ARTICLE AD

The latest study by Bitget found that one-third of cryptocurrency job seekers previously held positions in the traditional banking and finance industries.

The study reveals that 33% of individuals applying for roles within the cryptocurrency exchange were formerly part of the banking sector. Applicants are primarily interested in positions such as KYC Manager, Compliance Associate, Senior Compliance Associate, and AML Analyst.

The past few years have seen a considerable shift, with an influx of banking professionals transitioning to cryptocurrency. Specifically, there was a 113% increase in 2022 and a 143% increase in 2023 in the number of job applications from individuals with a banking background.

The trend aligns with the growing integration of blockchain technology in mainstream financial institutions. Prominent players in the banking industry, including HSBC, JPMorgan Chase, and Citi Group, have been actively exploring and adopting decentralized technologies. The impact of blockchain technology on retail banking is forecasted to be substantial, with projections estimating a market value of $40.4 billion by 2031.

Source: Bitget

Source: Bitget

Regarding job market trends, the UK saw a 46% increase in technology-related job openings in 2020, accounting for a third of all job advertisements. A case in point is Goldman Sachs, where 30% of the workforce comprises software engineers. Despite setbacks such as the 2022 FTX crisis, which resulted in over 2,000 job losses in the cryptocurrency sector, companies like Coinbase and Amber Group have been actively recruiting, bringing in 197 and 250 new employees, respectively.

Source: Bitget

Source: Bitget

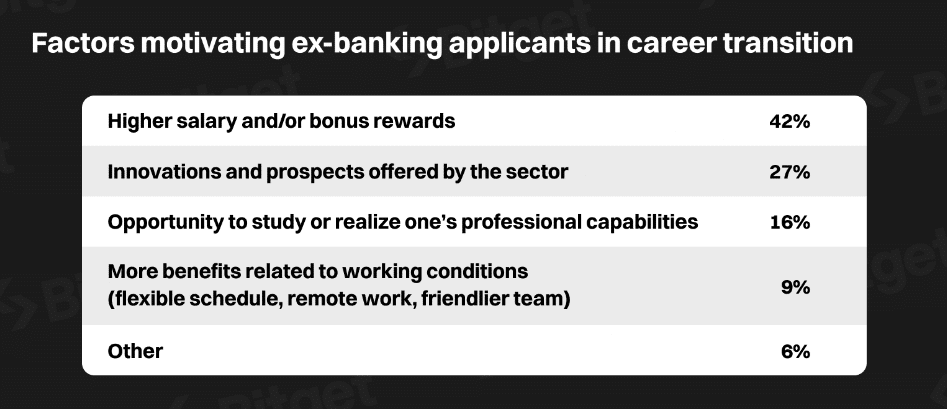

The report also highlights the disparity in compensation between the banking and cryptocurrency sectors. Traditional banks have reduced overall salaries, partly influenced by remote working arrangements and digitalization efforts. In contrast, the cryptocurrency industry offers significantly higher salaries, especially for remote positions.

In 2022, 36% of blockchain-related job postings were for remote roles, doubling the global average of 16%. For instance, junior engineers at cryptocurrency startups in London are offered starting salaries of around $125,000, with incentives markedly higher than the $87,810 investment banks offer for similar roles.

1 year ago

57

1 year ago

57