ARTICLE AD

Bitcoin price dipped to a 40-day low of $40,700 on Jan 19, sparking concerns of major liquidations if it loses the $40,000 support.

Since the much-anticipated spot ETF approval verdict, Bitcoin (BTC) has delivered sideways price performance. Another sell-off wave on Jan. 19 saw prices tumble toward $40,000 for the first time since mid-December.

Miners acquired BTC worth $482 million amid market downturn

On Jan. 19, Bitcoin price tumbled below $40,700 for the first time in 40 days, having consolidated within the $42,000 to $43,000 range for the better part of the past week. However, on-chain data trends reveal that the bullish miners swooped in to defend the vital $40,000 support level.

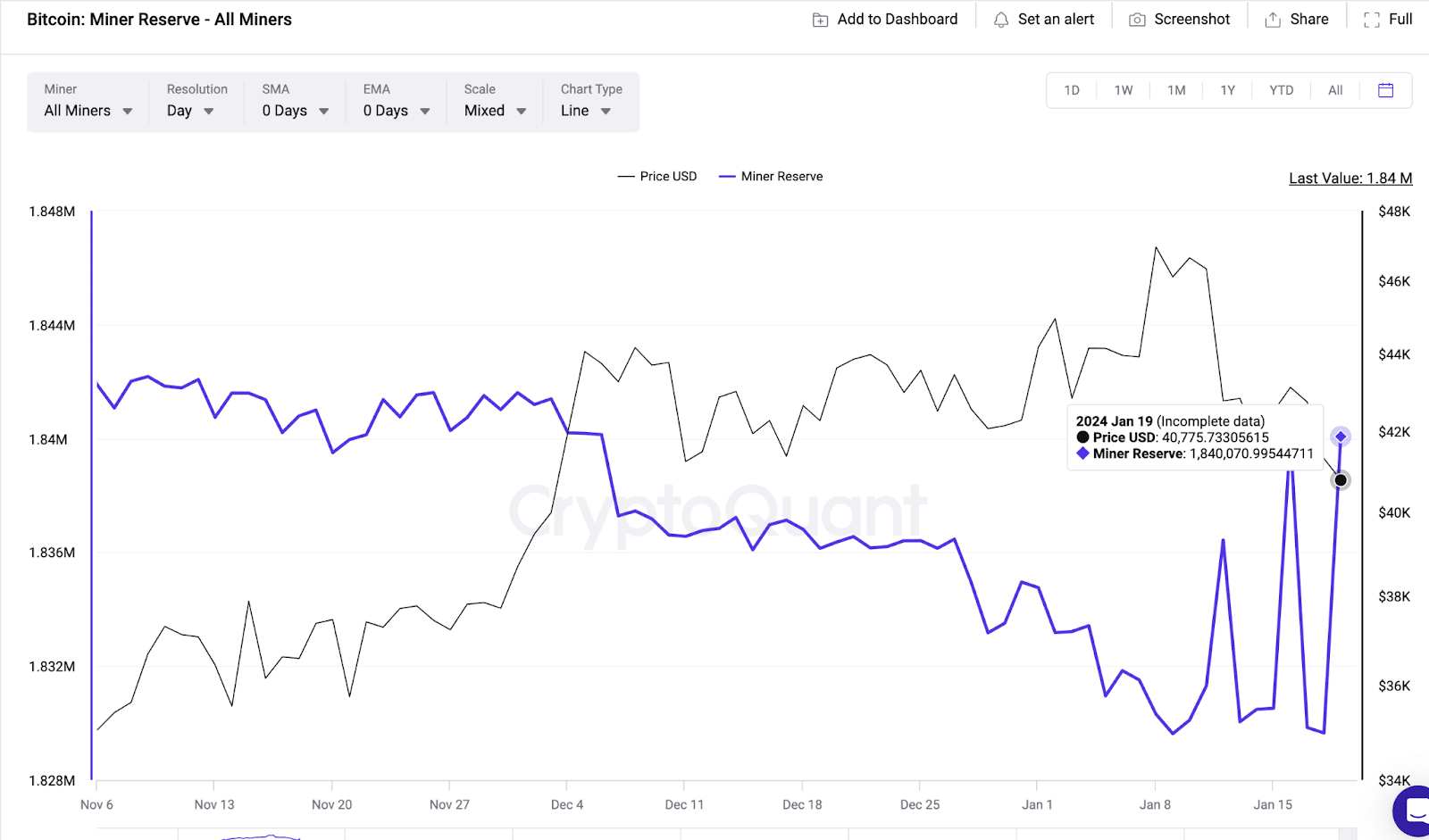

Cryptoquant’s miner reserve metric shows how many balances are currently held in wallets controlled by recognized mining firms and pools.

The chart below shows that Bitcoin miners increased their reserves by 12,058 BTC on Jan. 19 alone.

Bitcoin (BTC) MIners Reserves vs. Price | Source: CryptoQuant

Bitcoin (BTC) MIners Reserves vs. Price | Source: CryptoQuant

As depicted above, the miners increased their holdings by 12,058 BTC worth approximately $494 million at current prices. The timing of this massive acquisition suggests the miners swooped in to stop the slump just as prices began to tumble toward $40,000.

Miners are influential stakeholders in any proof-of-work cryptocurrency ecosystem. This significant buying trend among the miners could short retail investor’s confidence and avert a panic sell off.

Bullish futures traders are showing resilience

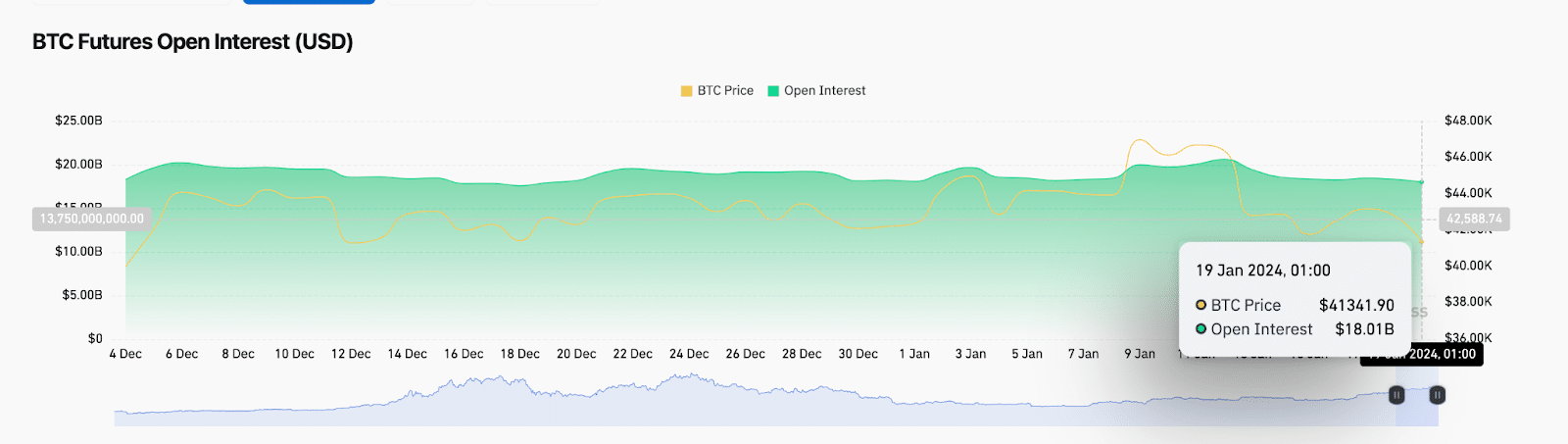

Furthermore, bullish traders in the Bitcoin derivatives markets also appear to keep up their optimism amid the BTC price slump. By noon Eastern trading hours on Jan. 19, BTC price had tumbled 7% within the daily timeframe.

The BTC open interest has held up firmly, barely shedding 2% as it moved from $18.5 billion to $18 billion — this alignment suggests widespread LONG-covering maneuvers among derivatives traders.

Bitcoin (BTC) Open Interest vs Price, Jan 19. 2024 | Source: Coinglass

Bitcoin (BTC) Open Interest vs Price, Jan 19. 2024 | Source: Coinglass

Open interest tracks the real-time value of all active derivatives contracts for a crypto asset. When open interest holds up steady during a price slump, as observed above, it suggests that the traders holding LONG contracts are doubling down on their positions in hopes of a quick rebound in the spot markets.

Rather than close out their positions as BTC prices dipped, the trading data shows that Bitcoin miners and bullish derivatives traders have swooped in, investing millions to defend their positions.

BTC price forecast: Can Bitcoin stay above $40,000?

As the BTC price tumbled below $41,000, it sparked concerns that losing $40,000 could trigger stop-loss orders and margin call orders. From an on-chain perspective, the $482 million acquisition by the miners and derivatives traders defending their LONG positions could build up sufficient demand to keep BTC above $$40,000.

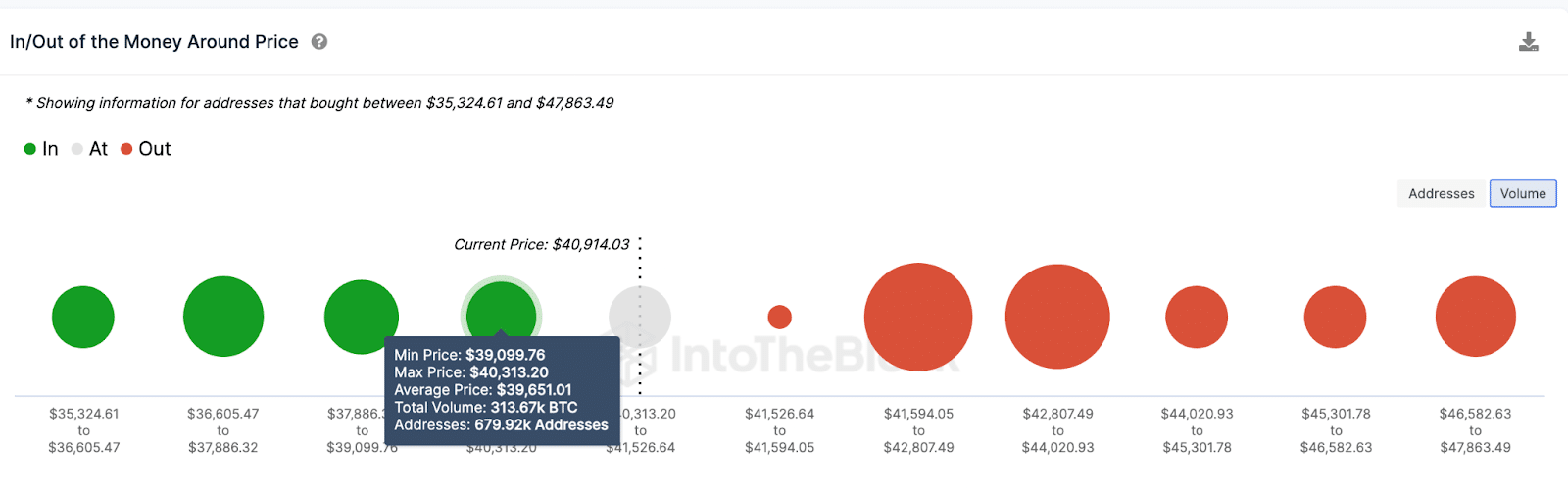

IntoTheBlock’s in/out of the money around price data further emphasizes that BTC has significant support in the $40,000 area.

Bitcoin (BTC) Price Forecast | Source: IntoTheBlock

Bitcoin (BTC) Price Forecast | Source: IntoTheBlock

The chart above depicts that 679,910 current addresses had acquired 313,000 BTC at the maximum price of $40,313. If that buy-wall can hold firmly, BTC price will likely avoid further downswing below $40,000 in the short-term.

On the upside, Bitcoin bulls could regain market control if the price can climb above the $45,000 barrier.

1 year ago

76

1 year ago

76