ARTICLE AD

Bitcoin ETFs see renewed demand, outpacing miner sell pressure.

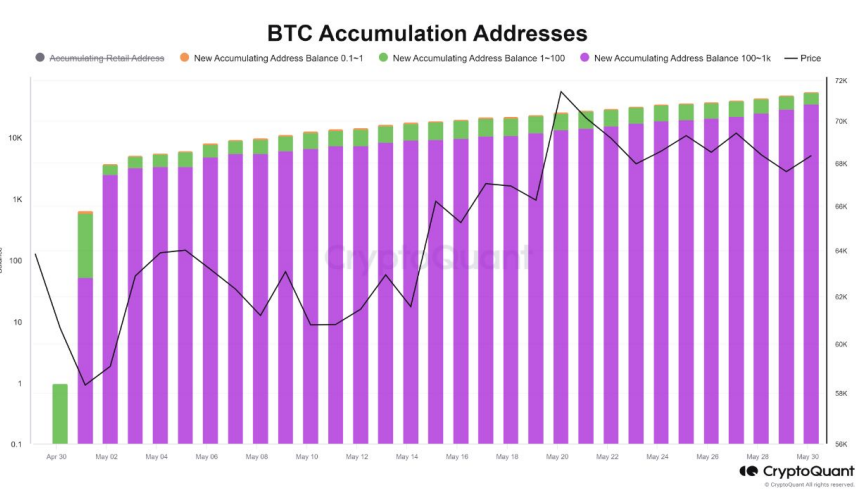

Bitcoin (BTC) long-term holders have resumed accumulating, signaling a shift in market dynamics, according to the latest “Bitfinex Alpha” report. Bitfinex’s analysts indicate that the selling pressure from these investors has subsided, with a noticeable uptick in buying activity.

Image: Bitfinex/CryptoQuant

Image: Bitfinex/CryptoQuantThis change comes after Bitcoin reached a new all-time high of $73,666 in March, followed by a significant sell-off from long-term holders (LTHs). The sell-off led to an increase in supply on the open market, causing a period of price correction and consolidation. However, the trend appears to have reversed, with LTHs beginning to re-accumulate Bitcoin for the first time since December 2023.

The pattern of LTHs selling during bullish periods was prominent from early 2024 through April, as evidenced by reductions in the supply held by 1-year and 2-year-old Unspent Transaction Outputs (UTXO). Despite this, the supply of Bitcoin in UTXOs held for over three years has continued to grow, reflecting a long-term bullish sentiment among these holders.

Image: Bitfinex/CryptoQuant

Image: Bitfinex/CryptoQuantBitcoin exchange-traded funds (ETFs), which experienced net outflows throughout April, have seen a resurgence in buy-side demand. Notably, the US Bitcoin Spot ETFs recorded average daily net inflows of $136 million over the past two weeks, outpacing the daily sell pressure from miners post-halving.

Additionally, the exchange reserves of BTC have declined sharply since February, contributing to the recent price rally and potentially setting the stage for another surge in value.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

41

7 months ago

41