ARTICLE AD

Despite the bullish momentum witnessed in the cryptocurrency market, fueled by a significant uptick in Bitcoin’s price, skepticism among short sellers persists, and billions of dollars have been wagered on the downturn of cryptocurrency-linked stocks.

For context, Short sellers are investors who speculate that a stock’s or other asset’s price will decline. They borrow shares of the asset from a broker and sell them on the open market at the current price.

They aim to buy back the same number of shares later at a lower price, return the borrowed shares to the broker, and pocket the difference as profit.

Betting Against Bitcoin? The Short Selling Surge

According to Bloomberg, citing a recent report from S3 Partners LLC, the short interest in the cryptocurrency-linked stock sector has escalated to approximately $11 billion this year, indicating a substantial bet against the sustainability of the current rally.

Notably, most of this short interest targets MicroStrategy Inc. and Coinbase Global Inc., accounting for over 80% of the total bets against the crypto sector.

Short sellers bet against stocks. | Source: Bloomberg

Short sellers bet against stocks. | Source: Bloomberg

This contrarian stance has resulted in paper losses nearing $6 billion for short sellers, as Bitcoin’s year-to-date gain of over 150% buoyed cryptocurrency-linked stocks. Despite these losses, short sellers appear undeterred, intensifying their positions against the sector.

According to Ihor Dusaniwsky, managing director of predictive analytics at S3, the increase in short selling is a strategy some investors employ to either anticipate a “pullback” in Bitcoin’s rally or hedge against direct Bitcoin investments.

Risks And Potential Squeezes

The persistence of short sellers in targeting crypto-linked stocks poses risks, particularly if the market does not align with their bearish forecasts. Several stocks within this sector, including MicroStrategy, Coinbase, and Cleanspark Inc., are identified as susceptible to short squeezes, according to Bloomberg, citing S3.

This phenomenon occurs when short sellers are compelled to purchase stocks to exit their losing positions, inadvertently driving prices up and exerting additional pressure on other short sellers.

So far this year, MicroStrategy’s stock has surged by roughly 167%, while Coinbase and Cleanspark have experienced gains of 58.60% and 85.16%, respectively, highlighting the potential for significant short squeezes.

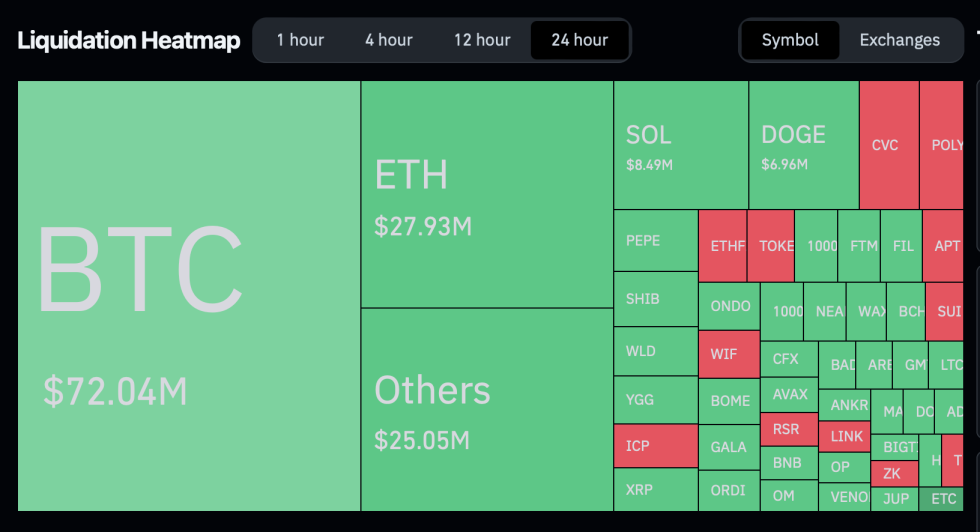

Amid these market dynamics, the broader cryptocurrency sector has also seen substantial liquidations. Data from Coinglass indicates that over $190 million worth of positions have been liquidated in the last 24 hours alone.

Crypto market liquidations heatmap. | Source: Coinglass.com

Crypto market liquidations heatmap. | Source: Coinglass.com

Most of these liquidations were long positions, accounting for approximately 61.45%. Binance traders bore the brunt of these liquidations, experiencing losses of $81.33 million, surpassing the liquidations on OKX, which amounted to $70 million.

This period of liquidations coincides with a slight retracement in Bitcoin’s price from its 24-hour high above $71,000 to a current trading price of $69,879 at the time of writing.

Featured image from Unsplash, Chart from TradingView

8 months ago

49

8 months ago

49