ARTICLE AD

Bitcoin's halving event may not mirror past price surges, Glassnode reports.

Bitcoin’s upcoming halving has sparked widespread speculation over significant price leaps, but analytics firm Glassnode suggests investors “ground expectations” based on historical data on their “Week On-Chain” report. The halving, a scheduled event that cuts Bitcoin mining rewards in half, has historically influenced price performance, yet Glassnode emphasizes the diminishing returns and shallower drawdowns over time due to the market’s growth and capital flow requirements.

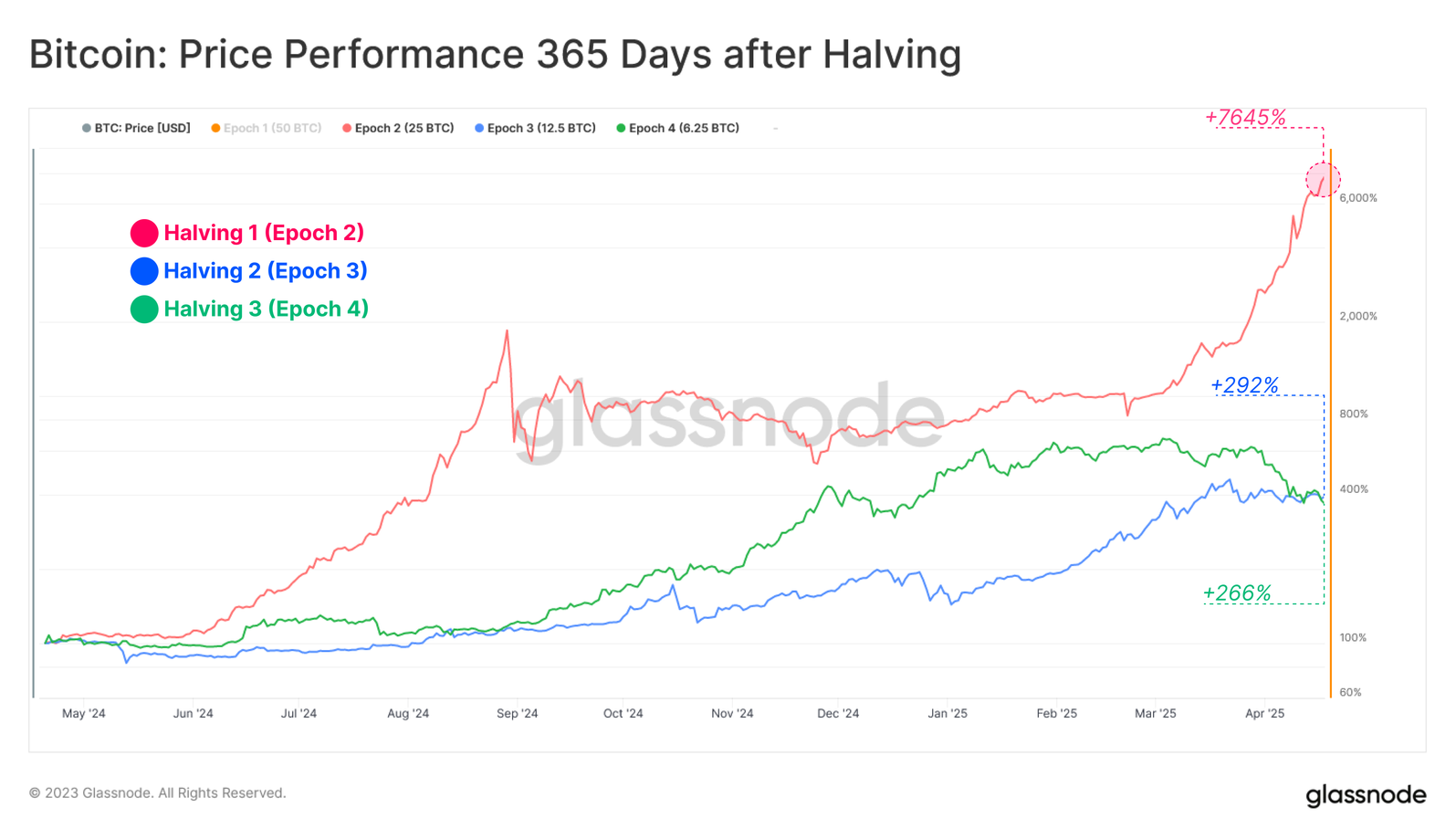

Epoch comparisons reveal a trend of diminishing returns, with the second epoch seeing a price increase of 5315% and a maximum drawdown of 85%, while the fourth epoch had a more modest 569% increase and a 77% drawdown. Glassnode notes the similarity in price performance across the last three cycles before the halving, with increases of approximately 200% to 300%.

Image: Glassnode

Image: GlassnodeThe current cycle is unique, having broken the previous all-time high (ATH) before the halving, a feat not recorded in prior cycles. Glassnode’s report also highlights the substantial unrealized profit held by investors at this halving event, with the MVRV Ratio indicating a +126% paper gain on average.

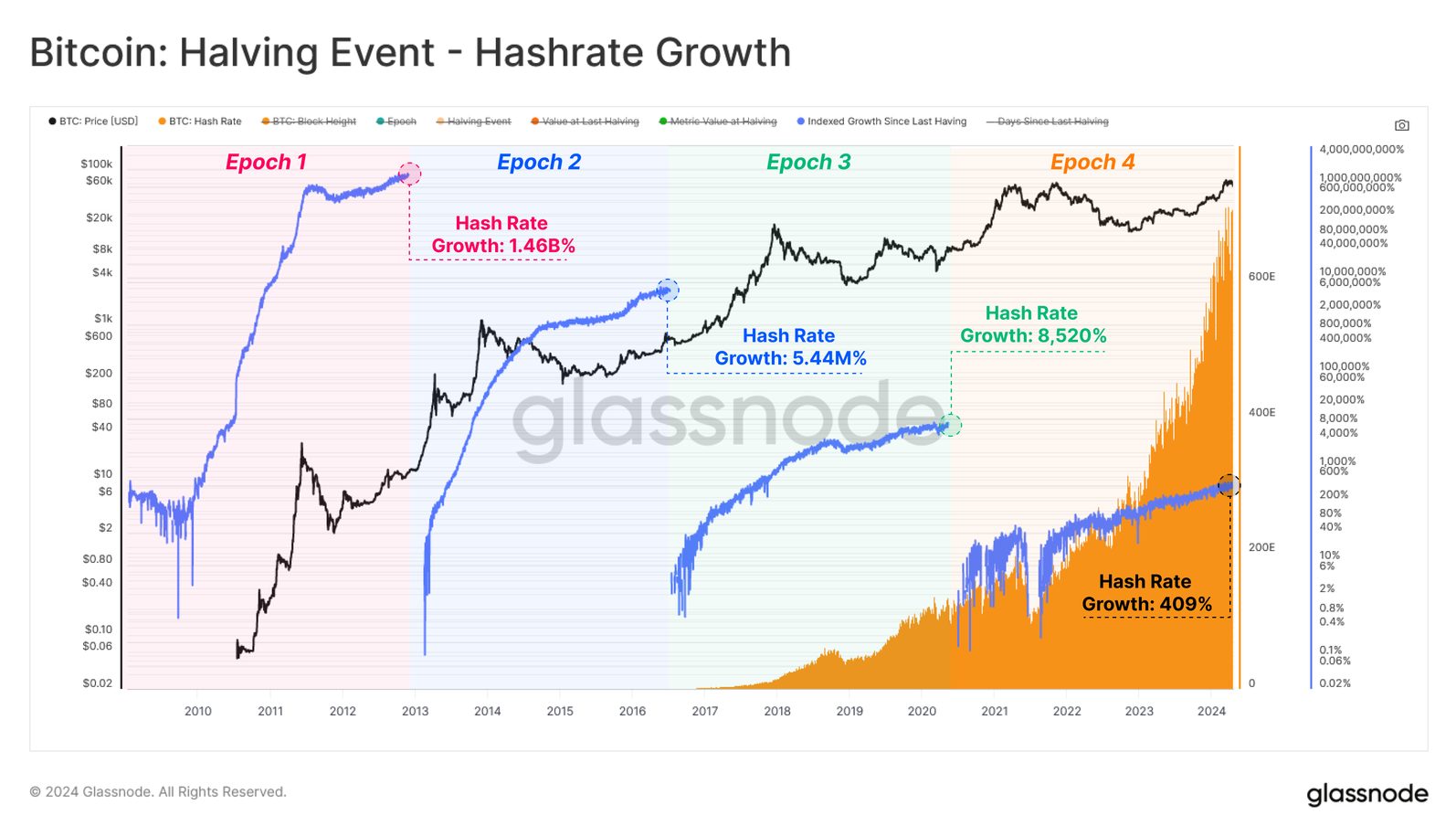

In terms of network fundamentals, the hash rate continues to grow, suggesting increased investment in mining infrastructure. Miner revenues, while showing a diminishing growth rate in USD terms, have seen a net expansion, with cumulative revenue topping $3 billion in the past four years. The realized cap, measuring the capital invested in Bitcoin, supports a $1.4 trillion market cap, having increased by 439% over the last epoch.

Image: Glassnode

Image: GlassnodeDespite the volatility and negative headlines, Bitcoin’s transfer volume over the last four years amounted to $106 trillion, showcasing the network’s capacity for settling transactions without intermediaries.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

33

7 months ago

33