ARTICLE AD

Analysts see potential for further growth in MicroStrategy Inc.’s shares following its Bitcoin acquisitions throughout the bull market.

According to Bloomberg, analyst Andrew Harte recently raised his price forecast for the company’s stock to $1,800, suggesting a potential increase of at least 10% from its current trading price. The new target significantly jumps from the previous estimate of $780.

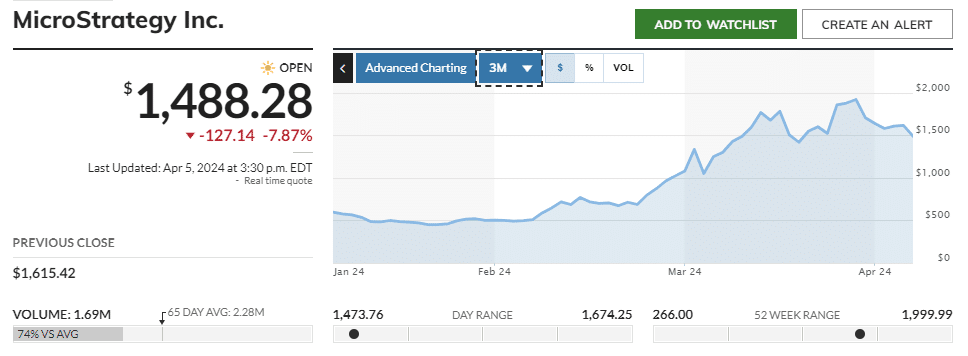

The rapid rise of MicroStrategy’s shares has surpassed many Wall Street predictions in the past month. The company, which holds over 214,000 Bitcoin as of March 18, has mirrored and even exceeded the cryptocurrency’s price increases. Despite reaching an intraday peak of $1,999 in March, the stock’s current valuations still exceed most analysts’ expectations.

MicroStrategy’s stock growth in 2024 | Source: MarketWatch

MicroStrategy’s stock growth in 2024 | Source: MarketWatch

The upcoming Bitcoin halving event, expected to occur later this month, typically results in a price increase for the cryptocurrency by reducing its new supply. Bitcoin’s surge of over 50% to new highs this year has played a critical role in MicroStrategy’s success, driven by acquiring more digital assets through capital fundraising.

MicroStrategy currently has the largest Bitcoin holding among all public companies. After its latest acquisition in March, the company now holds nearly 1% of BTC’s total supply.

9 months ago

54

9 months ago

54