ARTICLE AD

Analysts anticipate a major Bitcoin supply shock heading into April’s halving as BTC is down by nearly 10% since ETF approval.

Bitcoin’s supply dynamics have significantly changed since the SEC approved spot Bitcoin ETFs earlier this month. The leading token has been largely volatile in the past few weeks, but this volatility has remained within a very narrow price range. BTC’s price has fluctuated between $41,000 and $44,000, dropping below $41,500 today, the lowest price in 30 days.

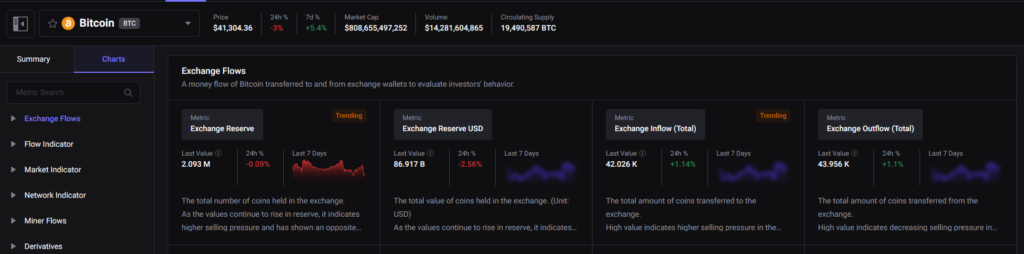

Analysts attribute these short price movements to supply dynamics driven by the ETF market. Since yesterday, according to data from Arkham Intelligence, Grayscale has transferred over $1 billion worth of BTC to Coinbase from its ETF fund. With other major funds contributing to this massive inflow of around 5,000 to 7,000 BTC daily to their custodian exchanges, only 900 BTC is being mined daily.

INSANE #Bitcoin supply shock incoming.

If we keep up massive BTC ETF inflows we’ll have thousands (5,000-7,000 BTC) being bought up daily but only 900 BTC mined daily.

People aren’t grasping how incredibly MASSIVE the supply shock will be.

Buckle up & see how frothy this gets!

Despite this, a record percentage of BTC supply remains untouched. Because of the unique supply dynamics of Bitcoin, analysts are predicting that the leading token might experience major supply-side illiquidity before the halving, which may result in a supply shock.

Despite the launch of #Bitcoin ETFs presenting an opportunity to "sell the news", most HODL'ers (unsurprisingly) have not done so.

A record % of the BTC supply remains untouched.

The new demand from ETFs, that will come slowly, not all at once, will be met with incredible… pic.twitter.com/WEbMREayuH

There are hundreds of millions of dollars in #Bitcoin being sent from grayscale daily to coinbase to be sold.

Insane, legitimate supply being dumped on the market.

And $BTC remains stable.

Pretty incredible.

At the same time, although slowly, we’re already seeing BTC supply shrink. In the past week, Bitcoin’s supply has declined from 19.6 million to 19.4 million. Historically, the token’s supply has never shrunk heading into a halving.

Source: CryptoQuant

Source: CryptoQuant

Just months away from the next halving, the ETF market is rapidly growing, and the market might see some major price movements in the next few months. Bitcoin has already become the second-largest ETF commodity in the U.S., surpassing silver, which indicates growing involvement from traditional institutes.

All of these factors could translate into one of the most intriguing and unpredictable halvings the market has seen since the inception of crypto.

1 year ago

113

1 year ago

113