ARTICLE AD

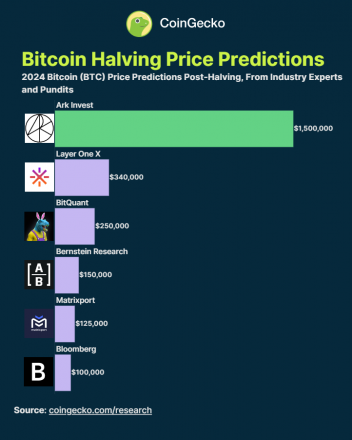

The price is the average prediction of 31 different fintech executives, which ranges from $100,000 to $1.5 million.

The approach of Bitcoin’s (BTC) fourth halving and the approval of its first spot ETF in the US prompted price predictions for 2024 ranging from $100,000 to $1.5 million, points out information gathered by CoinGecko from a Finder survey. The average BTC price found in 31 predictions made by different fintech executives is $87,000.

On top of representing the industry’s expectation of Bitcoin’s performance in 2024, this figure represents aggregated sentiment and understanding of asset potential post-halving value. Interestingly, nearly half of the surveyed experts believe BTC is currently underpriced, while 10% view it as overpriced.

Halving is the event in which BTC miners’ rewards paid for each successfully mined block are reduced by 50%, thus halving the daily batch of new Bitcoins. This supply shock is seen by analysts as a key event to track crypto market cycles, being the reason why crypto veterans pay attention to the halving.

Six Bitcoin price predictions. Imagem: CoinGecko

Six Bitcoin price predictions. Imagem: CoinGeckoHowever, it is crucial to acknowledge the diversity in these predictions, underscoring the complexity and uncertainty inherent in cryptocurrency markets. For instance, ARK Invest’s projection extends to a staggering $600,000 by 2030 in a worst-case scenario. In contrast, other forecasts, like those from Matrixport and BitQuant, suggest a more immediate target, with predictions ranging between $80,000 and $250,000 by the end of 2024.

These variations are indicative of the myriad factors influencing cryptocurrency prices, from market liquidity to macroeconomic trends.

This broad spectrum of predictions can also be exemplified by the recent VanEck valuation report on Solana (SOL), which offered a wide range of $10 to $3,211 by 2030. This highlights the speculative nature of the crypto market, where even the most informed predictions can encompass an extraordinarily wide range of outcomes.

Therefore, investors and enthusiasts must approach these predictions from a balanced perspective. While the average price target of $87,000 is a valuable indicator of market sentiment, it must be contextualized within the broader market dynamics and potential future developments.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

90

1 year ago

90