ARTICLE AD

Activity on the Bitcoin (BTC) network is approaching historic lows, with traders significantly slowing down transactions in the two months since Bitcoin reached a new all-time high price.

Insights from data analytics firm Santiment reveal a slowdown in on-chain activity on the Bitcoin network over the past few months, painting a nuanced picture of the cryptocurrency’s current state.

In a May 11 update on X, Santiment highlighted that on-chain activity on the Bitcoin network is the lowest it has been since 2019. This observation stems from a visible downtrend in various metrics, including transaction volume, daily active addresses, and whale transaction count.

According to Santiment, Bitcoin’s on-chain transaction volumes are closing in on their lowest level in 10 years, while the number of daily active addresses is at its lowest since January 2019.

Additionally, the analytics firm’s data shows that whale transactions, typically those worth more than $100,000, have slowed considerably, mirroring levels last seen in December 2018.

While the decline in on-chain activity may seem alarming at first glance, analysts at Santiment have suggested it might not directly correlate with impending BTC price drops, as witnessed in recent weeks.

Instead, they attribute the decline to “crowd fear and indecision” among traders, highlighting the intricate link between on-chain activity and market sentiment.

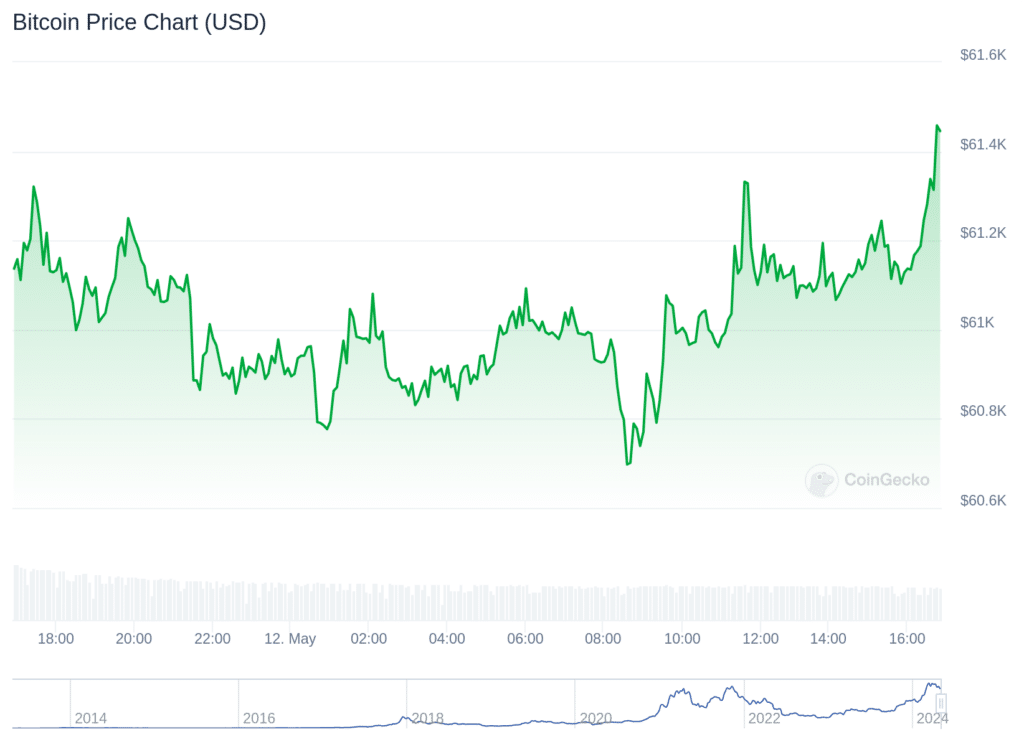

Despite these challenges, Bitcoin’s price was relatively steady at the time of writing, hovering just above $61,000, with a slight 0.1% increase in the past day.

Bitcoin 24-hour price chart | Source: CoinGecko

Bitcoin 24-hour price chart | Source: CoinGecko

The coin recorded a 24-hour trading volume of $12.67 billion, which was more than 37% lower than the previous day.

Over seven days, the price of Bitcoin dropped by 4.6%, meaning that it has underperformed the global crypto market, which is down by 4.2%, per data from CoinGecko.

As investors navigate through this period of consolidation and subdued on-chain activity, market sentiment and broader economic factors are likely to play a pivotal role in shaping Bitcoin’s trajectory in the coming weeks.

Bitcoin, Runes protocol

According to a Dune Analytics dashboard, the Runes protocol on Bitcoin raked in $135 million in transaction fees on the cryptocurrency’s largest blockchain.

On-chain data showed that tokens issued under the standard generated more than 2,100 BTC costs within a week after the halving.

Since then, activity has slowed. According to a Dune analytics dashboard, cited by The Block, Friday, May 10 saw the lowest level of activity on the Runes protocol.

8 months ago

54

8 months ago

54