ARTICLE AD

Bitcoin ETFs in US now manage over $12.3 billion, despite regulatory challenges.

Spot Bitcoin exchange-traded funds (ETFs) in the US registered $1.3 billion in inflows over the past two weeks, shared Bloomberg ETF analyst Eric Balchunas on X. This was enough to recover completely from April’s net outflows of over $343 million.

The Bitcoin ETFs traded in the US now hold more than $12.3 billion under management, which Balchunas considers a key number for considering inflows and outflows.

https://twitter.com/EricBalchunas/status/1791443740822745158

Moreover, Balchunas highlighted that those numbers make a point of not getting “emotional” over Bitcoin ETF flows, sharing his belief that the net flows will turn out as positive in the long term and that the flow amounts are relatively small when compared to the total under management.

As reported by Crypto Briefing, professional investment firms showed a high interest in Bitcoin ETFs in the first quarter, with 937 of them reporting exposure to those investment instruments in their 13F Forms.

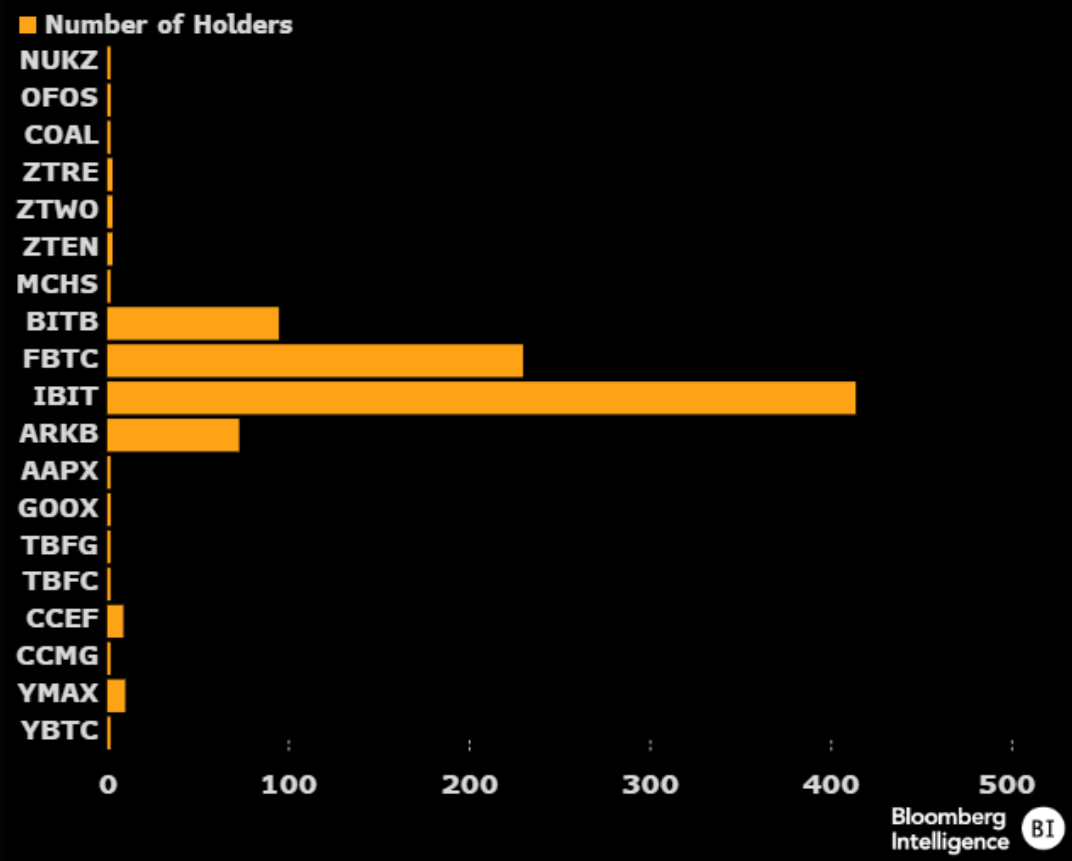

Balchunas doubled down on that, highlighting that BlackRock’s IBIT got 414 reported holders in Q1. He adds that having 20 holders for a recently launched ETF is “highly rare,” showing that at least four Bitcoin funds surpassed that mark with ease.

Number of holders for ETFs launched in January. Image: Eric Balchunas/Bloomberg Intelligence

Number of holders for ETFs launched in January. Image: Eric Balchunas/Bloomberg IntelligenceIn the last 24 hours, nine Bitcoin ETFs in the US added 3,743 BTC to their holdings, as reported by X user Lookonchain, which is equivalent to over $250 million. Grayscale’s GBTC added 397 BTC, while BlackRock’s IBIT added 1,435 BTC.

Galaxy’s BTCO was the only Bitcoin ETF showing daily net outflows, with 543 BTC leaving their chest.

Regulatory movements

Furthermore, recent regulatory developments in the US could heat up even more the Bitcoin ETF landscape. Yesterday, the Senate passed a vote to overturn the SEC’s Staff Accounting Bulletin No. 121 (SAB 121), which makes it more expensive for banks to hold digital assets for their customers.

However, US President Joe Biden has already manifested himself contrary to the bill, and a presidential veto is very likely.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

32

6 months ago

32