ARTICLE AD

With Bitcoin edging towards $47,000, Marathon Digital shares surge despite a considerable decrease in mined BTC in January.

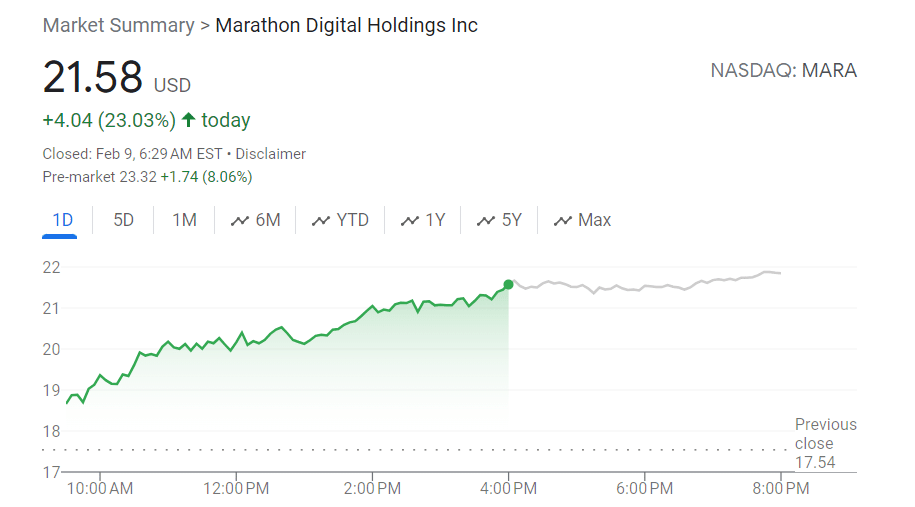

On Friday, Marathon Digital Holdings Inc (MARA) shares surged by 23% to reach $21.58, echoing the upward trend seen across all U.S. stock market crypto-related companies following Bitcoin‘s surge to $46,000, according to data from Google Finance.

MARA stock price in USD | Source: Google Finance

MARA stock price in USD | Source: Google Finance

For Marathon, the surge is notable given that the company reported a negative production rate for January, as it managed to mine 1,084 BTC last month, representing a 42% decrease compared to figures reported in December 2023. In a press release on Feb. 5, Marathon said the plunge was triggered due to “weather-related curtailment and equipment failures that led to site outages.”

“Our team is addressing the short-term disruptions and working to bring our sites back to full strength. We expect hash rate to improve over the next few weeks.”

Marathon Digital CEO Fred Thiel

Marathon’s positive response to Bitcoin’s price hike is mirrored by other crypto-related companies’ performance. For example, Canaan Technology (CAN) saw a 20% increase to $1.54, Bitdeer (BTDR) rose 16.6% to $8.25, Coinbase (COIN) climbed 8.6% to $132.5, and MicroStrategy (MSTR) jumped 15.7% to $587, according to Google Finance.

The enthusiasm surrounding Bitcoin’s price surge is further fueled by significant trading volumes observed in spot Bitcoin exchange-traded funds, surpassing $1 billion recently, with BlackRock and Fidelity leading the charge, crypto.news reported earlier.

Additionally, expectations of potential rate cuts by the Federal Reserve later this year, as suggested by comments from Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester, appear to be contributing to the market’s buoyancy and cryptocurrency’s investment appeal.

11 months ago

65

11 months ago

65