ARTICLE AD

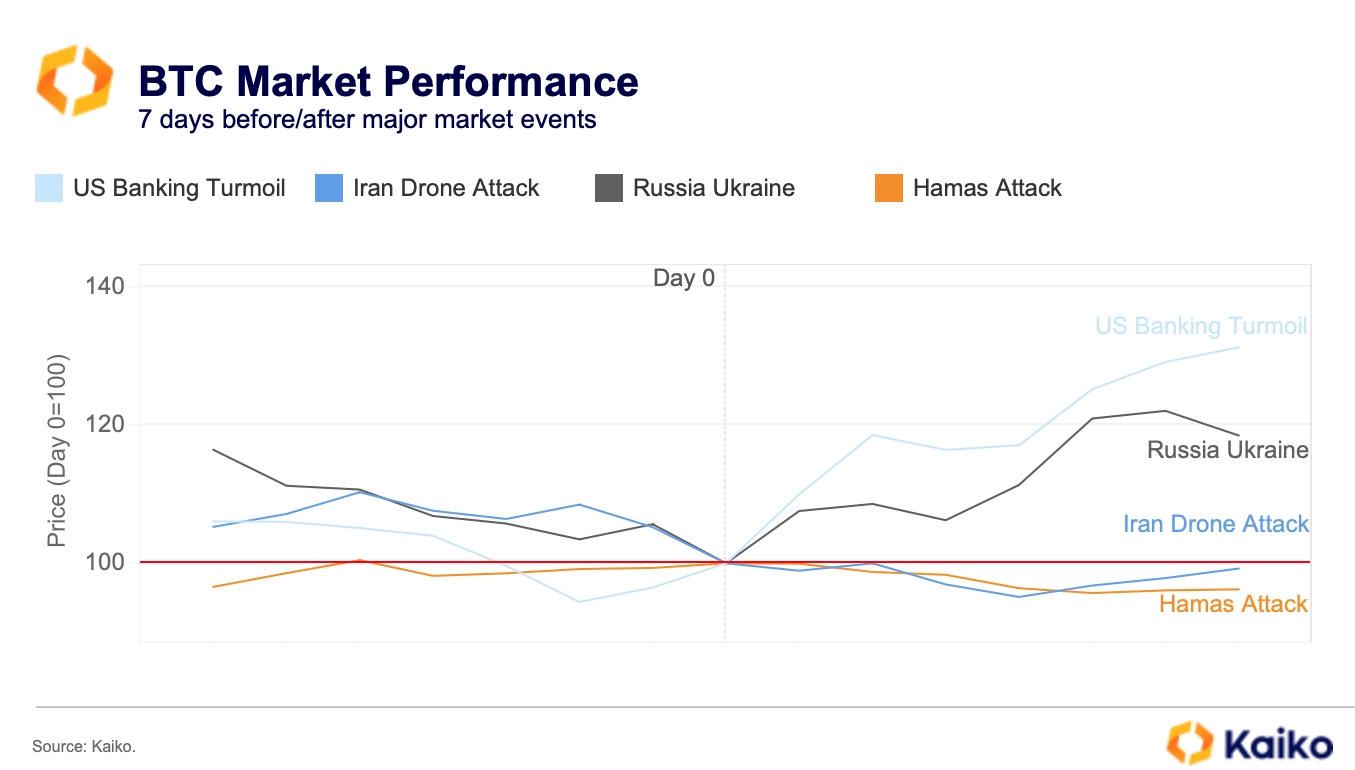

Bitcoin's 6% drop contrasts with gold, USD gains during geopolitical unrest.

Bitcoin’s value fell by 6% in April, diverging from traditional safe-haven assets like gold and the US Dollar, which experienced a rally amid the Middle East conflict escalation. According to a report by on-chain analysis firm Kaiko, the halving event and its usual volatility are among the factors influencing this trend.

Despite Bitcoin’s previous surges in response to the US banking crisis and Russia’s invasion of Ukraine, its reaction to other significant events such as the Hamas attack on Israel was negligible. Moreover, performance as a safe-haven asset is inconsistent across different fiat currencies, with currency devaluation often prompting increased crypto adoption.

Image: Kaiko

Image: KaikoAs Kaiko analysts mentioned, this could be tied to the halving. Trader Rekt Capital shared his analysis on the current state of this Bitcoin cycle, concluding that its price is in a post-halving accumulation range. This could be the last chance investors might have to buy BTC between $60,000 and $70,000, adds the trader, as a “parabolic uptrend” will potently start after this period.

Nevertheless, Bitcoin’s derivatives data are still strong. Funding rates for perpetual contracts remained close to neutral despite briefly flipping negative in the lead-up to the halving, which means short sellers are paying longs to maintain their positions. Overall, open interest remains elevated above $10 billion, even though it has retreated from a record high in dollar terms in March.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

20

7 months ago

20