ARTICLE AD

Bitcoin ETFs' rapid accumulation signals a shift in crypto whale dynamics.

Bitcoin (BTC) exchange-traded funds (ETFs) rapidly absorbed over 4% of the total BTC supply in less than three months, according to the latest “On-chain Insights” newsletter by IntoTheBlock. This development comes after the US Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs and the transformation of the Grayscale Bitcoin Trust (GBTC) into an ETF.

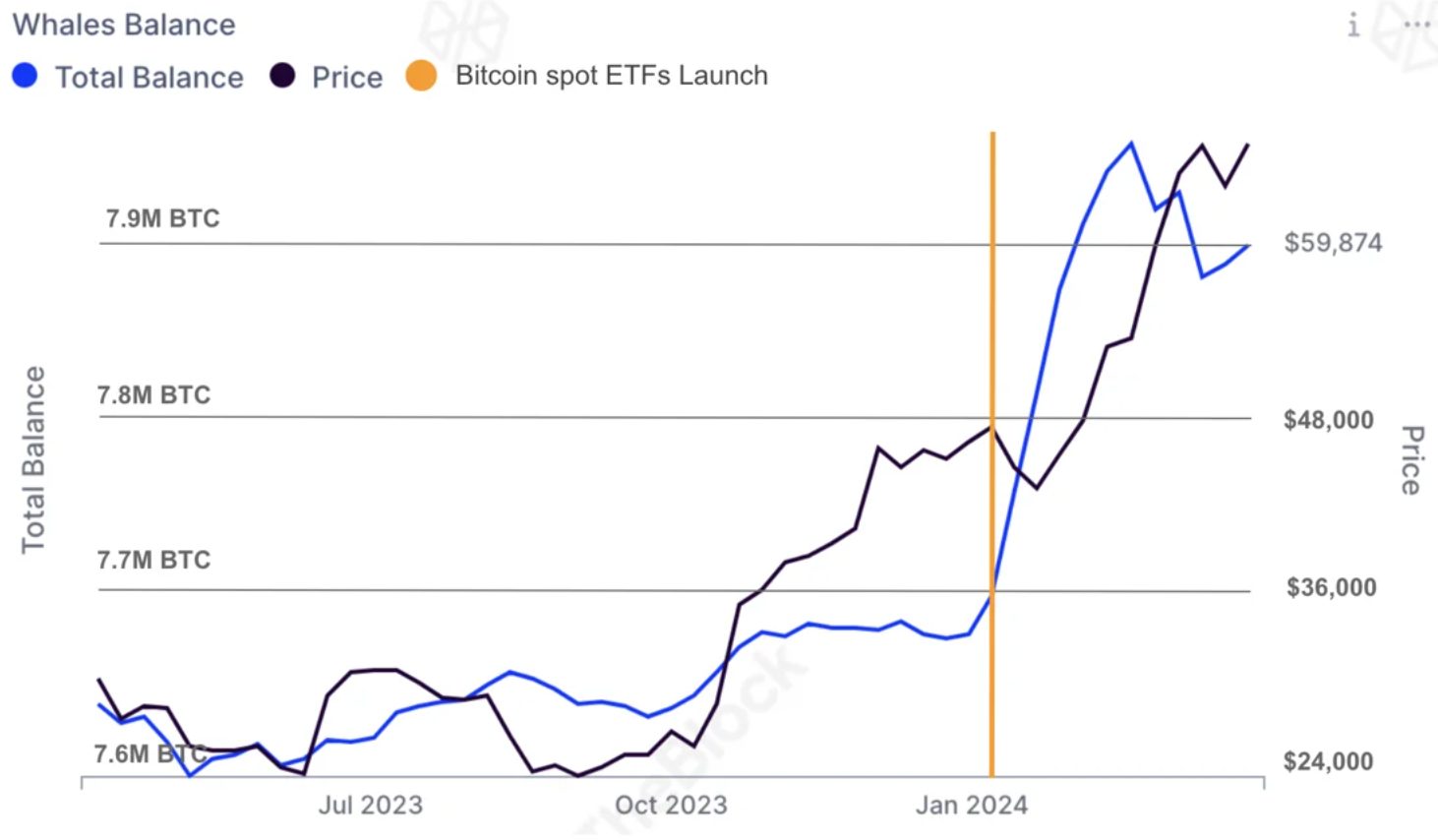

The influence of Bitcoin ETFs on the market has been profound, with addresses holding at least 1,000 BTC seeing their balances soar to the highest levels since June 2022. The total Bitcoin held by these whales has increased by 220,000 BTC, approximately $14.2 billion, with 210,000 BTC attributed to net inflows into the ETFs. This influx has not only propelled Bitcoin to new all-time highs but also spurred broader demand for crypto-assets.

Lucas Outumuro, Head of Research at IntoTheBlock, states that these financial instruments have simplified the process of investing in Bitcoin, attracting both institutional and retail investors by eliminating the complexities of centralized exchanges and private key management.

Meme coins and liquid staking played an important role in Q1

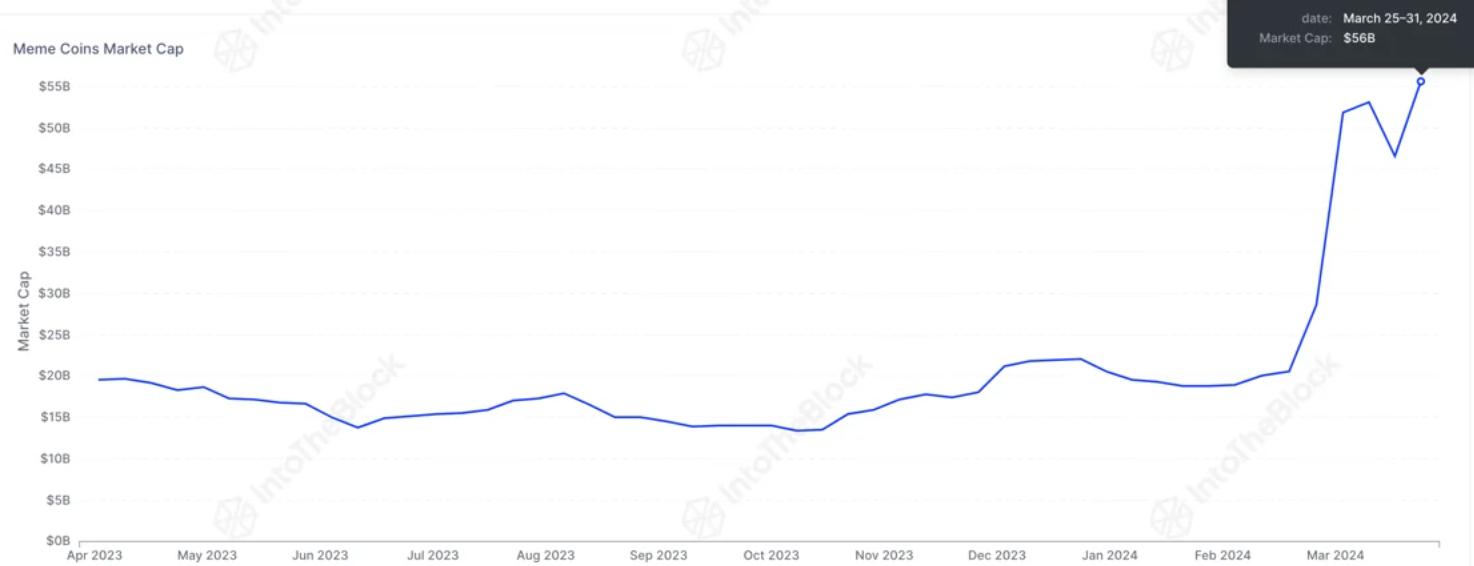

As the market momentum shifts towards a bull run, traders are increasingly seeking higher-risk assets, with meme coins emerging as a prime target. Despite high-interest rates and the absence of stimulus checks, the demand for meme coins has reached its peak since 2021.

The market capitalization for this category has nearly tripled in 2024, with Dogecoin, Shiba Inu, and other meme coins experiencing significant price increases. The meme coin craze has also benefited from lower transaction fees on networks like Solana, which has seen days with trading volumes surpassing those on Ethereum.

The resurgence of meme coins on the Ethereum ecosystem can be partly attributed to the successful implementation of the Dencun upgrade, which has led to a drastic reduction in gas fees, particularly on Coinbase’s Base layer-2 network. This upgrade has facilitated the transfer of the meme coin frenzy back to Ethereum, indicating a dynamic shift in the crypto landscape.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

42

7 months ago

42