ARTICLE AD

Data shows the American exchanges are observing a rise in their Bitcoin dominance. Here’s what happened the last two times this trend appeared.

Bitcoin Is Moving From Global Platforms To US-Based Ones

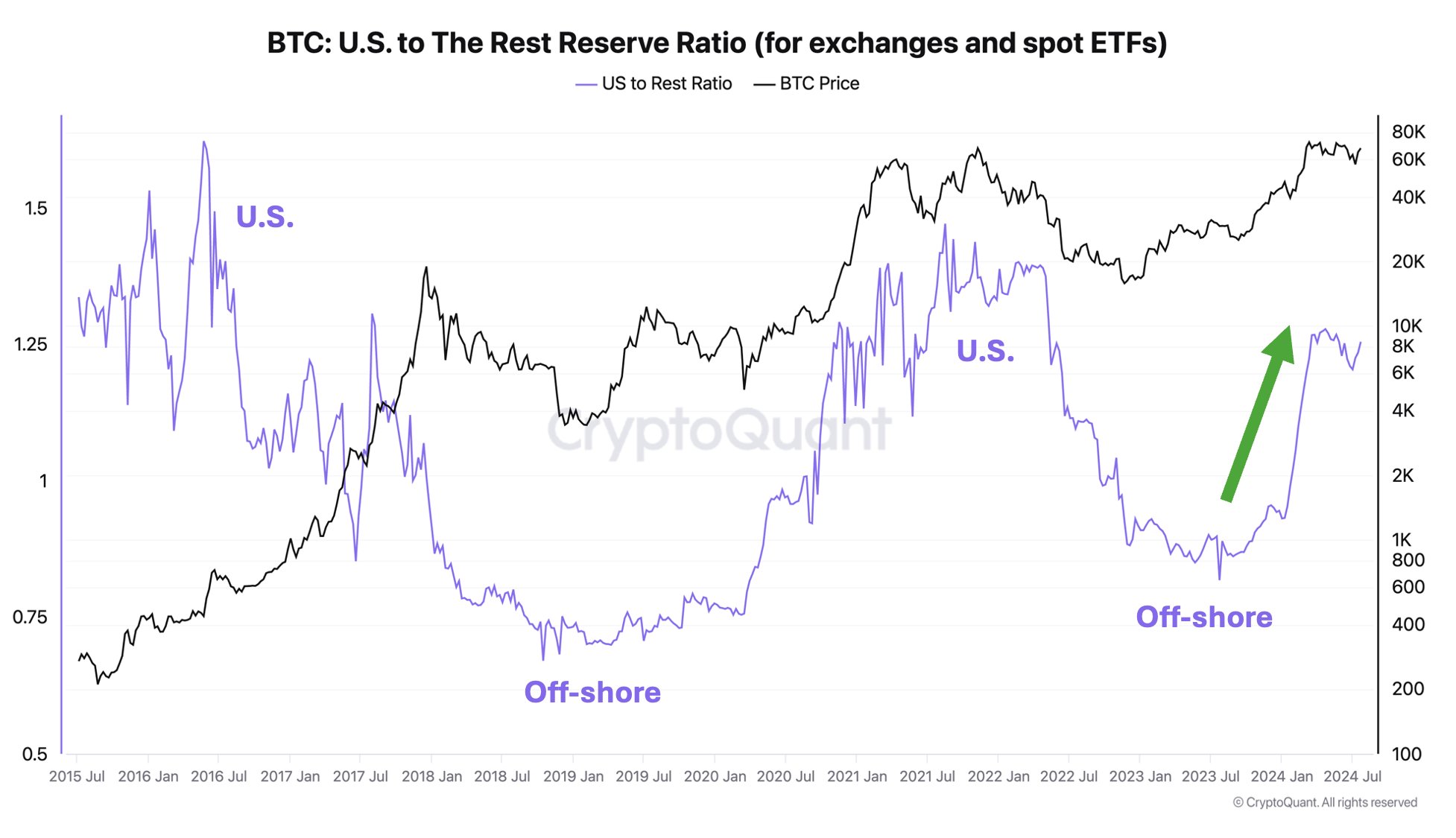

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has discussed a trend that has been emerging in a Bitcoin indicator recently. The metric in question is the ratio between the BTC reserve of US-based platforms and off-shore ones.

“Platforms” here not only include the exchanges, but also the spot exchange-traded funds (ETFs), which were only approved to operate in the US in January of this year.

When the value of this ratio goes up, it means the US-based platforms are seeing their reserve go up relative to the off-shore ones. Such a trend could suggest interest is shifting from the latter platforms to the former ones.

On the other hand, the metric registering a decline implies the cryptocurrency may be going through a transfer from US exchanges and spot ETFs to foreign platforms.

Now, here is a chart that shows the trend in this Bitcoin indicator over the past decade:

As displayed in the above graph, this ratio had plunged to relatively low values during the 2022 bear market and the 2023 recovery, but this year, the indicator’s value has observed a sharp increase.

This would imply that off-shore platforms have seen a notable reduction in their dominance. A major driver for this trend is likely to be the popularity the US spot ETFs have found since their launch.

From the chart, it’s visible that a similar pattern was also observed in the leadup to the 2021 bull run. Global exchanges dominated during the bear market and the recovery phase that followed, but then a shift towards American platforms occurred, which paved the way for the price rally.

The dominance of US-based exchanges had also shot up in the buildup of the 2017 bull run, so it would appear that BTC goes through bullish periods when interest in American platforms is more than for those in the rest of the world.

As the ratio has once again been forming this pattern recently, it’s possible that the cryptocurrency could be heading towards another major bull run. It now remains to be seen whether the trend will repeat or not.

In some other news, a large number of long investors have met liquidation in the derivatives sector during the last 24 hours, as Bitcoin and other coins have gone through drawdowns.

As is visible above, around $173 million in cryptocurrency-related contracts have been liquidated in this window, of which over $148 million were long positions.

BTC Price

Bitcoin had briefly slipped under the $66,000 level during its latest plunge, but the asset has since seen some minor recovery to $66,600.

Featured image from Dall-E, CryptoQuant.com, CoinGlass.com, chart from TradingView.com

4 months ago

28

4 months ago

28