ARTICLE AD

Eric Balchunas notes January's ETF surge, spotlighting BTC's dominance despite representing just 14% of the new products.

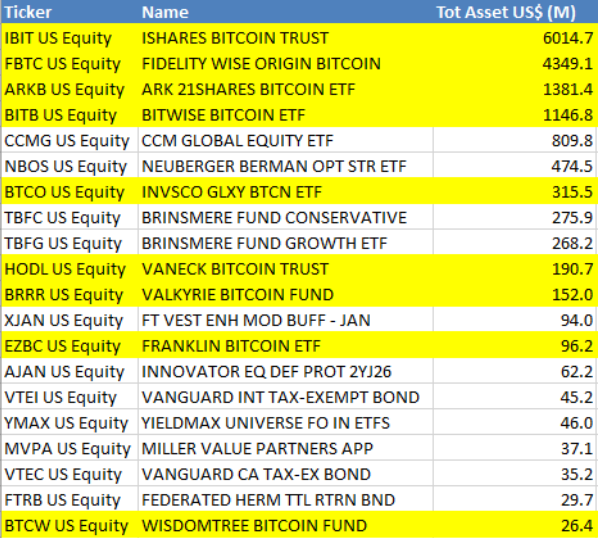

The nine spot Bitcoin exchange-traded funds (ETFs) launched in the US in January were responsible for 83% of all assets under management (AUM) allocated in the 65 ETFs released in the same month. This means that 14% of the exchange-traded funds negotiated last month were responsible for the majority of capital netflow.

Bloomberg ETF analyst Eric Balchunas pointed out on X (formerly Twitter) that this was the biggest January of all time in terms of ETF launches, which makes the feat accomplished by Bitcoin (BTC) investment vehicles even more impressive.

Moreover, all Bitcoin ETFs stood within the Top 20 by AUM of all ETFs launched in that same month. Even the BTCW, launched by asset manager WisdowTree, which was the smallest of the nine ETFs, secured a spot in the group.

Image: Erich Balchunas/X

Image: Erich Balchunas/XBitcoin ETF landscape

Bitcoin ETFs amass close to 184,500 BTC in AUM at the time of writing, according to on-chain data platform Arkham Intelligence. BlackRock’s IBIT Bitcoin ETF still holds the largest amount of Bitcoin, with over 109,000 BTC under management, equivalent to $5.7 billion.

ARK Invest’s ARKB Bitcoin ETF comes in second place, with 26,640 BTC tied to their address, which is close to $1.4 billion. WisdomTree’s BTCW Bitcoin ETF is still the smallest in AUM, with almost 563 BTC under management, representing $29.2 million.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

53

9 months ago

53