ARTICLE AD

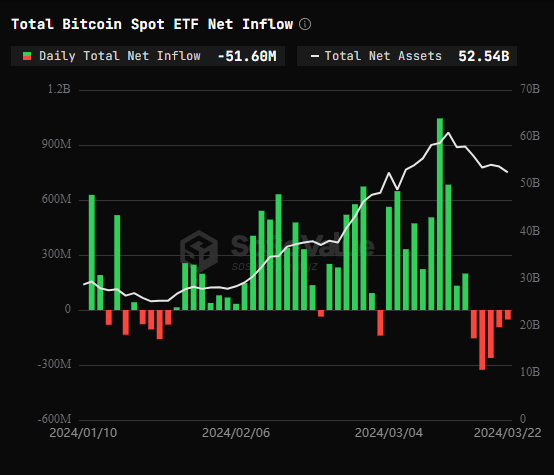

Spot Bitcoin exchange-traded funds (ETFs) reported total net outflows of $51.6 million on Friday, marking the fifth day of consistent withdrawals.

Among these, the Grayscale ETF (GBTC) experienced a substantial single-day net outflow of $169 million. In contrast, the BlackRock ETF (IBIT) and Fidelity ETF (FBTC) saw modest single-day net inflows of $18.89 million and $18.13 million, respectively, both reaching two-day record lows.

Despite this downward trend, there’s a silver lining as the rate of outflows appears to be decelerating. The most significant drop happened on Tuesday, with over $323 million exiting across all 10 ETFs. Correspondingly, Bitcoin’s value dipped to $62,000 on the same day.

Total Bitcoin ETF outflow since SEC approval | Source: SoSo Value

Total Bitcoin ETF outflow since SEC approval | Source: SoSo Value

However, as the outflow slows, Bitcoin has started to bounce back, showing a near 3% increase today, pushing its price up to $64,600.

Analysts have suggested that ETF demands could resurface as the largest cryptocurrency reaches certain support levels.

The upcoming halving could also see renewed interest from institutional investors in these ETFs.

#Bitcoin spot ETF netflows are slowing.

Demand may rebound if the $BTC price approaches critical support levels.

New whales, mainly ETF buyers, have a $56K on-chain cost basis. Corrections typically entail a max drawdown of around 30% in bull markets, with a max pain of $51K. pic.twitter.com/vZCG4F0Gh5

This recent activity underscores a strong correlation between Bitcoin ETF movements and the BTC’s market value.

Earlier in the month, when Bitcoin ETFs enjoyed a record influx of $1 billion, the price of BTC soared to an all-time peak of $73,700.

8 months ago

35

8 months ago

35