ARTICLE AD

In terms of market share, the Bitcoin options market shows high concentration, with most trading on Deribit.

Key Notes

Bitcoin options worth $11.8 billion expire on December 27, 2024, potentially triggering market volatility.Bitcoin’s open interest has reached $50 billion, with a heavy concentration of call options, signaling bullish sentiment.Deribit dominates Bitcoin’s options market with a 74% market share, influencing price movements significantly.

Bitcoin BTC $89 701 24h volatility: 1.5% Market cap: $1.78 T Vol. 24h: $98.78 B is approaching a critical deadline, signaling the start of substantial shifts in the market. As the expiration of $11.8 billion in Bitcoin options nears on December 27, 2024, traders prepare for increased volatility. This expiration encompasses both call and put options, potentially influencing Bitcoin’s price trajectory in the final days of 2024.

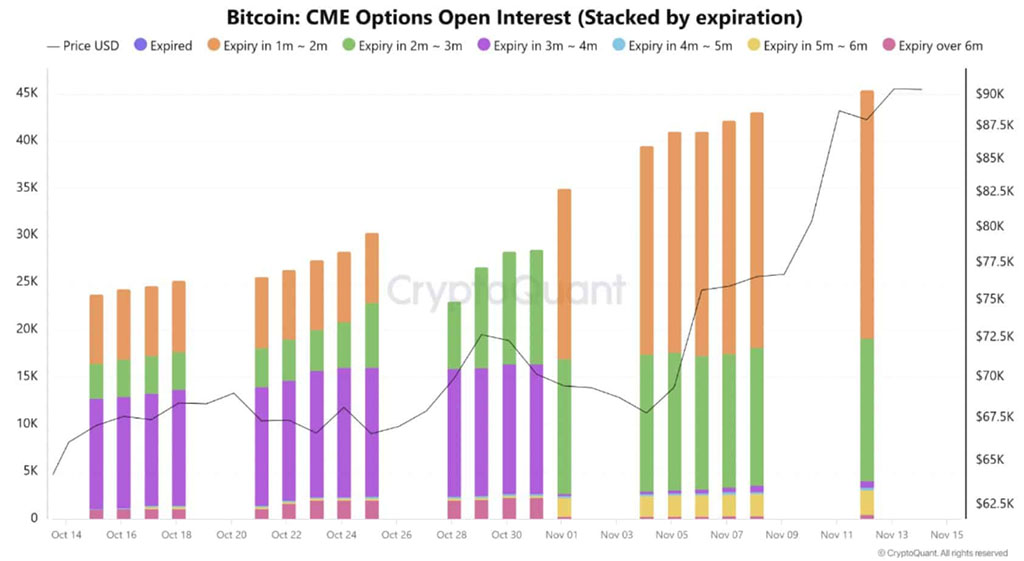

Source: CryptoQuant

The cryptocurrency has experienced a surge in bullish sentiment following the 2024 US elections. Some analysts forecast a rise to $100,000, fueled by increasing capital inflows and a market dominance surpassing 60%. However, achieving this milestone presents challenges, especially with billions in options contracts set to expire.

Bitcoin’s growing appeal is evident in the surge of open interest in the options market, which has recently hit an all-time high of $50 billion. However, much of this optimism hinges on Bitcoin’s performance in the upcoming weeks, particularly with the expiration of $11.8 billion worth of options contracts looming.

Bitcoin Price Hovers Above $90K

Bitcoin’s current price, just above $90K, reflects a balance of bullish and bearish forces. Over the past 24 hours, price corrections have emerged, suggesting that the market’s upward momentum may not last. The options market will play a crucial role in determining Bitcoin’s short-term price trajectory.

Of the $11.8 billion in call-and-put options set to expire, call options dominate, accounting for nearly 70% of the total order book, according to Coinglass data. Investors are optimistic about Bitcoin reaching the $100K mark. Should this target be met, a wave of call options would likely be exercised, generating substantial selling pressure as traders lock in profits.

However, this may not conclude the market’s movements. The expiry of these options could prompt a short-term pullback. Traders holding call options may flood the market with sales as they close their positions. If put options — bets on a price decline — begin to outnumber calls, market sentiment could shift, intensifying downward pressure.

Deribit Leads the Charge in Bitcoin Options Market

In terms of market share, the Bitcoin options market shows high concentration, with most trading on Deribit, which holds a 74% market share. CME and Binance account for around 10.3% each. The focus on Deribit highlights the main arena for Bitcoin price movement bets.

Bitcoin options face a delicate situation. Strong bullish sentiment has many traders anticipating a breakout above $100,000. However, the expiration of these contracts might trigger a self-fulfilling cycle of selling pressure if prices do not hold above $100K. The behavior of these contracts will be crucial for Bitcoin to maintain or exceed this value.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

2 months ago

21

2 months ago

21