ARTICLE AD

Selling pressure from long-term and short-term holders contributes to bitcoin price fluctuations nearing the next halving event.

Bitcoin (BTC) has shown considerable price volatility recently with fluctuations around the $70,000 level as holders realize profits, according to the latest “Bitfinex Alpha” report. Both short-term (STH) and long-term holders (LTH) are shedding a part of their positions as the next halving event approaches.

“Bitcoin is currently experiencing a consolidation phase, navigating a sideways range between $65,000 (range low) and $71,000 (range high). This movement indicates that the price is beginning to stabilize, even as the price fluctuates,” the report states.

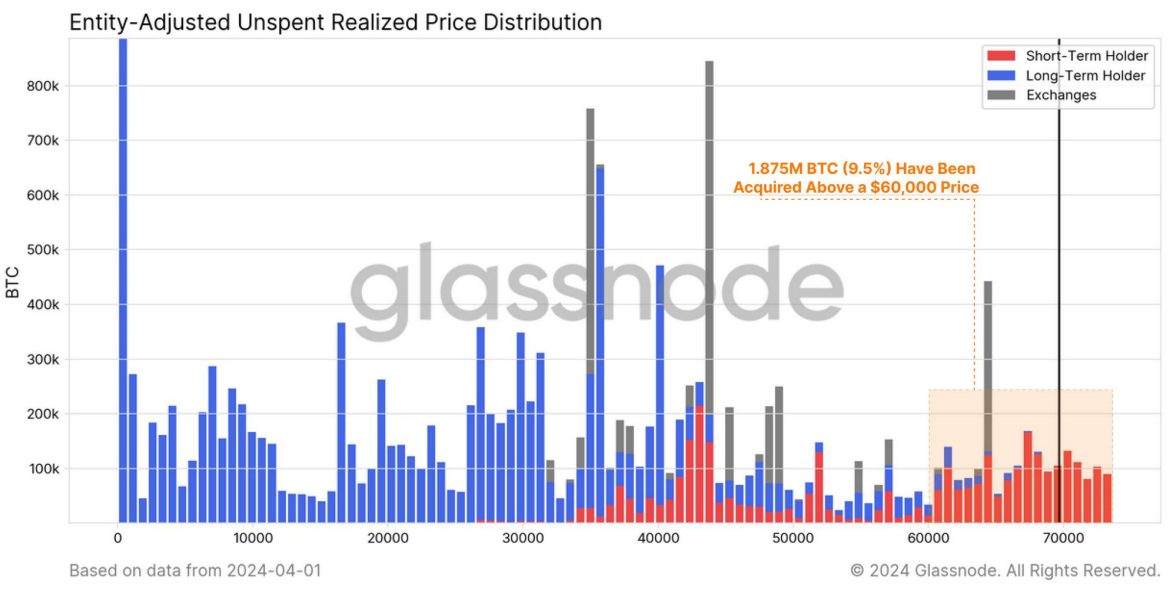

Image: Bitfinex/Glassnode

Image: Bitfinex/GlassnodeMaintaining the BTC price above critical support zones of approximately $60,000 and $57,000 reduces the chance of major corrections and preserves short-term momentum, as highlighted by Bitfinex’s analysts. The $57,000 support aligns with metrics tracking active Bitcoin addresses and ETF flows.

The current phase presents an opportunity to implement dollar-cost averaging strategies and accumulate Bitcoin at potentially advantageous prices amid uncertainty, the report notes.

More short-term holders

Moreover, the gap between STH and LTH has begun to narrow, as the latter group is selling part of their BTC holdings to secure significant unrealized profits. The peak of 14.9 million BTC held by LTHs was seen in December 2023, and it went down by approximately 900,000 BTC as of last week.

The report points out that the outflows from Grayscale Bitcoin Trust ETF (GBTC) account for about 32% of this reduction, amounting to around 286,000 BTC. Meanwhile, the supply held by STHs has seen an increase of 1.121 million BTC.

“This rise not only offsets the distribution pressure from LTHs but also indicates additional acquisition of about 121,000 BTC from the secondary market, including exchanges,” underscores the report.

Image: Bitfinex/Glassnode

Image: Bitfinex/GlassnodeThe short-term holders encompasse new spot buyers and include approximately 508,000 BTC currently held in spot Bitcoin exchange-traded funds (ETFs), excluding GBTC. This distribution highlights the active engagement of STHs at higher price levels and reflects the evolving dynamics of Bitcoin ownership, particularly in the context of recent market activities and the growing influence of institutional investments through spot ETFs.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

30

7 months ago

30