ARTICLE AD

In the last three days, Bitcoin miners have moved a total of 45,000 BTC to exchanges, with significant transfers, with the sell off putting some selling pressure on BTC price.

Key Notes

Along with Bitcoin miner outflows, factors such as rising US inflation data, surge in whale deposits, etc led to Bitcoin's price drop.Bitcoin profits of $5.42 billion were realized as prices surged, raising the sell-side risk ratio to 0.524%.Also, $400 million in outflows from Bitcoin ETFs, is creating caution among investors.Within just three days since November 12, Bitcoin miners have moved a total of 45,000 BTC to exchanges just as BTC price BTC $89 885 24h volatility: 1.0% Market cap: $1.78 T Vol. 24h: $96.86 B touched a new all-time high above $90,000.

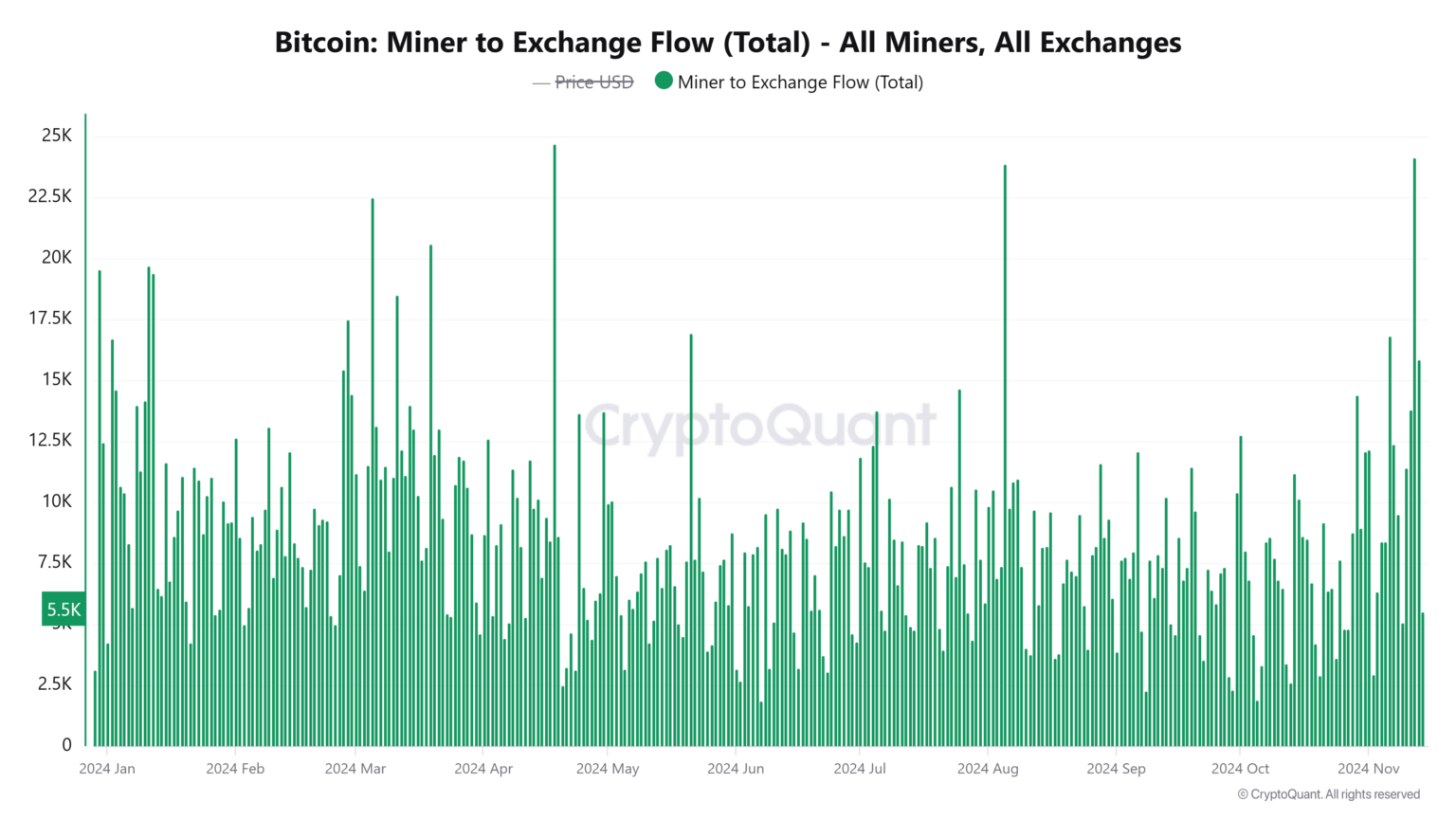

As per the on-chain data from CryptoQuant, Bitcoin miners collectively moved 24,138 BTC on November 12. This was the first major move from this cohort and the second-largest daily outflow from miners this year.

However, on the next day as the BTC rallied all the way past $93,000 levels, the miners moved an additional 15,840 BTC to exchanges. The trend continued further on November 14, with miners shifting another 5,500 BTC to exchanges. As a result, Bitcoin miners have transferred a total of 45,000 BTC cumulative in the last three days.

Courtesy: CryptoQuant

Large transfers to exchanges are often viewed as a sign that miners may intend to sell, potentially capitalizing on the recent price surge. Notably, this surge in transfers coincided with a slight correction in Bitcoin’s price, which briefly dropped below $90,000 and is now trading around $87,000.

However, such outflows don’t always indicate selling activity. Miners sometimes move Bitcoin to external addresses for operational purposes, and in some cases, these transactions may simply involve internal wallet reorganizations.

Other Factors Leading to BTC Price Drop

Apart from just Bitcoin miner sell-off, there are other factors as well leading to a BTC price sell-off. For example, the current US inflation data shows a spike in the number that would likely arrest the future Fed rate cuts moving ahead. This could probably also delay the future BTC rally.

Apart from Bitcoin miners, the whale deposits to crypto exchanges have also surged. A whale recently deposited 1,920 BTC, valued at approximately $169 million, to Binance just one hour ago, according to Lookonchain data. Over the past three days, the same whale has deposited a total of 4,060 BTC, worth around $361 million, to the exchange.

A whale deposited 1,920 $BTC($169M) to #Binance 1 hour ago.

The whale has deposited a total of 4,060 $BTC($361M) to #Binance in the past 3 days.https://t.co/8D2y9MbfFn pic.twitter.com/6NlWDPKoVx

— Lookonchain (@lookonchain) November 15, 2024

In a recent post on X, Ali Martinez highlighted that $5.42 billion in Bitcoin profits were realized as the price surged. This increase also brought the sell-side risk ratio to 0.524%, signaling caution for investors. Additionally, the Bitcoin RSI also shows that the asset is currently in the overbought conditions.

The daily RSI shows #Bitcoin $BTC is in overbought territory, typically signaling a potential price correction ahead! pic.twitter.com/61k7MXDZia

— Ali (@ali_charts) November 14, 2024

Apart from this, the spot Bitcoin ETFs registered a staggering $400 million outflows on Thursday, November 14. This happened after days of strong inflows into the investment products following the Donald Trump victory on November 5.

While BlackRock’s Bitcoin ETF (IBIT) has seen an influx of $126.5 million, other funds like Fidelity’s FBTC and Ark Invest’s ARKB have experienced $100 million outflows each.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News, Stocks

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

2 hours ago

1

2 hours ago

1