ARTICLE AD

Current market lacks clarity as rising interest rates and investor caution influence Bitcoin's uncertain path.

Key Takeaways

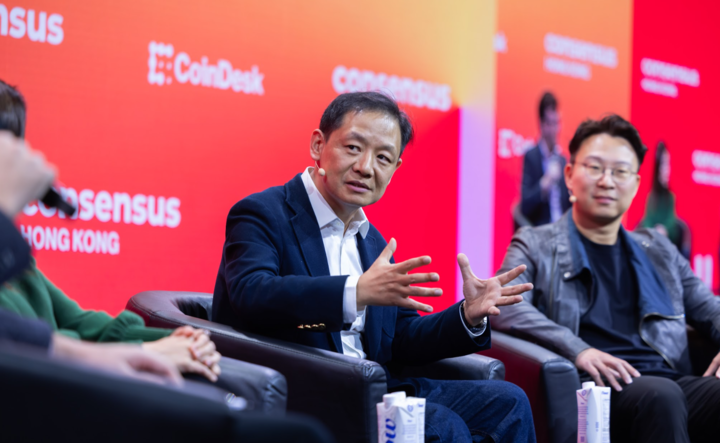

Bitcoin on-chain indicators are at the bull-bear boundary, needing more data for trend confirmation. Ki Young Ju forecasts the bull market could extend until April 2025, despite current uncertainty. <?xml encoding="UTF-8"?>CryptoQuant CEO Ki Young Ju warned today that Bitcoin on-chain indicators are hovering at the bull-bear boundary and that the next month or two will be a key turning point for the BTC market.

#Bitcoin on-chain indicators are at the bull-bear boundary.

I expect this to be the longest bull run in history, but I could be wrong. We need at least another month of data to confirm whether we’re entering a bear market. If demand doesn’t recover, indicators may fully signal a… https://t.co/QkaZx7wmAt pic.twitter.com/4iHbuitW4o

— Ki Young Ju (@ki_young_ju) February 27, 2025

“If every indicator confirms a downtrend, I’ll admit I was wrong and post about it,” Ju added. “Even in the worst case, I see a high probability of consolidating around $77K for a few months before moving back up.”

Ju also warned against excessive leverage, stating, “I don’t think heavy leveraged directional bets—long or short—are a good move right now.

The CEO of the crypto analytics firm predicted that the bull market could extend until April 2025, based on typical two-year cycles.

Bitcoin traded at $84,400 today, down 2.4% from yesterday’s close.

Institutional sentiment has shifted recently, with Bitcoin ETFs seeing $1.1 billion in outflows in a single day.

This price movement comes amid tariff threats and growing inflation concerns, which have heightened risk aversion among investors.

Disclaimer

3 hours ago

1

3 hours ago

1