ARTICLE AD

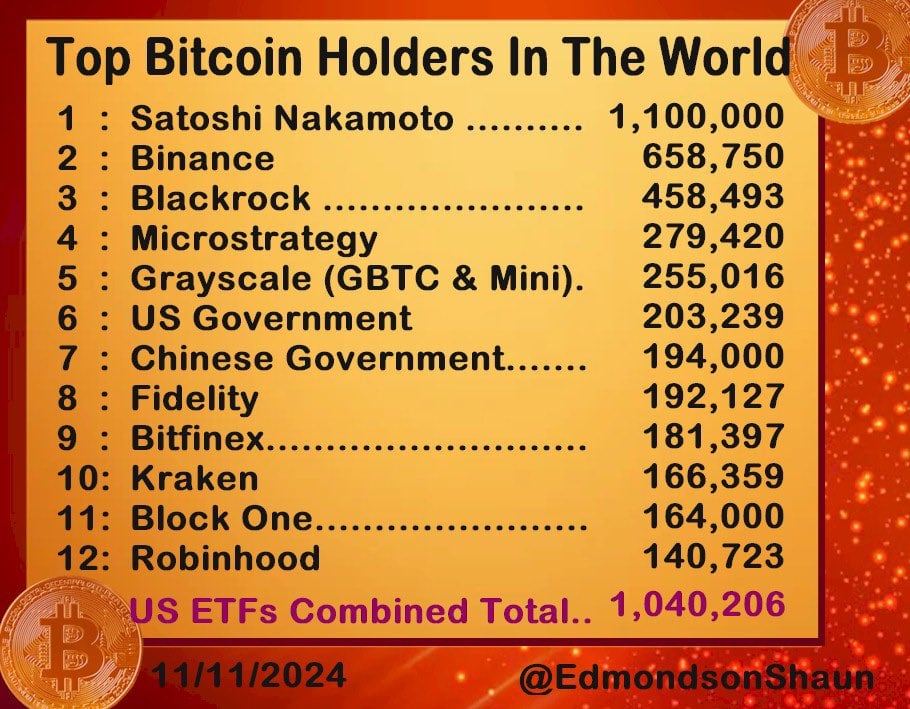

Both the US and Chinese governments are big Bitcoin holders.

Key Takeaways

US spot Bitcoin ETFs are just 5% shy of surpassing Satoshi’s estimated stash. Recent inflows into US spot Bitcoin ETFs have accelerated, with a weekly acquisition rate of 17,000 BTC. <?xml encoding="UTF-8"?>US spot Bitcoin ETFs are well on track to surpass Satoshi Nakamoto to become the largest holders of Bitcoin. These funds have accumulated around 1,04 million BTC, reaching 95% of Satoshi Nakamoto’s estimated 1.1 million BTC holdings, according to data compiled by Shaun Edmondson and confirmed by Bloomberg ETF analyst Eric Balchunas.

Balchunas predicted that Bitcoin ETFs will soon own more Bitcoin than Satoshi Nakamoto, and the milestone is expected around Thanksgiving.

Author: Shaun Edmondson

Author: Shaun EdmondsonAs of October 28, US Bitcoin funds held a total of 983,334 BTC, which means they have added over 56,000 BTC over the past two weeks.

The accumulation rate has accelerated following Donald Trump’s US presidential election victory. According to Farside Investors’ data, US spot Bitcoin ETFs have seen a massive influx of $3.4 billion in just four days post-Election Day.

Last Thursday was the group’s best performance, with investors pouring around $1.3 billion into ETFs. BlackRock’s IBIT itself reported a record-breaking $1.1 billion that day, alongside high trading volumes.

According to Balchunas, US spot Bitcoin ETFs are rapidly accumulating Bitcoin at a rate of approximately 17,000 BTC per week. Keeping this rate, these funds will soon surpass the estimated Bitcoin holdings of Satoshi by December 2024.

Edmondson’s list of top Bitcoin holders is dominated by major entities, including MicroStrategy. On Monday, the company announced it had added 27,200 BTC to its portfolio. It now holds 279,420 BTC, valued at approximately $23 billion.

Disclaimer

2 months ago

17

2 months ago

17