ARTICLE AD

Since last Friday, Bitcoin has seen a 4% retrace, following a strong 15% surge from its local lows. Despite this recent momentum, the market faces uncertainty and volatility as BTC trades below the crucial $60,000 level—a psychological mark that signals direction.

Investors are watching closely to see whether Bitcoin can regain strength and break past this key resistance or continue to struggle in the short term.

There are signs of recovery, however, as Coinbase data shows BTC has been trading at a price premium again, indicating strong demand. Additionally, key data from Coinglass highlights critical liquidity levels that BTC may target in the coming weeks.

These factors suggest BTC is now at a pivotal moment, with its price action over the next few days likely to determine the market’s direction in the months ahead. Traders and investors are bracing for Bitcoin’s next big move.

Bitcoin Consolidation Could Be Over: $70,000 Next?

The past few weeks have encouraged Bitcoin, sparking hope and optimism among investors bracing for a deeper correction. Recent data indicates a positive shift in market sentiment.

Analyst Daan highlighted on X that BTC has been trading at a premium on Coinbase, a sign of renewed spot demand from U.S. investors and potential interest from ETFs. This premium is generally bullish, reflecting increased buying activity and confidence in BTC’s future.

Bitcoin Coinbase premium index turns positive. | Source: Daan on X CryptoQuant chart

Bitcoin Coinbase premium index turns positive. | Source: Daan on X CryptoQuant chart

However, significant discounts on exchanges, often seen at market bottoms, can signal bearish sentiment, though they also offer potential entry points for savvy investors.

Complementing this, Coinglass has provided key metrics on Bitcoin’s liquidity levels. The Binance BTC/USDT Liquidation Heatmap shows that BTC recently absorbed a large liquidity cluster below $50,000 during the August 5th sell-off. This move cleared substantial support levels, leaving fewer significant clusters nearby.

Binance BTC/USDT Liquidation Heatmap showing liquidity resting below $47K and above $70K. | Source: Coinglass

Binance BTC/USDT Liquidation Heatmap showing liquidity resting below $47K and above $70K. | Source: Coinglass

The major liquidity levels now reside around $47,000 and lower, with substantial interest building at the $70,000+ mark.

These insights suggest that while Bitcoin faces potential support and resistance challenges, the current market dynamics indicate a more bullish outlook.

The absence of significant liquidity clusters around the current price and the premium observed on Coinbase could point to a continued upward trajectory, provided BTC can maintain its recent gains and build momentum.

BTC Technical Analysis: Key Levels To Watch

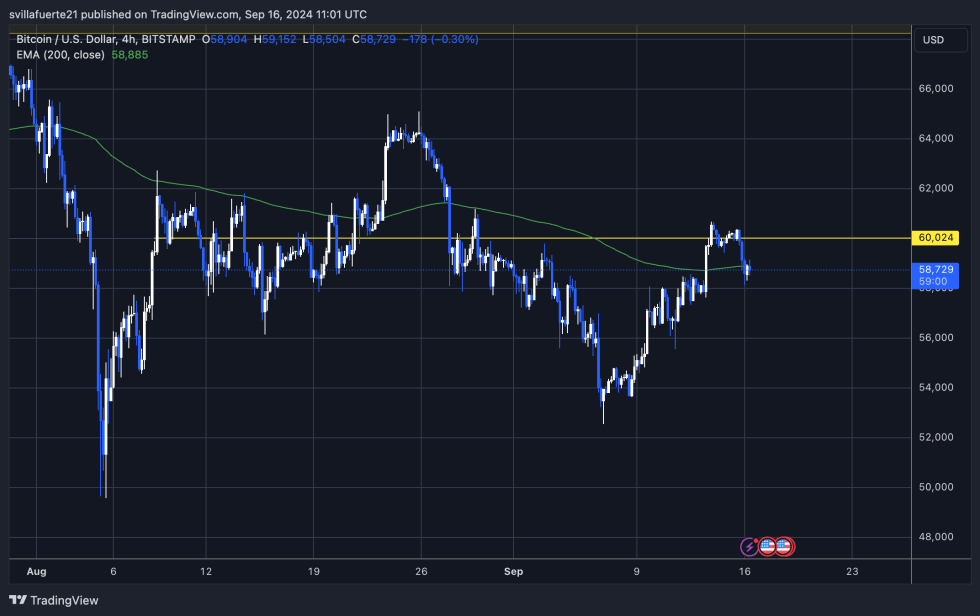

Bitcoin is trading at $58,593, reflecting a 4% dip from last week’s peak of $60,670. The cryptocurrency faces challenges in maintaining its position above the 4-hour 200 exponential moving average (EMA) at $58,883, a crucial level it reclaimed last Friday, signaling short-term strength.

This EMA has acted as significant resistance since early August and could serve as new support if BTC can hold above it.

BTC is testing the 4H 200 EMA for support. | Source: BTCUSDT chart on TradingView

BTC is testing the 4H 200 EMA for support. | Source: BTCUSDT chart on TradingView

To reinforce the bullish outlook, Bitcoin must reclaim and stay above the 4H 200 EMA and the $60,000 mark, as these levels are pivotal for shaping overall market sentiment. A failure to close above the 4H 200 EMA could lead to testing the next demand level around $57,500, representing a healthier support zone.

Should the correction extend further, BTC faces potential risks of dropping to $55,500. This deeper correction would test lower support levels and could signal more challenging market conditions ahead. Holding above these key levels will be critical in determining Bitcoin’s short-term direction and overall market stability.

Featured image from Dall-E, chart from TradingView

2 months ago

23

2 months ago

23