ARTICLE AD

Binance users will have a chance to bag an allocation for EZ, the native token for liquid staking protocol Renzo.

According to an announcement, Binance Launchpool will list Renzo (EZ) as its 53rd project on April 30. The maximum supply is set at 10 billion tokens, and the platform will field 1.05 billion EZ coins as an initial supply.

In February, Binance, crypto’s largest centralized exchange, previously invested in the Renzo protocol. However, the monetary amount injected into the project remained undisclosed. The investment was made via Binance Labs, the venture capital arm of the exchange now operates as a standalone business.

At the time, Binance Labs was worth $10 billion and its portfolio supported over 250 crypto protocols, per details provided by the company.

Renzo tails Ether.fi in liquid restaking market

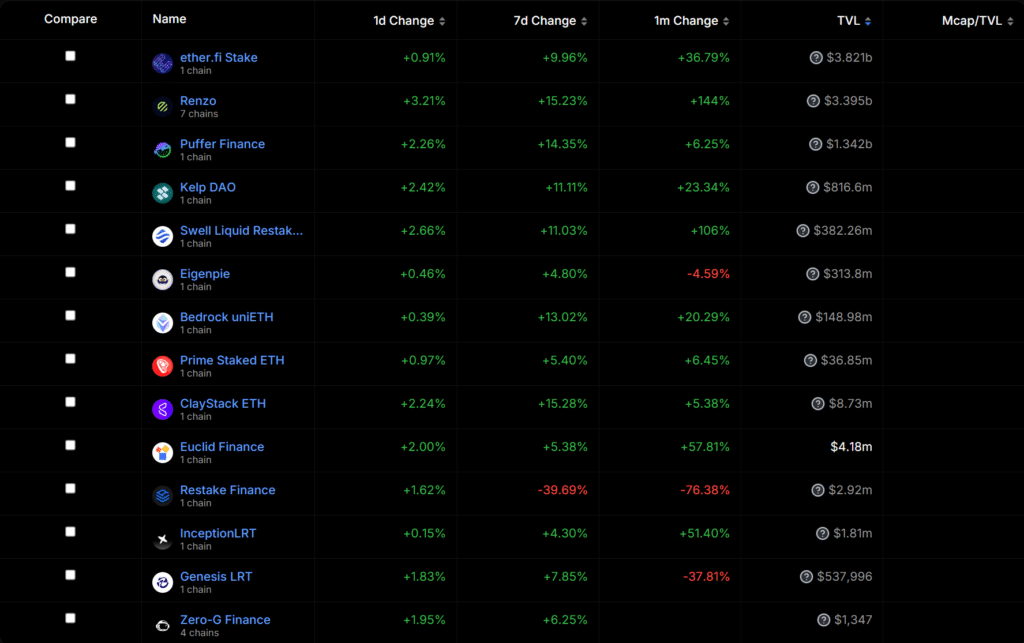

Following its mainnet launch in October last year, the Renzo protocol has grown into a major player in the Ethereum (ETH) liquid restaking market. DefiLlama data showed that users have deposited $3.39 billion into the defi platform.

With a 144% increase in the past month, Renzo is the second-largest liquid restaker on Ethereum. Only Ether.fi boasts a bigger user demand at $3.82 billion in total value locked.

Top liquid restaking protocols | DefiLlama

Top liquid restaking protocols | DefiLlama

Liquid restaking protocols spun off EigenLayer, a platform that allows users to secure other chains and dapps by repurposing staked ETH. The initiative also provides an additional yield source for stakers and derivative tokens to improve on-chain utility.

While the sector is now valued at over $10 billion, experts are divided over the risks associated with liquid staking, with some arguing that it is overstated and others advising caution among participants.

7 months ago

37

7 months ago

37