ARTICLE AD

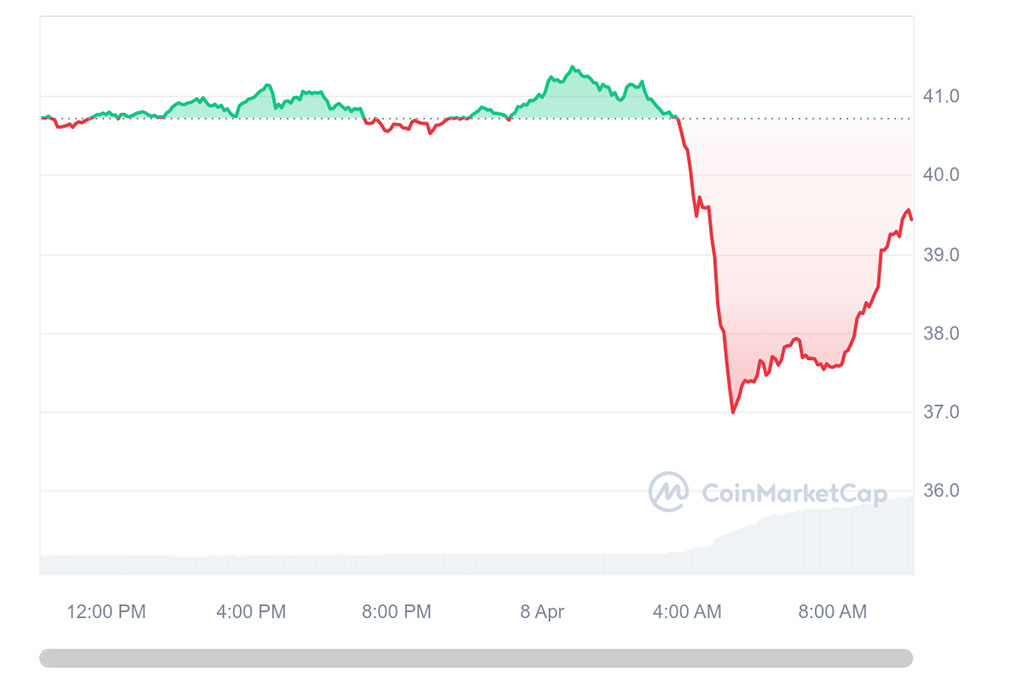

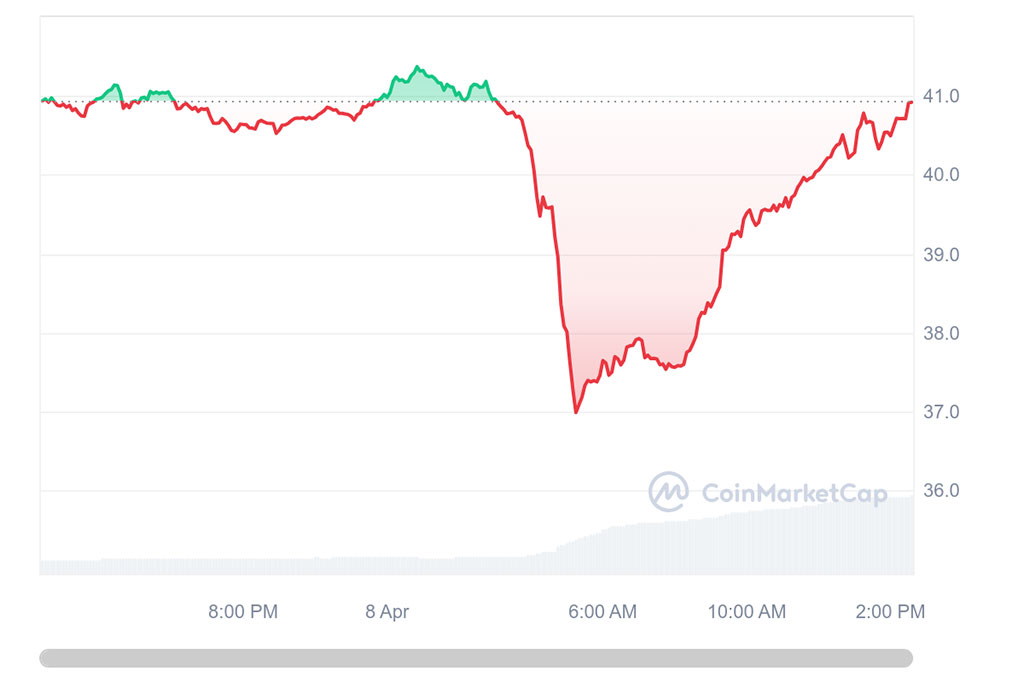

GMX price seems to have seen some recovery, finding stability around the $39 mark.

Co-founder of BitMEX Arthur Hayes caused bearish fallout for GMX price this morning after unstaking 237,672.8 GMX, worth almost $10 million, and transferring it to the market maker of NFT marketplace Blur.

Hayes was set to make over $3 million in profit from the potential selloff, as reported by Lookonchain. The market responded quickly, resulting in a sharp 10% price drop as GMX fell from highs of around $41 to $37.

Photo: CoinMarketCap

The unstaked GMX tokens cannot be tracked to confirm Hayes did in fact sell them, but the significant selloff that followed is indicative that he did.

Investors GMX Sentiment Unshaken

Despite the lack of a confirmed selloff by Hayes, GMX price saw some recovery, finding some stability a few hours later around the $39 mark. This price stability could be attributed to GMX investor enthusiasm in what one user described as “a bit like the price of ETH during the FTX debacle. I’m buying more.”

One of the largest holders of GMX send his bags to a market maker. Speculation goes that he is selling which is the most logical conclusion to make.

My question, why is price not tanking hard?

Feels a bit like the price of ETH during the FTX debacle.

I'm buying more.$GMX pic.twitter.com/jZi91vIghT

— JJcycles (@JJcycles) April 8, 2024

Investor enthusiasm continued through the day, GMX price has now almost completely recovered back to today’s opening price of just above $41.

Photo: CoinMarketCap

GMX V2 Single Token Pools Approved

On March 31, a GMX proposal voting poll was initiated to determine whether two new single token pools would be established on GMX V2.

The idea was proposed by coinflipcanda to create a gmBTC2 Market and a gmETH2 Market on the Avalanche and Arbitrum chains to draw “greater market liquidity to GMX”. “If these new Single token markets perform well it opens the possibility of other single token markets including stablecoin, yielding stablecoin, LSTs, GMX and other volatile assets to back markets,” wrote coinflipcanda.

The resulting proposal received significant support with over 99% approving both the gmBTC2 and gmETH2 Market pools.

Hayes PENDLE Pump

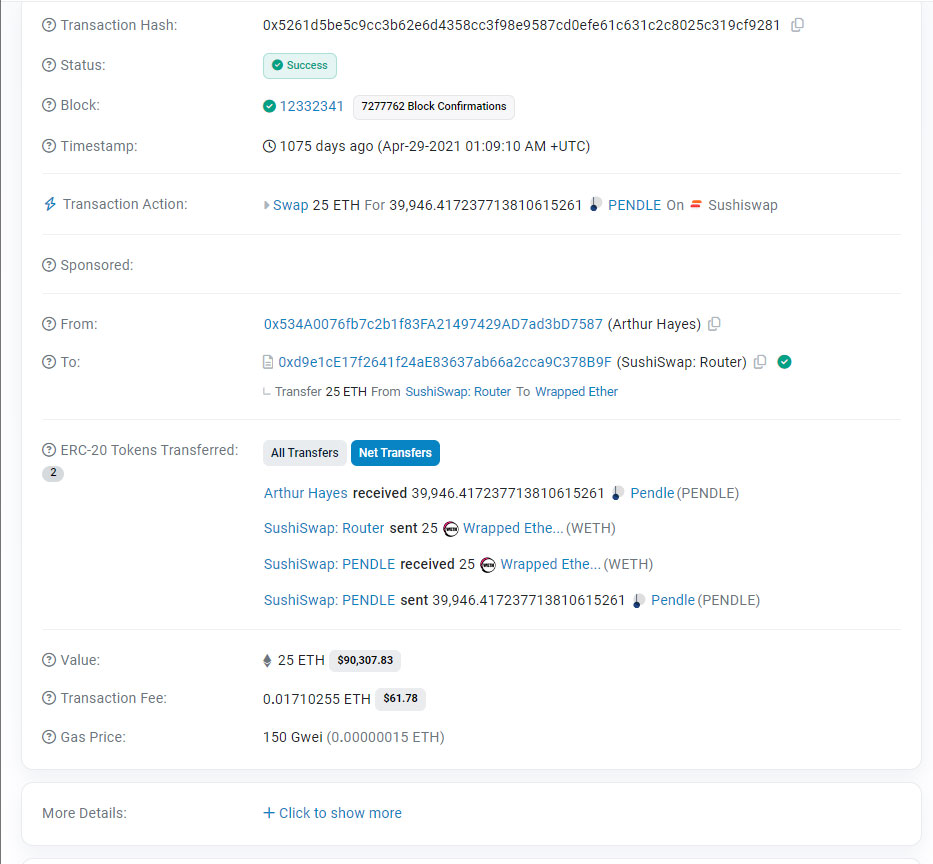

Back in 2021, on April 21 Hayes entered Pendle, receiving almost 40,000 PENDLE tokens for 25 Wrapped Ethereum (WETH) – worth roughly $67,500 at the time.

Photo: Etherscan

As it stands, that 39,946 PENDLE is currently worth over $265,000 – a healthy profit margin of almost 300% – and priced at roughly $6.56 at the time of writing.

Hayes published two bullish Pendle posts on April 5 and April 6 – effectively promoting his asset holdings to his almost 500,000 user following on X (formerly known as Twitter).

The future of #DEFI is $PENDLE.

Yachtzee bitches 😘😘😘😘😘 pic.twitter.com/4MtqmQvjpR

— Arthur Hayes (@CryptoHayes) April 5, 2024

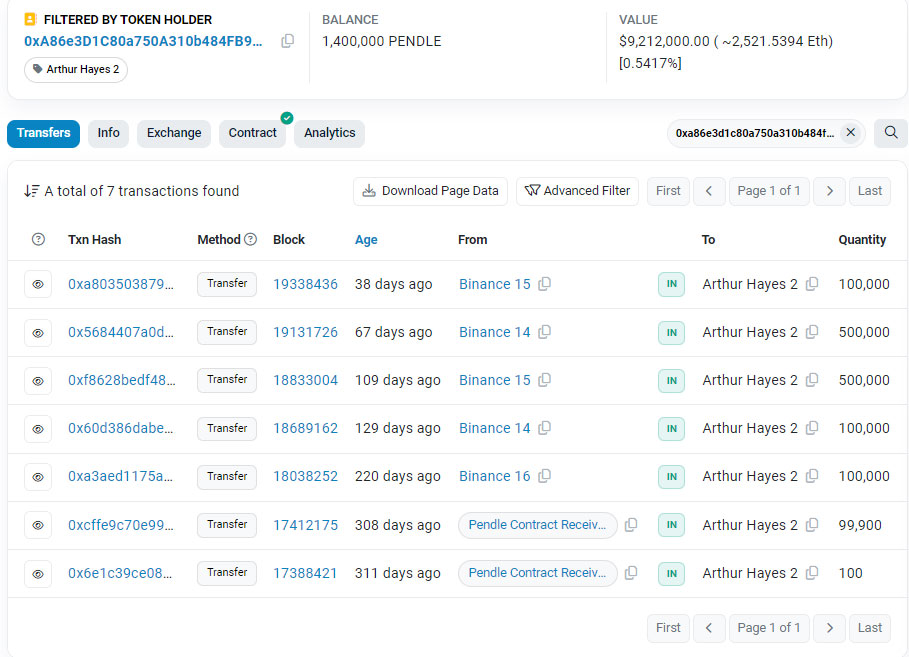

Furthermore, the wallet attributed at ‘Arthur Hayes 2’ currently holds a total of 1.4 million PENDLE tokens, received over the last 311 days.

Photo: Etherscan

An Emerging Theme

In December 2023, this theme was repeated as reported by Lookonchain. It explained that Hayes “frequently tweeted posts” from Dec. 6, 2022, stating that Solana (SOL) would reach $100.

Hayes sold his holdings on December 22, 2023, when SOL reached $99.

7 months ago

30

7 months ago

30