ARTICLE AD

Bitcoin is selling off when writing and approaching the psychological support at $60,000. From what’s printing out, clear in the daily chart, it represents a weak start for Q4 2024–a historically bullish quarter.

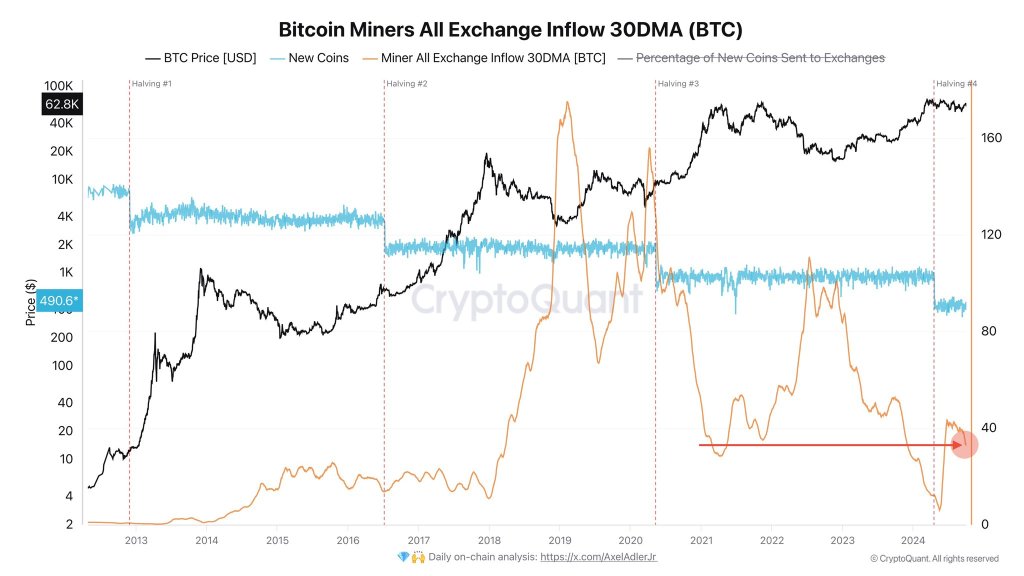

Bitcoin Miners Reducing Their Dumping

While BTC is under pressure, sliding nearly 10% from September highs, it is emerging that Bitcoin miners have been slowing down their liquidation activities. In a post on X, one analyst observes that over the past few weeks, top Bitcoin miners have been gradually reducing coin transfers to top centralized exchanges like Binance and Coinbase.

This development is a massive price boost after the April 20 Halving event. Usually, and looking at past trends, before and after Halving, miners tend to move their reserves to exchanges, selling them as they adjust to the new inflation regime.

Miners selling few coins | Source: @AxelAdlerJr via X

Miners selling few coins | Source: @AxelAdlerJr via X

After Halving, the protocol automatically reduces block rewards by 50%. The 50% drop also means miners have to adapt to the equal drop in revenue, more so if transaction fees associated with each block don’t change significantly.

After prices rallied to nearly $74,000 in March, market traders expected Bitcoin to resume the uptrend immediately after Halving. However, because of the thousands of BTC sold by “weak” miners post-Halving, prices edged lower even with net inflows in some instances from spot Bitcoin ETF issuers in the United States.

Will BTC Bounce Higher In Q4 2024?

Reducing selling pressure from miners would, therefore, likely support prices. Their decision to slow down their BTC liquidation signals that they expect prices to recover in the coming months. For the uptrend to be sustained, traders are keeping track of fundamental factors.

That historically bullish Q4 2024, especially in October and November, could support optimistic bulls. The problem now is that the losses of the past three days mean this is the worst start for Bitcoin in October in at least a decade.

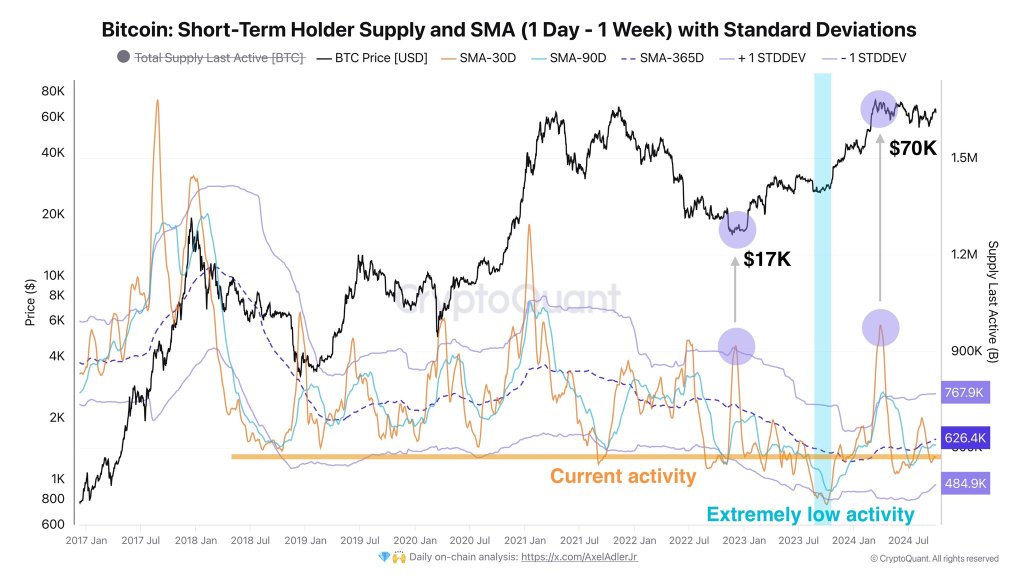

In the short term, the sell-off, the analyst says, could be contained if short-term holders (STHs) reduce their supply by 80,000BTC. STHs are entities that bought the coin within the last 155 days.

Will STHs reduce BTC supply? | Source: @AxelAdlerJr via X

Will STHs reduce BTC supply? | Source: @AxelAdlerJr via X

They are often considered speculators and present a risk to the BTC uptrend since they tend to sell and can’t withstand sharp price fluctuations. If they reduce their supply, BTC may find support at $60,000. Otherwise, should bears press on, the coin may sink below $57,000–a support line formed in the daily chart.

Feature image from Canva, chart from TradingView

1 month ago

15

1 month ago

15