ARTICLE AD

Bitcoin supporter Fred Krueger has recently voiced concerns about Ethereum’s (ETH) fundamental trends and potential regulatory hurdles. Krueger’s remarks, shared in a post on X, underscored notable statistics regarding Ethereum’s network activity and transactional utility.

Ethereum’s Declining Utility Raises Alarms

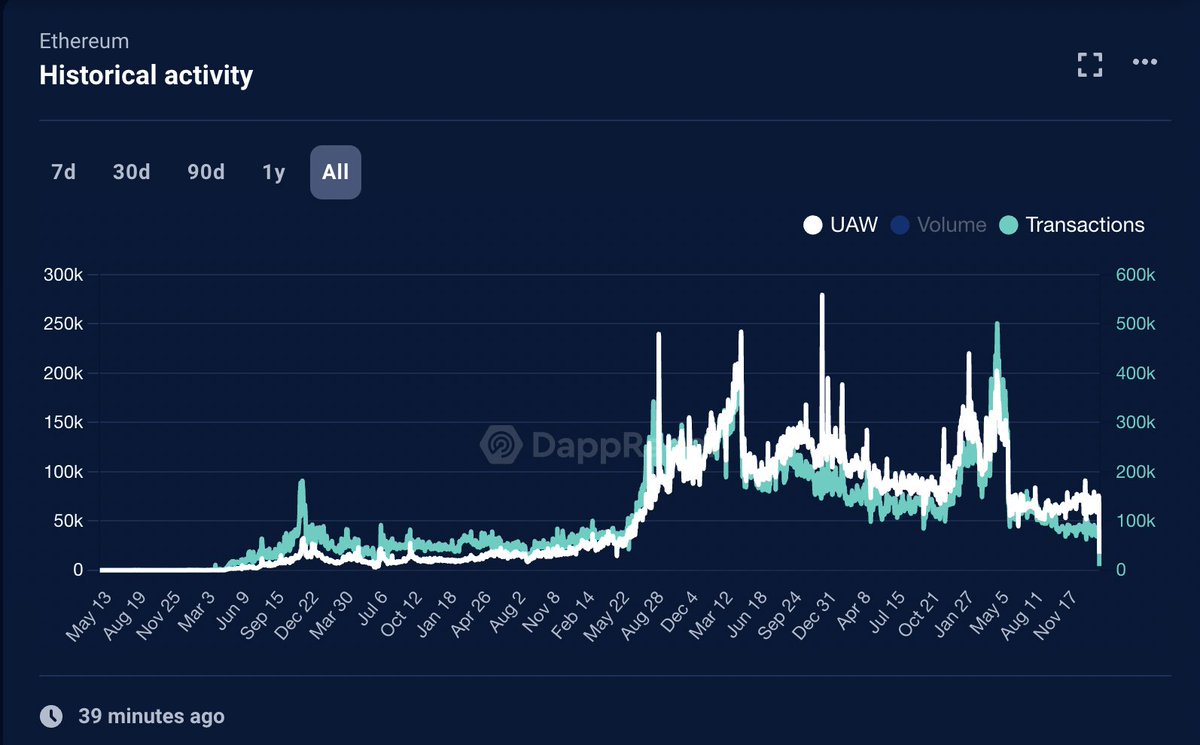

Krueger’s critique highlighted Ethereum’s soaring price, especially its recently achieved two-year peak juxtaposed with declining network usage. Despite ETH reaching $3,000, Krueger noted a significant drop in Daily Active Users (DAUs) from 120,000 in 2021 to just 66,000 in the past year.

The Bitcoin Maxi also highlighted the decline in user activity on the blockchain’s “top app,” Uniswap V3, Ethereum’s leading decentralized exchange protocol, highlighting it as a notable concern.

Ethereum (ETH) historical activity

Ethereum (ETH) historical activity

Krueger noted:

The top app, Uniswap V3 is only getting 16K DAUs. I remember, back in 2020 this number was 60K or more. It’s definitely the case the ETH as a chain is no longer used directly.

Krueger also starkly compared Ethereum’s current status and a “meme coin,” citing similarities to assets like Shiba Inu (SHIB).

Despite Ethereum’s price performance, Krueger highlighted a perceived erosion in its utility, especially when contrasted with alternative blockchain networks such as Solana, Avalanche, and Near.

The Bitcoin Maxi continued, noting:

Of course, that doesn’t stop investors from bidding it up to a $361 Billion dollar market cap. It really has become a type of meme coin, similar to Shiba Inu. It’s not particularily cheap ($1.50 per transaction), or fast. If you are just interested in reward points for games, or casino-style DeFi apps — Solana, Avalanche, Near etc.. all crush it.

Regulatory Uncertainty And Community Reaction

Krueger’s critique extended beyond Ethereum’s utility to its regulatory outlook. He expressed doubts about the possibility of a spot Ethereum Exchange-Traded Fund (ETF) approval, citing concerns over regulatory scrutiny:

Finally, I don’t think Gensler is going to allow an ETH ETF. If you believe in the Tooth Fairy, have fun. I just don’t think Gary wants to make his second ETF a massive pre-mine. Sets a very bad precedent.

The Bitcoin Maxi concluded: “Avoid ETH at all costs.” Despite Krueger’s assessment, the ETH community’s belief in ETH remains unshaken. Under Krueger’s post, many were found countering Krueger’s remark.

An X user named “n o k a” commenting on Krueger’s post pointed out that Ethereum has a roadmap focused on scalability through a modular and rollup-centric approach. They argue that solely considering Daily Active Users (DAU) on the mainnet is misleading, akin to assessing Bitcoin’s value based exclusively on its mainnet usage.

While they agree that depicting Ethereum as sound money “was/is clownish,” they noted: “but you [Fred Krueger] discredit yourself here.”

Even L2s like Arbitrum have been in decline last 12 months.

This is not the case that all is well in ETH-land pic.twitter.com/oOIPwyCrj2

— Fred Krueger (@dotkrueger) February 21, 2024

Another user, “John Doe,” argues that there has been a significant decline in total value locked (TVL) across the DeFi space, indicating a trend of decentralized finance (DeFi) users reducing their exposure to risk before potentially reinvesting in the future.

Sir, as much as you are well respected in the ETF space, you’re not well aware of how Defi Cycles work, just check out Defillama and see the TVL charts from the last bull run v/s today. There’s been sharp decline across the space. This is degens de-risking, before we Ape in again

— John Doe (@h0dlboi) February 21, 2024

Featured image from Unsplash, Chart from TradingView

9 months ago

53

9 months ago

53