ARTICLE AD

Spot Bitcoin ETFs defy skeptics with a surge in demand.

Bitcoin’s price soared to $71,200 on Tuesday, only 4% away from its all-time high of $73,700 established earlier in March, according to data from TradingView. The rally comes on the heels of massive inflows into US spot Bitcoin exchange-traded funds (ETFs).

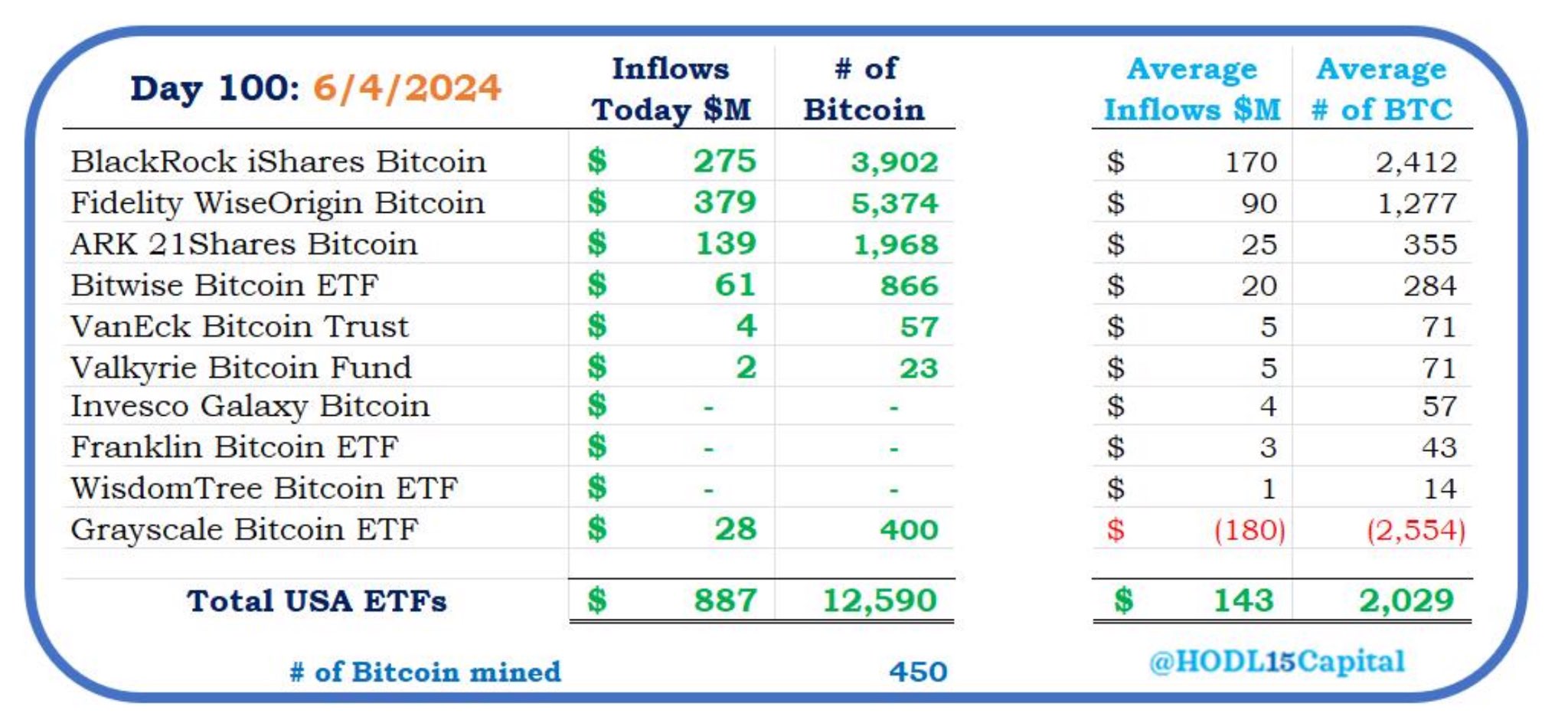

Data from HODL15Capital shows that US Bitcoin funds collectively witnessed $887 million in net inflows, marking the second-highest such inflow ever recorded.

US Spot Bitcoin ETF Inflows (June 4) – Source: HODL15Capital

US Spot Bitcoin ETF Inflows (June 4) – Source: HODL15CapitalLeading the charge, the Fidelity Wise Origin Bitcoin Fund amassed an impressive $378 million, while BlackRock’s iShares Bitcoin Trust followed with $275 million, according to insights from Farside Investors and HODL15Capital. The ARK 21Shares Bitcoin ETF claimed the third spot with over $138 million in net inflows.

These inflows marked a significant milestone, being the most substantial since March 12, which saw a record-setting $1.04 billion influx. The following day, Bitcoin reached a peak of $73,700.

At press time, BTC is trading close to $71,000, up almost 3% in the last 24 hours. The recent surge signals a positive turn for Bitcoin after several weeks of moving sideways. Industry experts suggest that the crypto market is set for a “bright June” due to anticipated spot Ethereum ETF developments.

With Bitcoin ETFs scoring big on their 100th trading day, Nate Geraci, president of ETF Store, addressed the skepticism surrounding Bitcoin ETFs and their demand, particularly from critics who doubted their appeal to retail investors.

Nate Geraci commented on US spot Bitcoin ETF inflows on June 4

Nate Geraci commented on US spot Bitcoin ETF inflows on June 4

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

4 months ago

25

4 months ago

25