a formidable defense against the SEC’s claims. Key to this counter-argument will be undermining the SEC’s assertion of the necessity for disgorgement, given the alleged lack of demonstrable financial harm to XRP purchasers. Furthermore, Ripple is likely to leverage favorable recent legal decisions and regulatory developments, aiming to weaken the SEC’s position.

According to the schedule, Ripple is expected to submit a public redacted version of its opposition brief along with associated declarations and exhibits today, if these materials are devoid of any SEC-designated confidential information. If confidentiality is a concern, Ripple will file the documents under seal and submit a redacted public version by April 24. Following this, the SEC will have the opportunity to reply, with their response anticipated to be filed under seal by May 6.

At press time, XRP traded at $0.53.

XRP price, 1-week chart | Source: XRPUSD on TradingView.com

XRP price, 1-week chart | Source: XRPUSD on TradingView.com

Featured image from NameCoinNews, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

7 months ago

30

7 months ago

30