ARTICLE AD

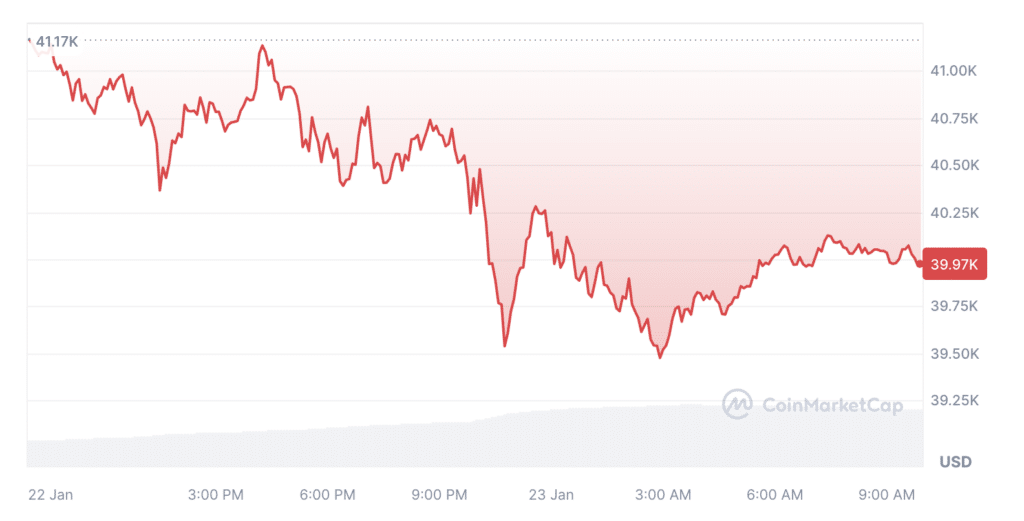

For the first time since the beginning of the year, Bitcoin (BTC) fell below the $40,000 level, leading to panic in the market.

Analysts at the Greeks.live service noted that the fall of BTC below $40,000 on the night of Jan. 22-23 led to a certain number of short-term panic orders on the market, and the bearish strength of the market has increased. However, overall, long and short positions are relatively balanced, and it is still a “fierce game.”

Bitcoin fell below the $40,000 as short-term IVs recovered. Overall VRP(volatility risk premium) has risen, and the Skew curve is skewed towards put options.

The above option data reflects the existence of a certain number of short-term panic orders in the market, the market… pic.twitter.com/D5wnuhSWz2

Bitcoin is still in a correction phase after launching several Bitcoin spot exchange-traded funds in the US for the first time. Over the past 24 hours, the price of the largest cryptocurrency has dropped by 3% to $39,970 at the time of writing. At the same time, BTC trading volumes have sharply increased over the past 24 hours by 113%, reaching $29.2 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Greeks.live previously highlighted that the impact of the BTC spot ETF is over; the core of the recent market play is Grayscale selling pressure and new investor buying; the market is likely to occur mainly during the ETF trading session.

🌍 This Week's Market Outlook (1/22-1/28):

The impact of the BTC spot ETF is basically over, the core of the recent market game is the gray scale selling pressure and the buying of new investors, the market is likely to happen mostly during the trading session of the ETF. after…

Meanwhile, spot Bitcoin ETFs experienced net outflows of $76 million in one day, according to Bloomberg analyst James Seyffart.

The leader in the outflow of assets was a fund from Grayscale with a total of $3.45 billion. However, the head of Grayscale, Michael Sonnenshein, remains optimistic about the fate of his company’s ETF, noting that Grayscale has been around for over ten years with a diverse investor pool and the most considerable liquidity of any spot Bitcoin ETF.

1 year ago

69

1 year ago

69