ARTICLE AD

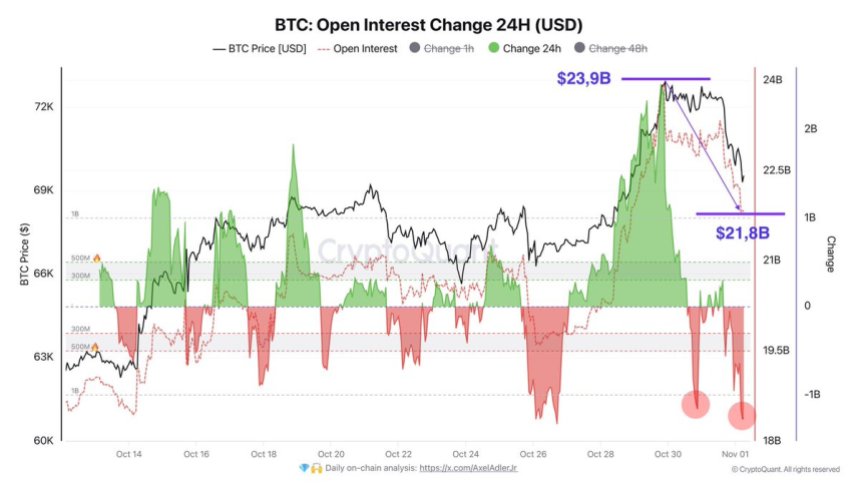

Bitcoin is currently trading above $69,000, following a 6% pullback from its recent peak at $73,600. The recent surge in open interest has been a key factor in driving BTC’s price action, with open interest reaching $23.9 billion on October 30, a significant uptick that indicated high market engagement.

However, in the past 24 hours, data from CryptoQuant reveals a $2.1 billion decline in open interest, signaling a shift as BTC’s price retraces to lower levels.

This cooling off has led analysts to closely watch for renewed buying interest from spot investors, which could provide the fuel needed for BTC to rally once more. With Bitcoin hovering near key support levels, a push from spot investors could potentially set the stage for a strong rebound.

The next few days will be pivotal as traders and analysts alike await fresh inflows that may reinforce BTC’s resilience and prepare it for another test of its all-time highs. As BTC holds around $69,000, market sentiment remains cautiously optimistic, with eyes on spot activity to gauge whether this retracement phase could soon give way to renewed momentum.

Bitcoin Hype Slowing Down?

Bitcoin has recently captured market excitement, coming within 1% of its March all-time high and fueling speculation of a massive breakout. However, this momentum appears to be losing steam, as BTC has yet to establish a new high, and open interest—a measure of the total value of futures contracts—has begun to shrink.

Renowned analyst Axel Adler recently shared key data on X, revealing a $2.1 billion reduction in open interest within the last 24 hours. This decline, from a peak of $23.9 billion to $21.8 billion, indicates that speculative futures trading alone may not be sufficient to push Bitcoin to new heights.

Bitcoin Open interest was reduced by $2.1B | Source: Axel Adler on X

Bitcoin Open interest was reduced by $2.1B | Source: Axel Adler on X

Adler suggests that for Bitcoin to break past this barrier, spot investors—the market participants who buy BTC directly rather than through derivatives—must step in to drive demand. With futures markets retreating, fresh buying from spot investors could be the needed catalyst to take Bitcoin above its all-time high and set the stage for further gains.

The timing is crucial, as Bitcoin is currently trading close to its historical peak, and the upcoming U.S. election on November 5 adds another layer of potential market volatility. Many market participants are eyeing the election as a potential driver of a broader market rally, with a Bitcoin bull run possibly following a political catalyst.

For now, Bitcoin hovers just below its all-time high, and while the futures market pulls back, attention shifts to spot buying as a key factor in determining whether BTC can resume its upward trajectory. As BTC holds near record levels, the next few days will be pivotal in defining its short-term direction and potential for a new bull phase.

BTC Holding Above Key Levels

Bitcoin is currently trading above the critical $69,000 mark, which previously acted as strong resistance since late July. Holding this level as support is essential for bulls aiming to push BTC toward new all-time highs.

If Bitcoin manages to consolidate above $69,000, the stage could be set for a breakthrough into uncharted territory and a price discovery phase. However, should BTC retrace below this level, it would signal that the asset needs additional momentum to test and surpass its all-time high.

BTC Holding above the $69K mark | Source: BTCUSDT chart on TradingView

BTC Holding above the $69K mark | Source: BTCUSDT chart on TradingView

In the event of a pullback, $66,500 stands out as the next critical support. This level would maintain Bitcoin’s bullish structure while providing a solid base for a potential rebound. Such a dip could attract fresh buying interest and add necessary fuel to Bitcoin’s rally, preparing the market for a renewed attempt at price discovery.

As BTC hovers above this significant support level, traders are closely watching for signs of sustained strength or a healthy retracement to solidify the base before the next leg up. Holding above $69,000 is key, but even a temporary decline to $66,500 would keep Bitcoin’s broader bullish outlook intact.

Featured image from Dall-E, chart from TradingView

3 weeks ago

8

3 weeks ago

8