ARTICLE AD

Chief Investment Officer at Lekker Capital, Quinn Thompson, expressed confidence in the market, suggesting it’s a clear opportunity to bid despite short-term fluctuations.

Key Notes

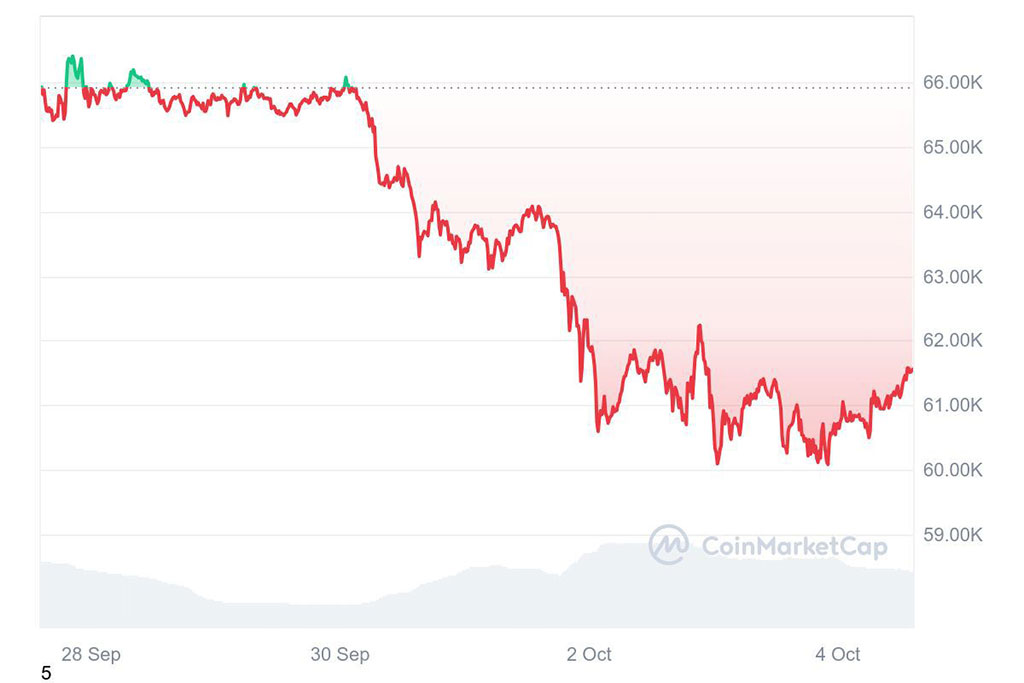

Bitcoin dropped 6% to $61,000 since September 30, influenced by geopolitical tensions and economic uncertainties.Quinn Thompson of Lekker Capital encourages buying Bitcoin, predicting a rebound based on past patterns and current market conditions.Historical data shows Bitcoin often rallies in late October, despite early month declines, suggesting potential gains ahead.Bitcoin BTC $61 379 24h volatility: 1.1% Market cap: $1.21 T Vol. 24h: $31.73 B has fallen 6% since September 30, 2024, dropping to $61,000. Quinn Thompson, Chief Investment Officer at Lekker Capital, sees this as a prime buying opportunity. He views the current price as an obvious chance for investors to accumulate more Bitcoin, citing changes in the broader economic landscape.

Photo: CoinMarketCap

On October 3, Thompson shared his analysis on X (formerly known as Twitter). He included a chart displaying Bitcoin’s price movements since March 5, 2024, when BTC reached a peak of $73,700. This chart highlighted Bitcoin’s volatility and the recent downward trend, prompting Thompson to compare it with past market behaviors.

I don't usually give very short-term views, but seems like a no-brainer to be bidding this area with clear invalidation on the back of a 180 degree shift in the macro backdrop from the relative to the 3 previous similar setups. https://t.co/NzqUSEvKbg pic.twitter.com/1PlviEyf5o

— Quinn Thompson (@qthomp) October 3, 2024Thompson noted three previous instances where Bitcoin fell below its 200-day moving average, a key metric for traders assessing an asset’s mid-term strength. However, in the current situation, BTC quickly recovered from this level. Thompson interpreted this rebound as a sign of a major shift in the broader economic landscape, suggesting that Bitcoin’s price is likely to rise again soon.

Geopolitical Tensions Fuel Bitcoin Bitcoin Sell-off

Thompson expressed confidence in the market, suggesting it’s a clear opportunity to bid despite short-term fluctuations. He pointed to geopolitical tensions in the Middle East, particularly Iran’s military actions against Israel, which have shaken global markets. These events, along with broader economic concerns, have led to a sell-off in risk assets like Bitcoin.

Worries about the strength of the US economy and the uncertain outcomes of the November elections have fueled market volatility, weakening investor confidence. This shift has dampened the enthusiasm surrounding “Uptober”, a term for October’s usually positive performance in the crypto space. As markets retreat, social media mentions of “Uptober” have faded.

Thompson’s view aligns with other analysts, such as Santiment’s Maksim Balashevich, who noted that while optimism is dwindling, it could signal a chance for a short-term recovery. However, Balashevich cautioned that it’s unclear whether the larger downtrend has ended. This reflects the mixed opinions within the investment community on Bitcoin’s future.

🎃 Mentions of "Uptober" have declined significantly, painting a picture that traders have become much more bearish on the idea of this month being an automatic money printer for crypto. The lack of optimism opens the door for (at least) a short-term bounce. 📈 https://t.co/iACWMGPvSs

— Santiment (@santimentfeed) October 3, 2024Bitcoin Dips Hint at October Surge

Historically, October has shown strong cryptocurrency performance, averaging over 20% gains in the past 11 years, according to CoinGlass. However, most of these gains typically occur in the second half of the month. In early October 2023, Bitcoin dropped 7%, hitting $26,650. Yet, within two weeks, it surged nearly 30%, closing the month at $34,500. This pattern has led traders to expect a similar spike this October.

Currently, Bitcoin’s 6% decline and signs of recovery create a cautiously optimistic outlook for investors. Quinn Thompson, a key voice, suggests buying during the dip, and historical trends back this view. Investors should weigh these factors, considering both risks and rewards in today’s market.

As the cryptocurrency market evolves, global events, economic signals, and technical analysis will shape strategies. The next few weeks will be crucial in determining if Bitcoin will repeat its typical October surge or follow a new path in this ever-changing financial environment.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

13

1 month ago

13