ARTICLE AD

After a tumultuous 2022, Bitcoin (BTC) is poised for a remarkable resurgence in 2024, according to a consensus of industry experts. This comprehensive analysis delves into the key factors driving this positive sentiment, including the highly anticipated Bitcoin halving event, surging institutional adoption, and the introduction of spot Bitcoin exchange-traded funds (ETFs).

The Halving Event: A Catalyst For Scarcity, Price Appreciation

The Bitcoin halving event, scheduled for April 2024, stands as a pivotal moment in the cryptocurrency’s history. This event, occurring every four years, reduces the block reward for miners by half, effectively diminishing the supply of new BTC. This scarcity, coupled with steady or increasing demand, has historically triggered substantial price increases.

A retrospective analysis of previous halving events reveals the transformative impact on Bitcoin’s value. In the year following the 2012 halving, BTC’s price skyrocketed by an astounding 10,000%, while the 2016 halving was followed by a remarkable 2,000% surge. These historical precedents provide a compelling basis for optimism regarding the upcoming halving event’s potential to ignite a new bull run.

Institutional Adoption: A Surge Of Confidence And Liquidity

The growing institutional adoption of Bitcoin represents another key driver of its bullish outlook. Institutional investors, recognizing the cryptocurrency’s potential as a hedge against inflation and currency devaluation, are increasingly allocating funds to this emerging asset class.

This influx of institutional capital, coupled with the recent launch of spot Bitcoin ETFs in the United States and Hong Kong, has significantly enhanced the accessibility and legitimacy of Bitcoin as an investment vehicle.

Spot Bitcoin ETFs, unlike their futures counterparts, allow institutional investors to directly buy and sell the actual cryptocurrency, eliminating the need for intermediaries. This added flexibility, combined with the increasing regulatory clarity surrounding cryptocurrencies, is expected to attract even more institutional money into the market, further fueling demand and price appreciation.

Bitcoin Price Predictions: Experts Weigh In

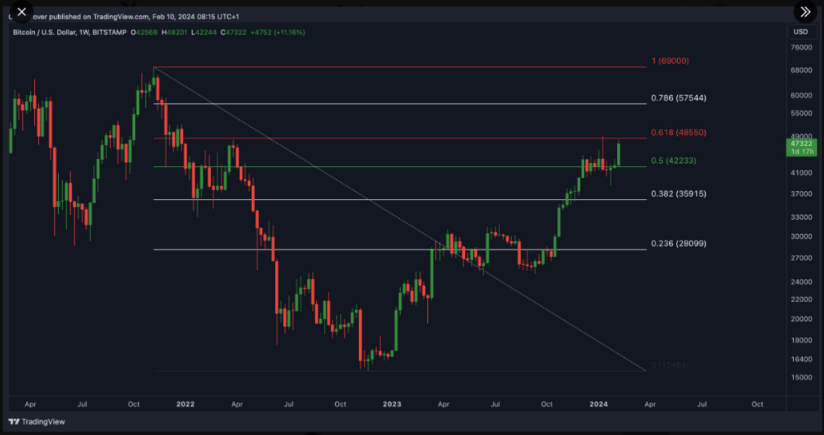

Prominent crypto analysts and market experts have offered their predictions for Bitcoin’s price trajectory in 2024. Crypto Rover, a renowned market analyst, believes that Bitcoin could embark on a bullish trend if it surpasses the $48,500 resistance level and reaches the 0.618 Fibonacci level.

I think #Bitcoin will hit a new ATH in 2024.

— Crypto Rover (@rovercrc) February 10, 2024

At the time of writing, Bitcoin was trading at $48,234 up 0.2% and 13.7% in the daily and weekly timeframes, data by Coingecko shows.

Once #Bitcoin breaks the $48,500 mark, better said, the 0.618 Fibonacci level,

that will mark the official trend reversal to a bull market. I’m keeping a close eye on this level! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

The CEO of analytics platform CryptoQuant, Ki Young Ju, predicts that by the end of the year, the price of a bitcoin might soar to an astounding $112,000 per unit.

#Bitcoin could reach $112K this year driven by ETF inflows, worst-case $55K.https://t.co/HrkV3TU8Ul pic.twitter.com/jBn6HWpt9b

— Ki Young Ju (@ki_young_ju) February 11, 2024

A Year Of Transformation And Growth

In light of the impending Bitcoin halving event, the surge in institutional adoption, and the introduction of spot Bitcoin ETFs, 2024 emerges as a pivotal year for the cryptocurrency. While price predictions may vary, the overwhelming consensus among experts points to significant potential for growth and appreciation.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

9 months ago

54

9 months ago

54