ARTICLE AD

Bitcoin ETFs inflows outpace new BTC creation, signaling strong investor interest.

The Bitcoin (BTC) on-chain dynamics after its fourth halving indicate that BTC exchange outflows are reaching peaks not seen since January 2023 and that the market is showing a “robust absorption” of selling pressure. According to the latest edition of the “Bitfinex Alpha” report, those are “decidedly positive” on-chain metrics.

Since the SEC’s approval of spot Bitcoin exchange-traded funds (ETF) in the US on January 10, 2024, the BTC landscape has seen a marked transformation, the report highlights. The first quarter of the year has witnessed Bitcoin ETFs amassing approximately $60 billion in inflows, providing significant support to the market.

These ETFs have not only spurred some of the highest trading volumes on record but have also increased market liquidity by attracting new BTC demand.

Bitcoin price on past halving events. Image: Bitfinex/BitBo

Bitcoin price on past halving events. Image: Bitfinex/BitBoThe latest Bitcoin halving on April 20, 2024, has further tightened supply growth from mining rewards, which historically has led to substantial price increases. For example, the 2020 halving preceded a nearly seven-fold price escalation over the following year. Despite the immediate revenue drop for miners post-halving, the market typically recovers as prices rise and larger mining operations scale up.

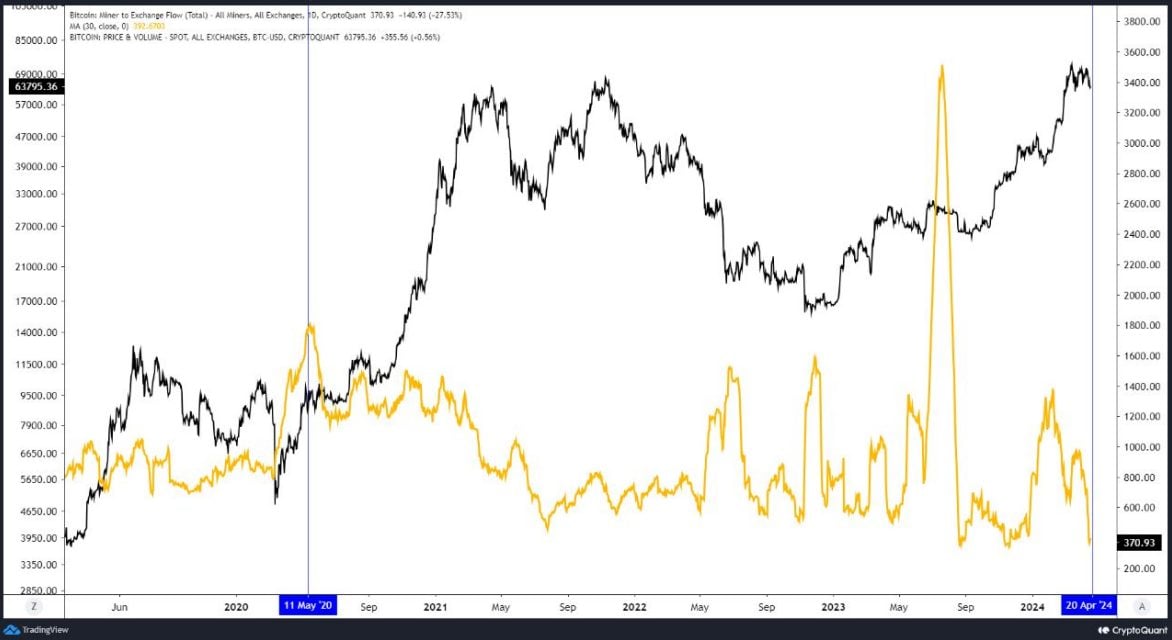

Recent data indicates a daily average of about 374 BTC sent to spot exchanges by miners over the last month, a decrease from the 1,300 BTC in February. This suggests miners sold their Bitcoin reserves ahead of the halving, distributing potential selling pressure over a longer period and avoiding a sharp market drop.

Miner-to-exchange flow. Image: Bitfinex/CryptoQuant

Miner-to-exchange flow. Image: Bitfinex/CryptoQuantThe evolving market dynamics for crypto assets, driven by institutional investor demand and the acceptance of Bitcoin ETFs, may mitigate the immediate impact of new Bitcoin issuance on market prices. ETFs are expected to significantly influence market volatility, with their ability to attract large-scale inflows and outflows.

Moreover, Bitcoin’s supply certainty, with a cap of 21 million to be reached by 2140, contrasts sharply with fiat currencies that are subject to inflationary government policies. Post-halving, the daily new supply of Bitcoin is estimated to add $40 million to $50 million in dollar-notional terms to the market, which is overshadowed by the average daily net inflows from spot Bitcoin ETFs of over $150 million.

Therefore, the SEC’s approval of spot Bitcoin ETFs has opened new avenues for demand, similar to the introduction of gold ETFs in 2004. Two months after the Bitcoin ETF launch, the daily net flow into ETFs remains positive, with demand outstripping the creation of new coins by over 150,000 BTC, a trend expected to persist in the coming months.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

32

7 months ago

32