ARTICLE AD

Bitcoin’s surge to new all-time highs signals its entry into the euphoria zone, accompanied by substantial capital inflows driven by the success of spot Bitcoin ETFs.

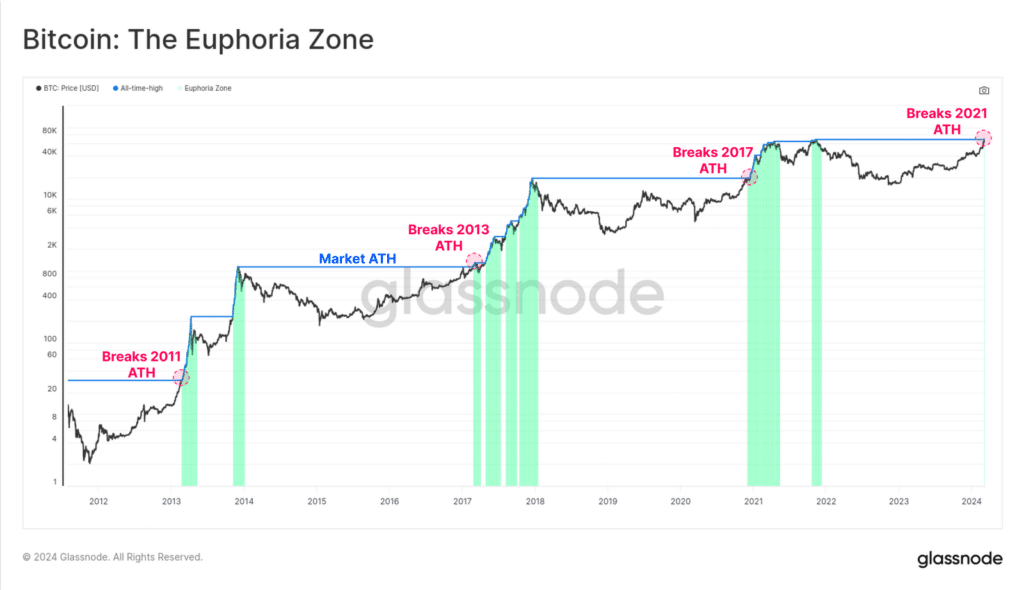

Bitcoin has finally entered the fourth cycle in its history as its price keeps growing beyond the $70,000 mark, Glassnode analysts said, adding that the interest surrounding the cryptocurrency appears to be transitioning it into the euphoria zone.

Bitcoin’s euphoria zones by cycles | Source: Glassnode

Bitcoin’s euphoria zones by cycles | Source: Glassnode

According to on-chain data analysis, the Bitcoin Realized Cap, a measure of the total wealth stored in BTC on-chain, has surged to a new high of $504 billion, experiencing a $40 billion increase in capital inflows since Mar. 1 alone.

“From an on-chain data perspective, this moment has historically triggered a distinct shift in investor behaviour patterns, particularly in the relative balance between HODLers and the Speculator cohorts.”

Glassnode

The Realized Cap is currently increasing at a rate of $54 billion per month, analysts say, adding that Bitcoin is now approaching levels last seen during the early 2021 bull run. This underscores the significant capital inflows into Bitcoin, partly fueled by the success and demand for new spot exchange-traded funds (ETFs), which were approved by the U.S. Securities and Exchange Commission earlier in January.

“Across numerous metrics, the current cycle is surprisingly and eerily similar to previous all-time high breaks, with the transfer of wealth from HODLers to new investors and speculators well under way.”

Glassnode

However, Glassnode noted that this week, a significant level of realized profit has been locked in through on-chain spending, surpassing “statistically high levels,” with analysts highlighting parallels to the onset of previous euphoric phases, such as those seen in the 2017 and 2021 bull markets.

8 months ago

35

8 months ago

35