ARTICLE AD

Bitcoin is currently trading at $66,800 after a week of significant volatility. The price has stabilized above the crucial $65,000 support level, signaling resilience as the market takes a breather after several weeks of heightened excitement. This consolidation phase below the key $70,000 mark suggests that BTC may be preparing for its next major move.

Data from CryptoQuant reveals that demand for Bitcoin remains robust, even amid cooling momentum. This strong demand is a positive indicator, suggesting that market participants are accumulating BTC at current levels, anticipating further upside potential. Analysts interpret this data as a sign that BTC is poised for an upward push once market conditions align.

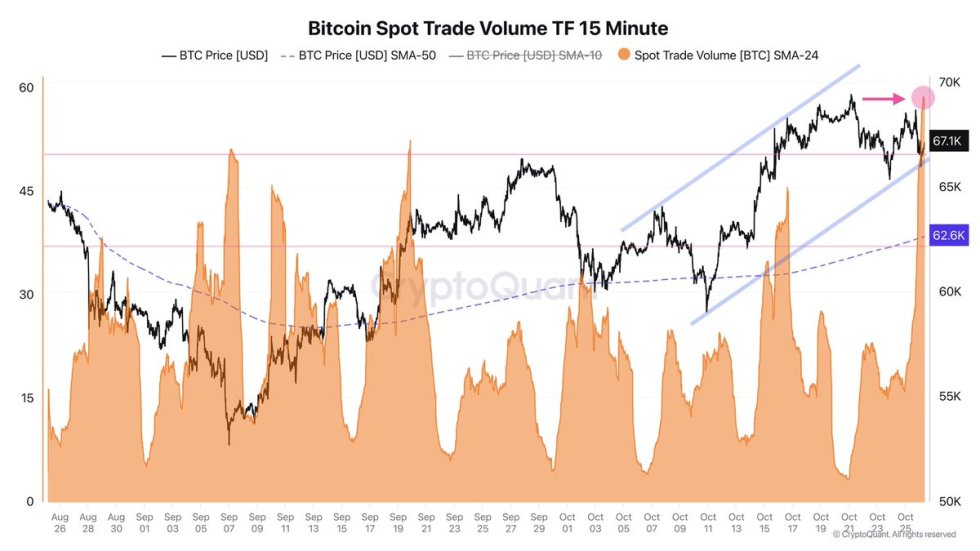

The average trading volume over each 15-minute interval in the past 24 hours has been 60 BTC, marking a local high for the past two months. Such elevated trading volume highlights active participation and increased interest in the current price range, further supporting the potential for a breakout.

As Bitcoin consolidates within this range, the $70,000 resistance level remains a pivotal threshold. Breaking above it would likely attract more buyers and signal the beginning of a more sustained rally. With these volume and demand indicators in play, BTC could soon capitalize on this momentum to target new highs.

Bitcoin Trading Volume Indicates Strong Demand

Bitcoin is showing resilience with a bullish outlook as spot trading volume reaches levels not seen in two months. Top analyst and investor Axel Adler shared critical insights on X, revealing that the average trading volume per 15-minute interval over the past 24 hours was 60 BTC, marking a local high. This peak in trading activity points to robust demand, indicating strong interest in BTC even amid recent market challenges.

Bitcoin Spot Trade Volume (15min) hits a 2-month high | Source: Axel Adler on X

Bitcoin Spot Trade Volume (15min) hits a 2-month high | Source: Axel Adler on X

The surge in volume arrives in the wake of Friday’s FUD (fear, uncertainty, and doubt) surrounding USDT, which could have triggered sell-offs or hesitancy among retail investors. However, the heightened trading volume suggests that major investors, often referred to as “smart money,” are instead seizing the opportunity to accumulate BTC at current levels. This accumulation phase is often a precursor to a larger price movement, as these high-volume buyers typically seek to position themselves before significant price shifts.

Analysts interpret this volume spike as a signal that BTC is at a pivotal level, reinforcing a bullish sentiment across the market. If trading volume remains high, it may fuel upward momentum and support a breakout above resistance levels in the near term. The strong demand under current conditions suggests that BTC could be primed for its next rally, especially if it breaks through key resistance levels like $70,000.

Should volume sustain these elevated levels, Bitcoin could confirm the bullish signals and push toward new highs, driven by a foundation of strategic accumulation and renewed investor confidence.

BTC Support Holding Strong

Bitcoin is currently holding steady above $66,000 after a stretch of volatility and market uncertainty. This level, a significant liquidity area, served as a strong resistance point in late September and has now flipped into support, signaling potential strength in BTC’s trend. If Bitcoin manages to maintain its position above this crucial level, a push to new all-time highs appears increasingly likely as buyer momentum builds and confidence returns to the market.

BTC holding above $65K | Source: BTCUSDT chart on TradingView

BTC holding above $65K | Source: BTCUSDT chart on TradingView

However, if BTC falls below the $65,000 mark, we could see the price enter a period of sideways consolidation as it seeks fresh liquidity. Such a consolidation phase would likely serve as a reset for the market, giving bulls and bears time to recalibrate. For the bullish structure to remain intact, BTC needs to stay above the 200-day moving average (MA), currently at $63,250. This MA level represents a pivotal threshold that market participants watch closely, as a drop below it could shift sentiment and invite bearish pressure.

In the near term, maintaining strength above $66,000 could be the catalyst for a continued upward trajectory, potentially propelling BTC to challenge key resistance levels on the path to new highs.

Featured image from Dall-E, chart from TradingView

4 weeks ago

47

4 weeks ago

47