ARTICLE AD

Bitcoin, the undisputed king of cryptocurrencies, is making headlines again with a recent price surge that has pushed it past the coveted $50,000 mark. This rally, coupled with an “extreme greed” reading on the Crypto Fear and Greed Index, paints a picture of a market brimming with optimism, but also raises concerns about potential overheating.

Greed Galore: Index Hits Highest Since ATH

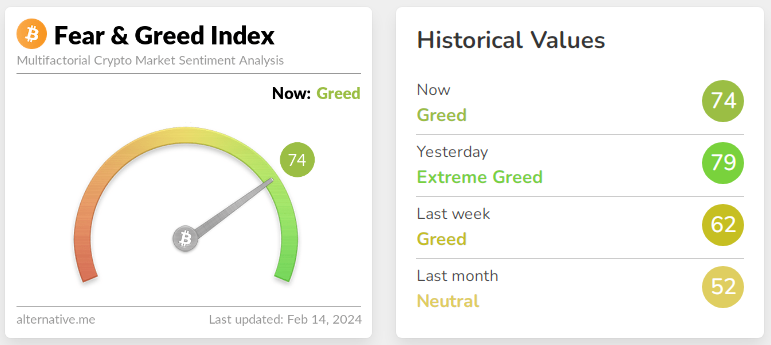

The Crypto Fear and Greed Index, a widely used indicator of investor sentiment, recently skyrocketed to 79, its highest level since November 2021, when Bitcoin peaked at a record-breaking $69,000. This “extreme greed” reading suggests that investors are feeling euphoric about the current rally, potentially leading to risky investment decisions.

Source: Alternative.me

Source: Alternative.me

Bitcoin’s Bullish Charge: 15% Gain YTD

Fueling this optimism is Bitcoin’s impressive performance year-to-date. Since January 1st, the cryptocurrency has climbed a staggering 15%, showcasing a sustained bullish trend. This surge comes on the heels of a volatile 2023, where Bitcoin saw both dramatic dips and exciting climbs.

Spot Bitcoin ETFs: A Catalyst For Growth?

Many analysts point to the recent launch of spot Bitcoin exchange-traded funds (ETFs) in the US as a key driver of the current rally. These ETFs offer investors a regulated way to access Bitcoin, potentially attracting new money to the market. While the initial launch saw a sell-off, analysts like Cathie Wood of ARK Invest believe it was short-lived, paving the way for long-term institutional participation.

Doubled Value In A Year: A Turning Point?

Bitcoin’s current price of $50,000 is more than double what it was a year ago. This significant growth, coupled with the influx of new investors, leads some to believe that Bitcoin is entering a new era of stability and sustained growth. However, the cryptocurrency market is notoriously volatile, and past performance is not always indicative of future results.

Proceed With Caution: Experts Advise

Financial experts urge investors to exercise caution despite the current market enthusiasm. The “extreme greed” reading on the Fear and Greed Index serves as a warning sign of potential irrational exuberance. Investors should always conduct their own research, understand their risk tolerance, and not blindly follow market trends.

Bitcoin’s future remains uncertain, but one thing is clear: the crypto market is once again buzzing with excitement. Whether this translates into another $69,000 peak or a sudden correction remains to be seen. Only time will tell if the current “greed” translates into long-term prosperity or a fleeting blip on the radar.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 year ago

69

1 year ago

69