ARTICLE AD

On-chain data shows the Bitcoin miners have been making an unusually high number of transactions to centralized exchanges recently.

Bitcoin Miner To Exchange Transactions Metric Has Just Seen A Spike

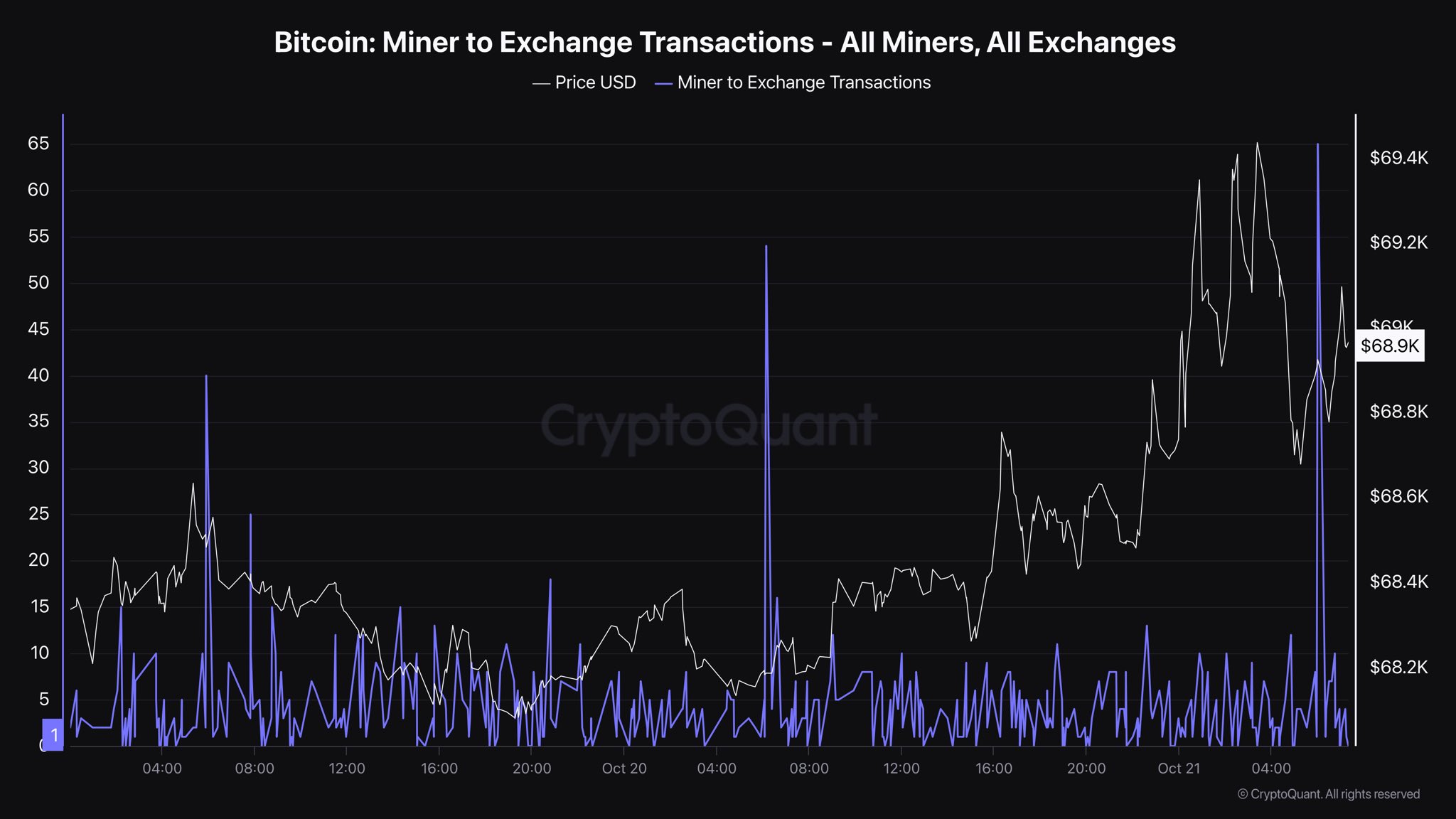

As pointed out by CryptoQuant author IT Tech in a new post on X, the Miner to Exchange Transactions indicator has been high recently. The “Miner to Exchange Transactions” keeps track of the total number of transfers that the miner-associated Bitcoin wallets are making to addresses connected with exchanges.

When the value of this metric is high, it means the miners are making a large amount of moves to these platforms. As one of the main reasons why these chain validators would deposit to exchanges is for selling-related purposes, this kind of trend can have a bearish effect on the BTC price.

On the other hand, the indicator being low implies miners aren’t making inflows to exchanges, potentially because they plan to hold onto their coins for a while. Naturally, this HODLing from this cohort can be a positive sign for the asset.

Now, here is a chart that shows the trend in the Bitcoin Miner to Exchange Transactions over the last few days:

The value of the metric appears to have been quite high in recent days | Source: @IT_Tech_PL on X

The value of the metric appears to have been quite high in recent days | Source: @IT_Tech_PL on X

As displayed in the above graph, the Bitcoin Miner to Exchange Transactions has registered a large spike during the past day, suggesting that the miners have just made a large number of moves to these platforms.

It’s possible that this is an indication of a selloff from these chain validators, but whether this potential selling would actually affect the cryptocurrency depends on the exact scale of coins that’s involved in the transactions.

The analyst has also shared the data of an indicator that provides information related to it, called the Miner to Exchange Flow:

The data for the miner exchange flow over the last couple of days | Source: @IT_Tech_PL

The data for the miner exchange flow over the last couple of days | Source: @IT_Tech_PL

From the chart, it’s visible that this metric’s value has also shot up alongside the spike in the Miner to Exchange Transactions. At its height, the metric touched 225 BTC, which is equivalent to a little under $15.4 million at the current price.

This isn’t a small sum in itself, but when considering the scale of the total Bitcoin market cap, these exchange inflows hardly weigh to much. Thus, even if the miners plan to sell these coins, the market should be able to absorb the pressure just fine.

Miners are entities that have constant running costs in the form of electricity bills, so they tend to be regular sellers. Most of the time, their selling remains limited, which would make the recent value of the Miner to Exchange Flow in line with the norm.

The number of individual transfers to exchanges that the miners have made, however, is certainly unusual, so these indicators could be to keep an eye on in the coming days, in case more spikes pop up.

BTC Price

Bitcoin had surpassed the $69,000 level on Sunday, but the asset appears to have dropped back to $68,200 today.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView

1 month ago

18

1 month ago

18