ARTICLE AD

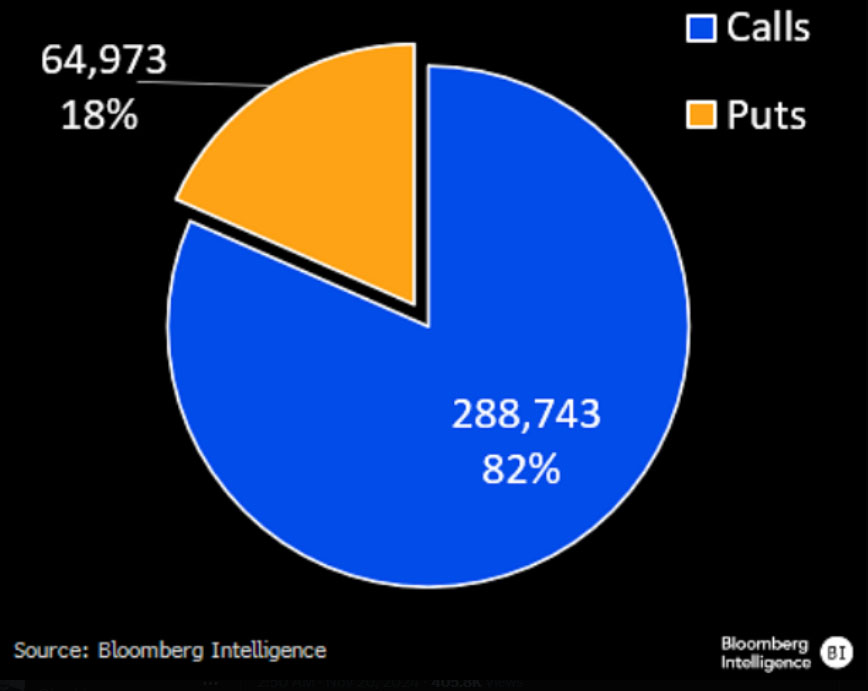

Call options dominated the activity, making up 82% of contracts, signaling strong bullish sentiment.

Key Notes

Bitcoin ETF options launched with nearly $2 billion in notional exposure on their first trading day.Out of 354K contracts, 289 K were calls and 65K puts, reflecting a 4.4:1 ratio.The IBIT options debut is expected to attract more institutional investors and impact Bitcoin’s volatility.

Bitcoin (BTC) ETF options have made a remarkable entrance, amassing nearly $2 billion in notional exposure on their very first day, significantly impacting Bitcoin’s market dynamics. On November 20, options tied to BlackRock’s Bitcoin exchange-traded fund, known as IBIT, began trading.

Bloomberg Intelligence analyst James Seyffart highlighted the extraordinary volume, stating:

“1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts, […] That’s a ratio of 4.4:1. […] These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

The introduction of IBIT options marks a pivotal moment for Bitcoin investors, particularly institutions. Market participants widely anticipate that the availability of these options will attract more institutional interest in Bitcoin BTC $93 572 24h volatility: 2.1% Market cap: $1.85 T Vol. 24h: $76.52 B . This follows the US Securities and Exchange Commission’s approval in September for options on several of the 11 spot bitcoin ETFs across various exchanges, with more options products expected to launch shortly.

Bitcoin Sees 80% Bullish Options Surge

According to James Seyffart’s post, the launch of IBIT’s options trading saw an impressive debut, with $1.9 billion in notional exposure traded across 354,000 contracts. The data reflects heightened market interest, aligning with Bitcoin’s climb to new all-time highs. Call options dominated the activity, making up 82% of contracts, signaling strong bullish sentiment.

Source: Bloomberg Intelligence

Out of 354,000 contracts traded on IBIT’s first day, 289,000 were calls, while 65,000 were puts. The call-to-put ratio of 4.4:1 highlights the overwhelming preference for bullish bets on Bitcoin. The surge in options trading suggests investors are optimistic about Bitcoin’s price trajectory amidst the ongoing crypto rally.

Financial derivatives offer buyers the right to buy or sell an asset at a set price within a defined period. A call option enables the asset’s purchase at the strike price, while a put option allows its sale at the same predetermined price. Investors often favor call options when expecting price increases, enabling profitable purchases or sales if the market moves upward. Conversely, put options offer protection against price drops or allow speculation on declines, letting holders sell the asset at the strike price even if its market value falls.

The rise in IBIT options trading has introduced new strategies for experienced investors, enhancing market liquidity and shaping the broader market landscape. Institutional players, hesitant about unregulated platforms, can use IBIT options to hedge bullish positions and earn extra income by selling calls. Speculators, meanwhile, exploit both call and put options to profit from Bitcoin’s volatility without directly owning the asset.

Can Bitcoin Options Reduce Long-Term Volatility?

The influx of IBIT call options may shape Bitcoin’s implied volatility over time. Analysts suggest substantial call option volumes could lower volatility in the long run. In the short term, heightened demand during bullish trends might trigger price surges akin to GameStop’s gamma squeeze, where leveraged buying drives rapid increases.

Bitcoin surged to a fresh high of $93,800 on Wednesday, extending its impressive post-election rally. Over the weekend, prices steadied near $91,000 following last week’s climb past $80,000 and $90,000 for the first time, marking a significant milestone for the cryptocurrency market.

Bitcoin’s rise is linked to the “Trump trade,” fueled by President-elect Donald Trump‘s promises to consider crypto-friendly initiatives. Proposals like establishing a Bitcoin national stockpile have invigorated market optimism, underscoring the cryptocurrency’s expanding role in both policy and global financial markets.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin ETF News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

3 months ago

48

3 months ago

48