ARTICLE AD

Bitcoin open interest signaled higher price expectations from investors, but one analytics firm opined a possible market correction amid historic spot ETF net inflows.

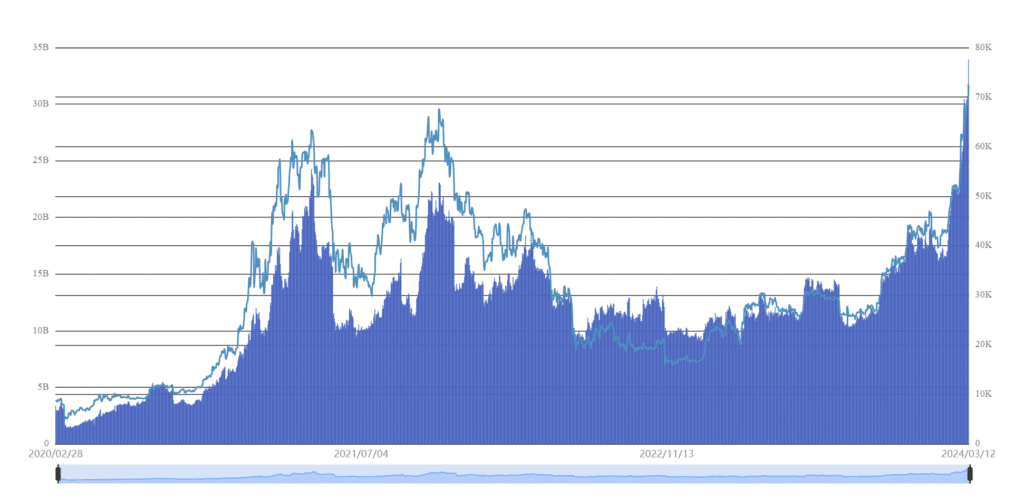

According to SoSo Value, Bitcoin (BTC) futures open interest reached a new all-time high (ATH) of $33.9 billion on March 13 as the cryptocurrency set another ATH. The landmark moment for BTC contract holdings came as the $1.4 trillion asset hit a $73,637 price tag, per CoinMarketCap.

BTC futures open interest | Source: SoSo Value

BTC futures open interest | Source: SoSo Value

BTC contract positions leapfrogged the previous peak of $23 billion recorded during the bull cycle top in November 2021. SoSo Value noted that funding rates across major exchanges like Binance also touched the highest point since early last year. The startup advised caution as crypto markets hovered around these new highs.

“High funding rates signal potential pullback risks for investors. Yet, the Bitcoin ETFs have also seen record single-day net inflows.”

Spot BTC ETF data showed over $1 billion in cumulative net inflows garnered by nine issuers on March 12. BlackRock’s iShares BTC ETF (IBIT) took the lead again, attracting $848 million for its highest-ever single-day net inflow.

Grayscale’s GBTC also saw less than $80 million in net outflows and has shed more than $11 billion in three months.

Saylor: Bitcoin is the endgame

MicroStrategy executive chairman Michael Saylor has updated his view on Bitcoin as the superior digital currency and the ultimate digital property. When asked what MicroStrategy’s end game is with the crypto, Saylor reiterated the plan to buy more Bitcoin for as long as possible and never sell.

Saylor’s thesis predicted that most of the world’s $900 trillion wealth will eventually flow into BTC as more companies and investors migrate into the digital sphere for optimal capital preservation.

MicroStrategy is one of the largest BTC holders, with a 205,000 Bitcoin stack worth over $15 billion. According to Google Finance, the software designer’s stock has grown 157% year-to-date, outperforming the S&P 500 index.

MicroStrategy stock | Source: Google Finance

MicroStrategy stock | Source: Google Finance

9 months ago

58

9 months ago

58