ARTICLE AD

The recent sight of ETF outflow aligns with Bitcoin’s downward trajectory. The cryptocurrency lost 13% of its worth over the past week.

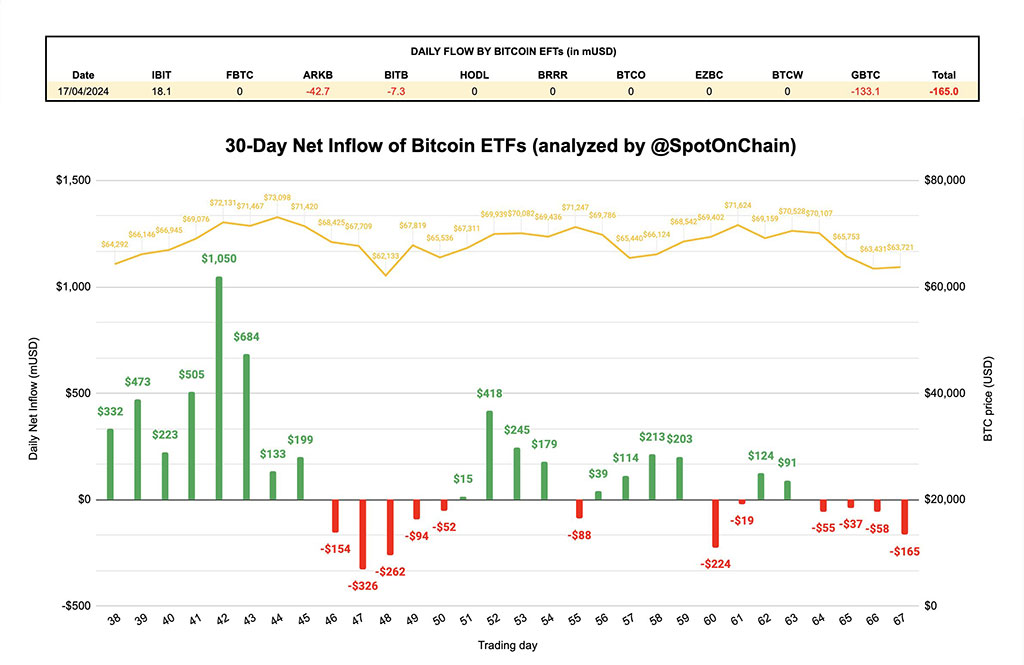

The steady outflow from Bitcoin (BTC) exchange-traded funds (ETFs) highlights the ongoing selling pressure. These funds experienced negative inflows for five consecutive days, closing in a $165 million outflow on April 17, 2024. The negative outflow follows Bitcoin’s current bearish trend, which has declined over 13% in the last week.

The Grayscale Bitcoin Trust (GBTC), the largest Bitcoin investment fund globally, keeps facing withdrawals from investors. Yesterday’s outflow of $133 million added to the continuous negative inflows, showing investors’ waning interest amid a substantial 1.5% management fee.

However, a bright spot emerges in the form of BlackRock’s iShares Bitcoin Trust (IBIT). While the IBIT’s inflows have slowed compared to earlier this week, it remains the only ETF recording positive net inflows. However, the rate decreased to $18 million on April 17, substantially lower than previous days.

Photo: SpotOnChain

Bitcoin ETFs Signal Shifting Investor Sentiment

The decline in Bitcoin ETFs signifies a broader shift in the Bitcoin investment arena. While the introduction of spot Bitcoin ETFs initially sparked enthusiasm, the overall inflow into these offerings has decreased substantially, highlighting a changing sentiment among investors towards Bitcoin-related investment vehicles.

However, the declining outflow stands in contrast to the substantial investments made earlier in April, when BlackRock’s IBIT ETF led the inflow by accumulating a net inflow surpassing $25.78 million on Tuesday, driving the collective inflows beyond the impressive $15.3 billion milestone.

Furthermore, Bloomberg ETF consultant James Seyffart emphasizes that days without any inflows are typical for Bitcoin ETFs and should not be mistaken as an indication of product failure. He says similar patterns happen across many types of exchange-traded funds in the United States.

Bitcoin Price Decline Drives ETF Outflows

The recent sight of ETF outflow aligns with Bitcoin’s downward trajectory. The cryptocurrency lost 13% of its worth over the past week, currently hovering around $62,300 with an overall market evaluation of $1.21 trillion. Bitcoin’s price drop likely impacted investor confidence, driving outflows across its investment products.

Photo: Bitcoin2go

According to the technical analysis from a pseudonym analyst named “Bitcoin2go”, Bitcoin shows an essential $61,000 support level. Although regaining the lost 200 EMA (4h) earlier this week is possible, efforts to recover significantly have faced obstacles.

The coming weeks could see a shift in market sentiment depending on factors like geopolitical tensions and corporate earnings reports. However, some analysts believe that these outflows are simply an acceleration of a correction that was inevitable.

With the Bitcoin halving event just around the corner (less than 48 hours away as of April 18), opinions are divided on its short-term price impact. While experts believe it might not significantly influence the price, the overall market atmosphere will likely continue to play a major role in shaping Bitcoin’s trajectory in the near future.

7 months ago

34

7 months ago

34