ARTICLE AD

Bitcoin whales accumulate as ETF inflows bolster market stability.

Bitcoin’s perpetual futures markets are currently experiencing high funding rates, signaling a premium for long positions and further correction for spot prices, according to the “Bitfinex Alpha” report’s latest edition.

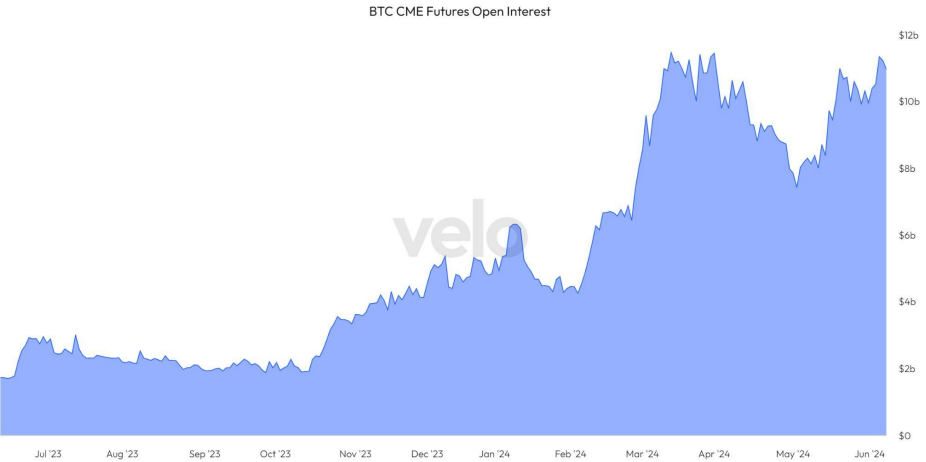

The rising Bitcoin CME futures open interest, reaching $11.4 billion as of June 4th, parallels the March all-time highs before a notable price correction. Traders appear to be leveraging the basis arbitrage opportunity, shorting Bitcoin on the open market while gaining spot exposure through ETFs, aiming to profit from futures and spot market price discrepancies.

Image: Velo/Bitfinex

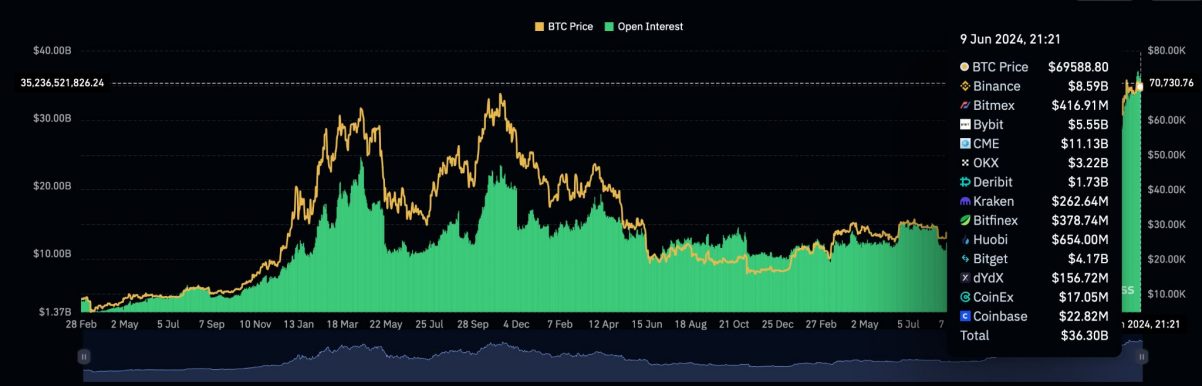

Image: Velo/BitfinexDespite 20 consecutive days of ETF inflows since May 10, potential disruptions loom with the upcoming US Consumer Price Index report and the US Federal Open Market Committee’s interest rate discussions set to happen this week.

Last week, Bitcoin’s price fluctuated, reaching over $71,500 and then correcting to local lows around $68,500. Major altcoins experienced declines, with Ethereum (ETH) and Solana (SOL) dropping 7.5% and 12.1%, respectively.

The recent “leverage flush” saw significant liquidations in altcoin leveraged longs, with Coinglass data showing Bitcoin open interest at an all-time high of $36.8 billion on June 6th.

Nevertheless, short-term holders have increased their Bitcoin activity, with holdings peaking at 3.4 million BTC in April. Long-term holders, on the other hand, are demonstrating confidence by accumulating Bitcoin, with the inactive supply for one-year holders remaining stable.

Image: Coinglass/Bitfinex

Image: Coinglass/BitfinexBitcoin whales are also on an accumulation spree, with their balance reaching a new historical high.

Therefore, although derivatives data suggest a price pullback in the short term, factors such as increased ETF buying activity, reduced selling pressure from long-term holders, and improved liquidity could potentially catalyze Bitcoin’s upward movement in the long term.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

23

3 months ago

23