ARTICLE AD

Nate Geraci, President of ETF Store, called it a “monster day” for spot Bitcoin ETFs. He highlighted that net inflows over the past ten months are approaching $20 billion.

Key Notes

Spot Bitcoin ETFs saw $555.9 M inflows on October 14, led by Fidelity’s FBTC with $239.3M.Total Bitcoin ETF inflows near $20 B over ten months, driven by institutional investors, not retail.Bitcoin surged to $66,400, its highest since July, boosting optimism for breaking $70,000.US spot Bitcoin exchange-traded funds (ETFs) saw their largest single-day inflow in over four months, pulling in over $500 million. On October 14, 11 ETFs together recorded net inflows of $555.9 million, the highest since early June, according to Farside Investors. This surge followed Bitcoin’s price jump to a two-week high of $66,400 during late trading.

Nate Geraci, President of ETF Store, called it a “monster day” for spot Bitcoin ETFs. He highlighted that net inflows over the past ten months are approaching $20 billion. In an October 15 X post, he noted the demand far exceeded expectations, driven mainly by advisers and institutional investors rather than retail traders.

Monster day for spot btc ETFs…

$550mil inflows.

Now approaching *$20bil* net inflows in 10mos.

Simply ridiculous & blows away every pre-launch demand estimate.

This is NOT “degen retail” $$$ IMO.

It’s advisors & institutional investors continuing to slowly adopt.

Fidelity’s FBTC Leads the Pack

Fidelity’s Wise Bitcoin Origin Fund (FBTC) led with an inflow of $239.3 million, the highest since June 4. Bitwise’s Bitcoin ETF (BITB) followed, bringing in slightly over $100 million. BlackRock’s iShares Bitcoin Trust (IBIT) reported inflows of $79.6 million. Meanwhile, the Ark 21Shares Bitcoin ETF (ARKB) attracted nearly $70 million, and Grayscale Bitcoin Trust (GBTC) saw $37.8 million in its first October inflow, the largest since May.

In an October 14 post, Bloomberg senior ETF analyst Eric Balchunas compared Bitcoin ETF performance with gold ETFs. Since January, Bitcoin ETFs have hit all-time highs five times, whereas gold has set records 30 times this year. Despite this, gold ETFs only gained $1.4 billion in inflows, compared to over $19 billion for Bitcoin ETFs.

Interesting, since the launch of the bitcoin ETFs bitcoin has hit records highs 5 times but gold has hit record highs 30 times.. albeit has only taken in $1.4b in net flows vs $19b for btc ETFs.. via @psarofagis pic.twitter.com/3ZNbuW1XJW

— Eric Balchunas (@EricBalchunas) October 14, 2024Ethereum funds have not fared as well. Bitwise, VanEck, Franklin, and Grayscale reported no net flows, while Fidelity and Invesco saw small inflows. BlackRock’s iShares Ethereum Trust (ETHA) did see an inflow of $14.3 million, bringing its total to $17 million.

Uptober Brings Hope for Bitcoin

On October 15, Bitcoin made headlines by rallying 6% to reach $66,400, its highest price since July 30. The surge positively impacted publicly traded crypto-linked companies in the United States, with several firms reporting significant gains. In an October 14 X post, Dan Tapiero, founder of crypto investment firm 10T Holdings, stated that Bitcoin is “on the verge” of breaking through $70,000.

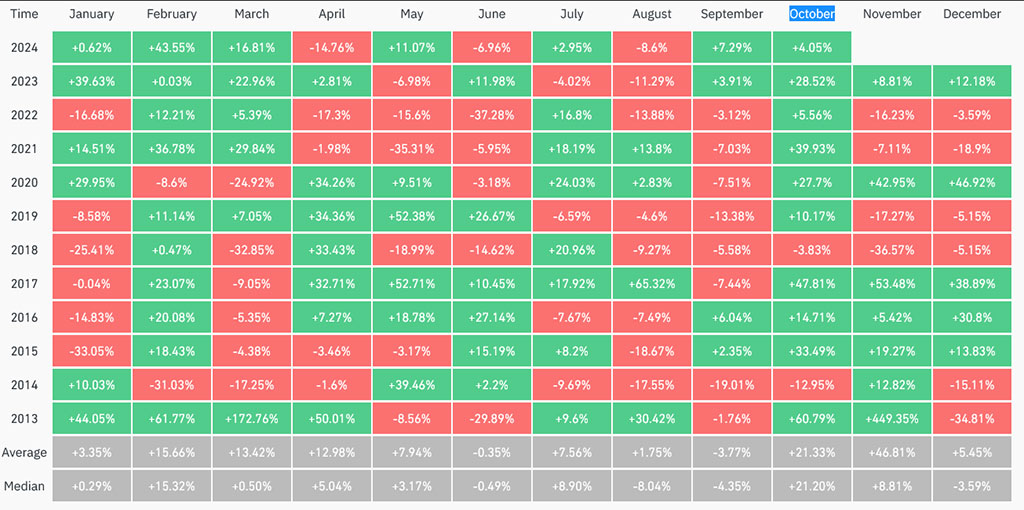

“Uptober”, a bullish term for October that has seen Bitcoin price increase in nine of the last eleven Octobers, often kickstarts strong fourth quarters for the cryptocurrency, according to CoinGlass data.

Photo: CoinGlass

The recent price surge aligns with election campaigns where candidates like Kamala Harris and Donald Trump are promoting better regulations for the crypto industry. Harris is perceived as friendlier toward crypto than President Biden, while Trump is more pro-industry.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

11

1 month ago

11