ARTICLE AD

Mt. Gox BTC distribution nears completion, market absorbs selling pressure without significant price decline.

Key Takeaways

Bitcoin touched $70,000 after holding crucial support levels, including the Short-Term Holder Realised Price. Mt. Gox Bitcoin reserve has decreased by 66%, signaling the end of a significant supply overhang. <?xml encoding="UTF-8"?>Bitcoin (BTC) reached $70,000 following a brief intra-week pullback, holding crucial support levels including the Short-Term Holder Realised Price. According to the latest “Bitfinex Alpha” report, this is the highest price level for BTC since early June, reached after a 30% rebound following.

Bitcoin chart annotated. Image: Bitfinex/TradingView

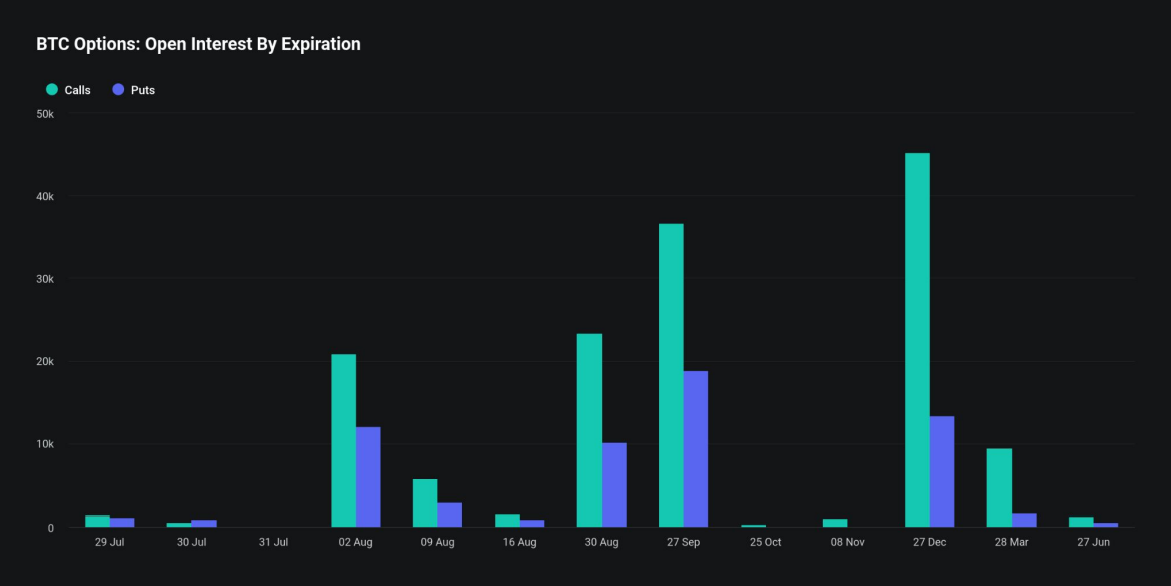

Bitcoin chart annotated. Image: Bitfinex/TradingViewDespite the bullish momentum, implied volatility in the options market declined as traders closed positions ahead of the Bitcoin 2024 Nashville conference. The monthly options expire on August 2nd, with contracts totaling $2.2 billion in notional value, and it is expected to impact market dynamics further.

“We expect that the $68-69,000 level to continue to act as resistance however and we expect to chop in a range or decline slightly around these levels,” stated the Bitfinex analysts.

Image: Bitfinex/Deribit Metrics

Image: Bitfinex/Deribit MetricsMoreover, the Mt. Gox Bitcoin reserve has decreased by nearly 94,460 BTC (66%), signaling the end of a significant supply overhang. This distribution has contributed to net market selling, although its impact on price has been less severe than anticipated.

In the futures market, open interest for Bitcoin trading pairs has increased to $37.26 billion, approaching the all-time high of $39 billion recorded in March. This surge indicates a rise in leveraged long positions entering the market.

Notably, the Short-Term Holder Realised Price at $65,700 served as a key support level, successfully retested and held on a daily closing basis last week.

Disclaimer

4 months ago

13

4 months ago

13