ARTICLE AD

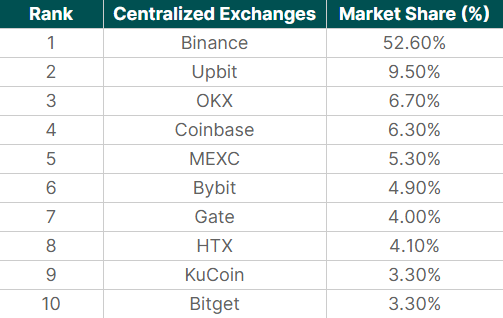

Centralized exchange Binance was responsible for $3.8 trillion in spot trading volume, with 52.6% dominance over the centralized exchange market in 2023, according to a Jan. 30 report by CoinGecko. The year-on-year growth in market share got close to 4%.

On December 2023, Binance registered over $427 billion in spot trading volume and managed to recover almost 3% of its monthly market share. Analyzing the month-by-month period, the exchange showed an increase of 37.5% in trading volume, reaching 43.7% dominance in 2023’s last month.

Binance secured good momentum despite the regulatory turbulences experienced by the company last year. The exchange found itself at the center of a landmark settlement with the U.S. Department of Justice (DoJ) and the Commodity Futures Trading Commission (CFTC), agreeing to a $4.3 billion fine to resolve allegations of financial misconduct.

This period also saw Changpeng Zhao (CZ), one of the most influential figures in crypto, stepping down from his role as the company CEO.

Upbit took its chance to also raise its market share in 2023, boasting a spot trading volume of $687 billion in 2023 and a 2.2% year-on-year growth in dominance. Last year’s Q4 was particularly fruitful for Upbit, which saw its trading volume surge by 93.5% quarter-over-quarter to $238.2 billion.

A significant driver of Upbit’s success, according to CoinGecko’s report, can be attributed to the ‘Kimchi Premium’, a phenomenon rooted in the high local demand for cryptocurrencies in South Korea, leading to higher prices on the exchange.

OKX rounded out the top three, capturing 6.7% market share with $485.9 billion in trading volume throughout 2023, and also reporting a 1% rise in its market dominance. The final quarter was especially notable for OKX, marking a 152% increase in trading volume quarter-over-quarter to $177.9 billion.

Centralized exchanges’ market share in 2023. Image: CoinGecko

Centralized exchanges’ market share in 2023. Image: CoinGeckoThe exchange showed a consistent upward trajectory in market share, starting the year at 5.1% and closing at 8.9%. Despite being momentarily overtaken by HTX in the third quarter, OKX managed not only to reclaim its position but also to outperform HTX’s growth.

The final quarter of 2023 also highlighted MEXC as the most significant gainer among the top 10 centralized exchanges, with a growth rate of 204%, translating to over $90 billion in trading volume. Bybit and KuCoin followed closely, with growth rates of 162% and 161%, respectively.

KuCoin, in particular, made a notable comeback, securing the ninth position at the end of December with a 3.3% market share, after briefly dropping out of the top 10 in the third quarter.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

59

1 year ago

59